US Dollar Holds Critical Support - Where to Next?

DailyFX.com -

- US Dollar holds key support versus Yen, Euro, GBP. Watch next moves

- A breakout in the US currency seems possible, opens up a larger advance

- See more information on DailyFX on the Real Volume and Transactions indicators

Receive the Weekly Volume at Price report via David’s e-mail distribution list.

The US Dollar has held critical support versus the Euro, Japanese Yen, and British Pound. A break of these key levels could open up a much larger Dollar advance.

EURUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Euro continues to consolidate below major congestion at the $1.10 mark, and a failure here sets the stage for a test of next key support closer to the $1.08 price floor. A break above $1.10 resistance leaves the recent spike high at $1.11 as the next near-term target.

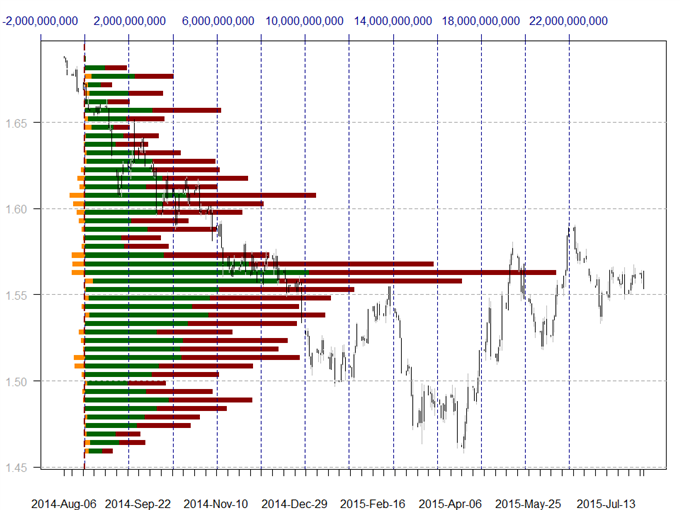

GBPUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The British Pound continues to hold just below major volume-based resistance at $1.5650, and continued failure at this level would keep focus on near-term support in the $1.54-$1.55 range Trading above the $1.5650 mark would open a move towards late-June highs near $1.5800.

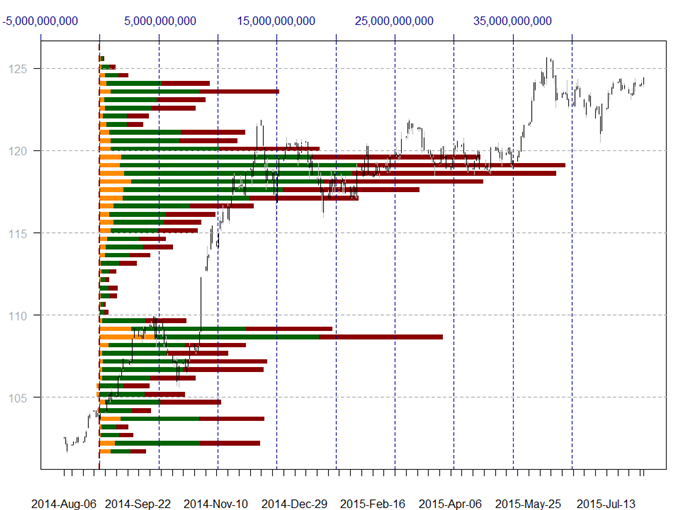

USDJPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The US Dollar has held and traded above key support versus the Japanese Yen at ¥123.50, and continued gains leave focus on major highs closer to ¥126.00. Support remains at major congestion starting at ¥123.50.

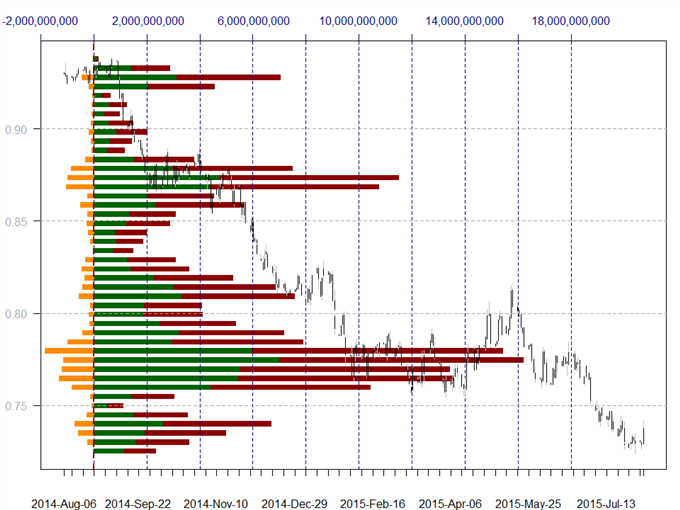

AUDUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Australian Dollar has bounced off of key lows and now trades just below major volume-based resistance at the $0.7400 level. Failure to close above would keep risks to the downside, and near-term support remains at recent lows near $0.7250. A break above $0.7400 would instead target the bottom of a major volume-based congestion range near $0.7600.

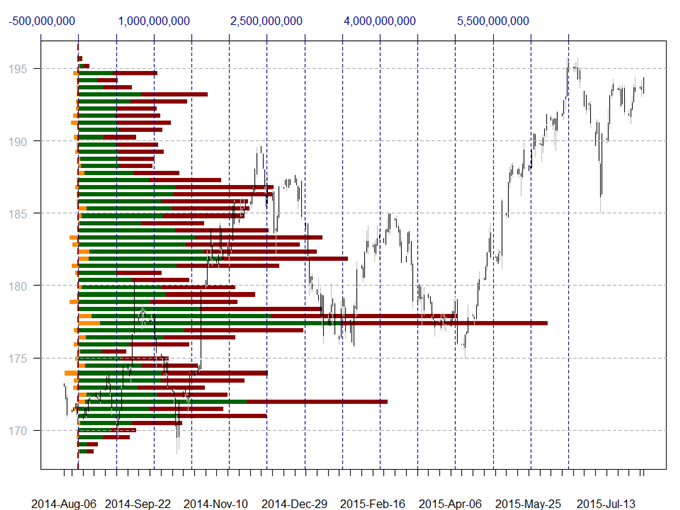

GBPJPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

A sharp British Pound rally versus the Japanese Yen leaves it just short of key volume-based congestion levels near ¥195, and trading above said level makes major highs at ¥196 the next logical target. A failure to finish above volume-based resistance would shift our attention towards similar support at the top of a congestion range near ¥193.

EURJPY

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The Euro has failed to sustain a move above major volume-based resistance at ¥137 versus the Japanese Yen but has likewise held comparable support at ¥135. Our short-term trading bias is effectively neutral until we see a break in the deadlock.

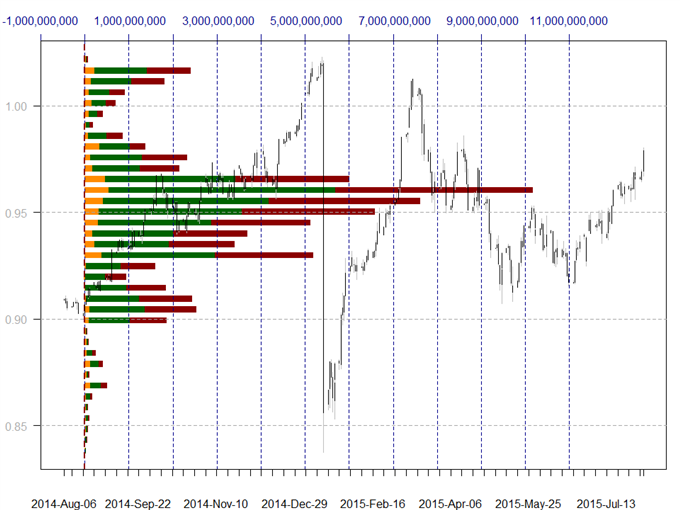

USDCHF

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The US Dollar has surged above significant volume-based resistance against the Swiss Franc at SFr0.9650, and subsequent price targets are now the April high near SFr0.9850 and eventually the psychologically significant 1.000 mark. Former resistance is now support at SFr0.9650.

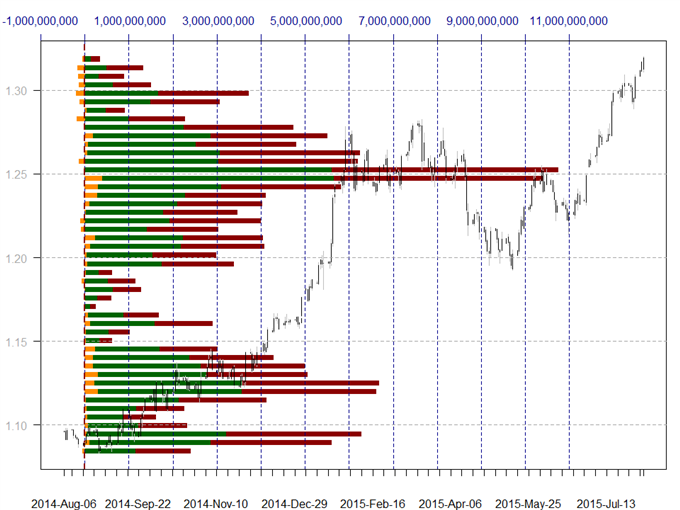

USDCAD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The US Dollar continues to trade to fresh highs versus the Canadian Dollar, and there remains little in the way of major technical resistance ahead of 10-year highs near C$1.3400. A recent build in volume and price-based congestion leaves C$1.2900-1.2950 as near-term support.

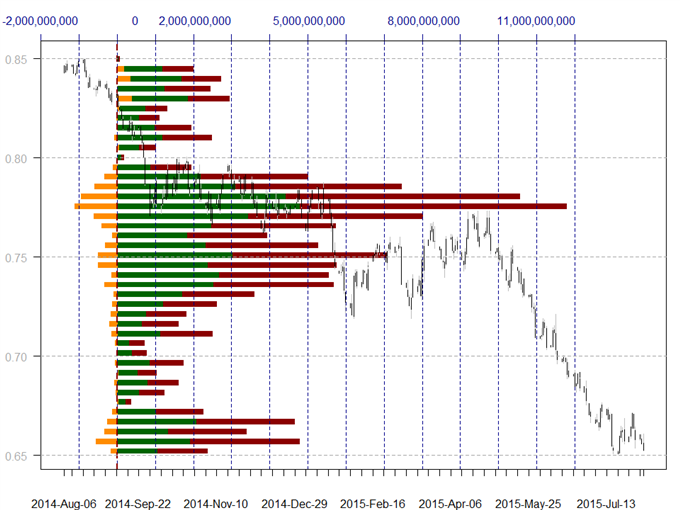

NZDUSD

Total Buy Volume Executed, Total Sell Volume Executed, Net Volume Executed (Buy-Sell)

Length of bar indicates the sum of Buy and Sell volume.

Data source: FXCM Real Directional Volume Indicator, Chart source: R. Prepared by David Rodriguez

The New Zealand Dollar’s failure to close above key volume-based resistance near $0.6700 leaves risks to the downside, and our short-term focus shifts towards major lows close to $0.6500. Resistance remains at $0.6700, while a break below $0.6500 opens up a move towards July, 2009 highs near $0.6200.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

Receive the Weekly Volume at Price via David’s e-mail distribution list.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.