19% earnings growth over 1 year has not materialized into gains for WSFS Financial (NASDAQ:WSFS) shareholders over that period

One simple way to benefit from a rising market is to buy an index fund. In contrast individual stocks will provide a wide range of possible returns, and may fall short. For example, the WSFS Financial Corporation (NASDAQ:WSFS) share price fell 21% in the last year, slightly below the market decline of around 20%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 1.9% in three years. Shareholders have had an even rougher run lately, with the share price down 20% in the last 90 days. Of course, this share price action may well have been influenced by the 12% decline in the broader market, throughout the period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for WSFS Financial

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the WSFS Financial share price fell, it actually saw its earnings per share (EPS) improve by 19%. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

With a low yield of 1.3% we doubt that the dividend influences the share price much. WSFS Financial managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

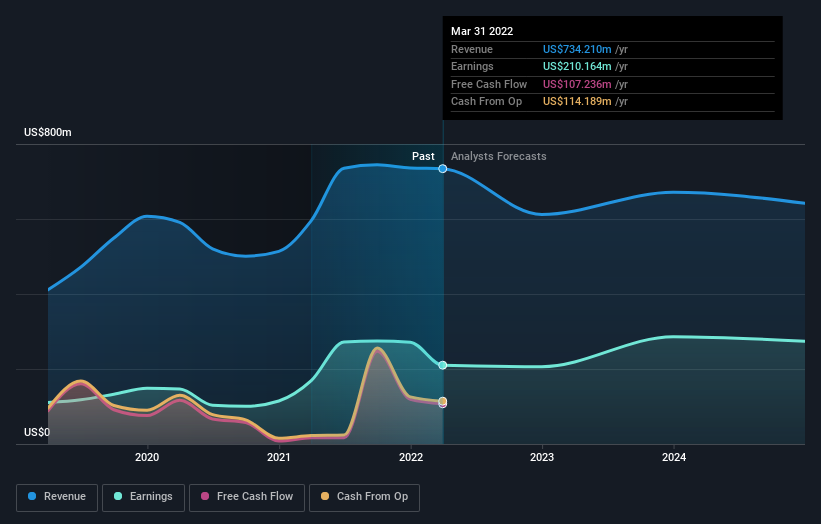

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think WSFS Financial will earn in the future (free profit forecasts).

A Different Perspective

WSFS Financial shareholders are down 21% over twelve months (even including dividends), which isn't far from the market return of -20%. So last year was actually even worse than the last five years, which cost shareholders 1.4% per year. Weak performance over the long term usually destroys market confidence in a stock, but bargain hunters may want to take a closer look for signs of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for WSFS Financial (1 can't be ignored) that you should be aware of.

But note: WSFS Financial may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.