Why the Austria ETF is Struggling

Year-to-date, the iShares MSCI Netherlands ETF (EWN) is off nearly 3% while the iShares MSCI Germany ETF (EWG) has traded slightly lower. The iShares MSCI Belgium ETF (EWK) is something of a standout with a 5.5% gain.

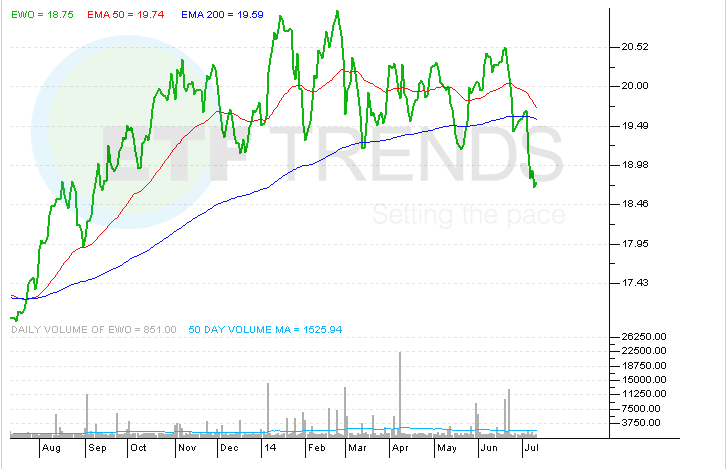

However, the real laggard among single-country ETFs tracking Central European Eurozone members is the iShares MSCI Austria Capped ETF (EWO) . EWO is off 3.9% this year, but that loss has accelerated to 7.6% in the past month.

Erste Group, the Austrian bank that is EWO’s largest holding at 11.8% of the ETF’s weight, is to blame. Shares of Erste Group have been in a tailspin this month after the company warned about losses it will incur due to its exposure to emerging European nations. On July 4, $1.4 billion was slashed from Erste’s market value, according to Reuters.

Hungary and Romania are the markets weighing on Erste and, in turn, EWO. Erste recently forecast a loss of $408 million related to a new Hungarian law that is forcing lenders there to reimburse borrowers for loans dating back to 2004.

In Romania, Erste “will carry out an impairment test on the entire amount of Romanian intangibles (goodwill, brand, value of customer relationships) of about $1.1 billion, which may result in the full write-off of such intangibles,” according to Romania Insider.

Speculation that Erste is not the only Austrian bank that could be vulnerable to emerging Europe exposure is hampering EWO because the ETF allocates 38% of its weight to the financial services sector. That is nearly 1,600 basis points more than its weight to industrials, the ETF’s second-largest sector weight. [Spotlight on Austria ETF]

Last week, “Austria’s central bank said that the country’s lenders should review their business model after they had to use 44 billion euros, or almost two-thirds of their operating profit since 2008, on provision for delinquent debt. Rapid credit growth had fueled bank earnings and economic growth until 2008 as clients borrowed to buy homes, cars and consumer goods. When economic growth contracted, bad loans and writedowns soared,” report Stefan Riecher and Boris Groendahl for Bloomberg.

This is not the first time EWO has felt the chill of Austrian banks’ Eastern Europe exposure. In the first half of 2011, EWO struggled due to loans made by Austrian banks in the Czech Republic, Romania, Hungary and Croatia. The global financial crisis left the Austrian banking system vulnerable to the massive movements of foreign credit and foreign currency-denominated loans. [Austria ETF Gets Relief From Bank Deals]

iShares MSCI Austria Capped ETF