US Dollar Grinds Higher as S&P 500 Lingers Despite Bullish Cues

THE TAKEAWAY: The US Dollar continues to grind higher through near-term resistance levels as the S&P 500 follow-though proves lacking after prices produced signs of a rebound.

S&P 500 – Prices put in a Bullish Engulfing candlestick pattern above support at a rising trend line set from late July, hinting a move higher is ahead. Initial resistance lines up at 1466.10, with a break above that targeting the top of a channel established from the June 4 low at 1488.20. Alternatively, a break below trend line support (now at 1442.50) exposes 1422.40.

Daily Chart - Created Using FXCM Marketscope 2.0

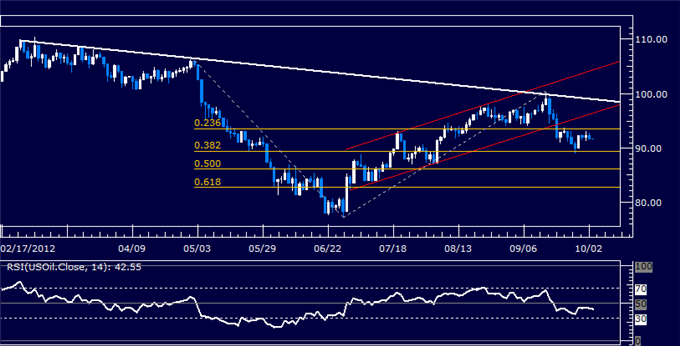

CRUDE OIL – Prices bounced from support at 89.44, the 38.2% Fibonacci expansion, to challenge the 23.6% level at 93.60. A break above this barrier exposes the underside of a rising channel set from early July, now at 96.46. Alternatively, a reversal through support targets the 50% Fib at 86.04.

Daily Chart - Created Using FXCM Marketscope 2.0

GOLD – Prices remain range-bound above a falling trend line connecting major swing highs since early November 2011 (1746.79). Near-term resistance is at 1790.55-1802.80 area, with a break above that exposing 1850.00 and the 1900.00 figure. Support is reinforced by the 23.6% Fibonacci retracement at 1737.59, with a push below that targeting the 38.2% and 50% Fibonacci retracements at 1704.25 and 1677.30 respectively.

Daily Chart - Created Using FXCM Marketscope 2.0

US DOLLAR – Prices are testing through resistance at 9893, the 50% Fibonacci retracement level, to challenge the top of a rising channel set from the September 14 swing low (9905). A break above this boundary exposes the 61.8% Fib at 9929. Initial support lines up at 9857, the 38.2% retracement.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, send a note with subject line "Distribution List" to ispivak@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.