1 Favorite Electric Vehicle Tech Stock Just Got Clobbered -- Time to Buy in 2024?

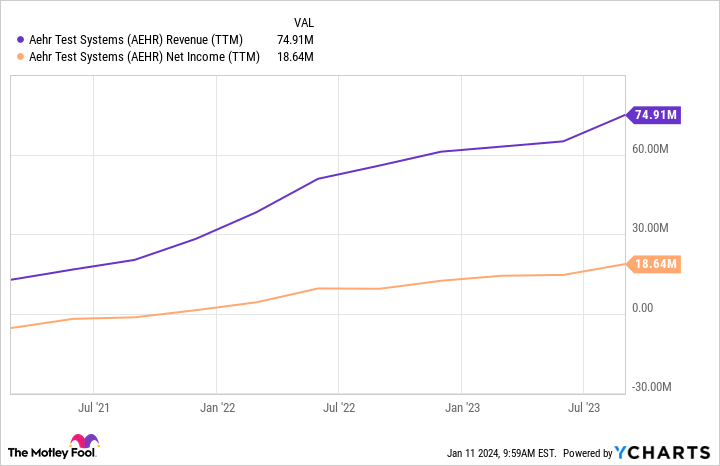

After soaring well over 100% in value in 2023 through the summer and early autumn months, shares of electric vehicle (EV) electronics equipment supplier Aehr Test Systems (NASDAQ: AEHR) have reversed course. In fact, after its most recent earnings update, the stock has given up all of its 2023 gains and then some.

Nevertheless, Aehr has earned itself a spot as an investor favorite in the EV supply chain for good reason. After getting clobbered, is Aehr stock a buy for 2024 and beyond?

Getting up to (EV) speed

Aehr provides equipment for silicon carbide (SiC) semiconductors. SiC devices have picked up a head of steam as the EV market has heated up in recent years, thanks to SiC being better suited to conducting higher voltages with lower energy loss (via release of heat) than plain old silicon.

Aehr is best known for its Fox-XP systems, which provide test and burn-in functions on SiC wafers (the discs you often see someone in a lab suit holding in a semiconductor fabrication facility) and die (once the wafers get diced up into "chips"). SiC testing weeds out those devices that have an early failure rate. Burn-in is another necessary step for SiC used in EVs, as SiC devices need to be "aged" (kind of like wine) to induce consistency across all components.

In other words, Aehr provides some of the new tech equipment needed to match with this new substrate material. And Aehr has been growing spectacularly as it rides the EV wave.

However, the wheels really started to come off of the Aehr hype wagon at the very end of October. ON Semiconductor, which has been ramping up its SiC production, has been far and away Aehr's largest customer. In its first quarter of fiscal 2024 (the three months that ended in August 2023), onsemi accounted for 88% of its revenue.

Aehr CEO Gayne Erickson and the top team are well aware of their need to diversify the customer base, and they've been doing just that. But in the meantime, onsemi reported a big slowdown in SiC sales growth in the final months of 2023 -- which caused the initial drop in Aehr's stock price.

Other customers that Aehr has been helping ramp up SiC production (like Wolfspeed) have issued similar warnings in recent weeks, according to Erickson on Aehr's own most recent earnings call.

The market finally realized what's going on -- a slowdown in EV growth, not an end to EV growth, that will delay delivery of some of Aehr's SiC equipment. The stock price reacted accordingly.

What will happen next?

The market's most recent angst centered on revised financial estimates from Erickson and company, that reflect a push out of some of their orders into fiscal 2025 (which begins in June 2024).

Aehr Test Systems Metric | Updated Guidance (January 2024) | Previous Guidance (October 2023) |

|---|---|---|

Full-year expected revenue | $75 million to $85 million | At least $100 million |

Implied revenue growth rate (YOY) | 15% to 30% | 50% |

GAAP net income and margin | Between 20% and 25% of revenue (~$19 million to $21 million) | At least $28 million, representing earnings growth of greater than 90% YOY |

Chart by Author. Data source: Aehr Test Systems. YOY = year over year. GAAP = generally accepted accounting principles.

Here are two upshots, though: First, Aehr is still growing, albeit at a far slower pace than before. Thus, there is a need for a valuation reset. Things were getting ludicrous last summer.

And second, the company still expects ample growth from SiC and other new power applications in the coming years. Its customers are just managing through a rough patch at the moment. Additionally, Aehr is working on other applications for its Fox-XP systems, including industrial and solar power and new optical interconnects for networking chips.

At this point, Aehr trades for about 27 times management's revised outlook for net income this current fiscal year. It's a premium price to be certain. But after getting clobbered, the stock is far more reasonable than before. If a wild small-cap stock bet on the EV industry is what you're after, I believe a dollar-cost average plan is the best way to buy right now, if at all. But keep any position small, because there are other high-quality semiconductor stocks worth owning for the long term.

Should you invest $1,000 in Aehr Test Systems right now?

Before you buy stock in Aehr Test Systems, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Aehr Test Systems wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Nicholas Rossolillo and his clients have positions in Aehr Test Systems and ON Semiconductor. The Motley Fool has positions in and recommends Wolfspeed. The Motley Fool recommends ON Semiconductor. The Motley Fool has a disclosure policy.

1 Favorite Electric Vehicle Tech Stock Just Got Clobbered -- Time to Buy in 2024? was originally published by The Motley Fool