2 Insurance Stocks to Short Before Earnings

Lincoln National Corporation (NYSE:LNC) is due to report earnings after the market closes today, Oct. 30. The insurance stock shed 8.4% the day after the firm's last report, and one reliable technical signal suggests another post-earnings sell-off could be in LNC's near future.

Taking a quick step back, LNC stock bounced from a seven-month low near $51 in late August, and has since added 20% to trade at $61.12. However, the equity is now within one standard deviation of its 80-week trendline after a lengthy stretch below it. Per data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been 13 similar signals over the last 15 years, and the stock was down 5.8%, on average, one month out, with the majority of the returns negative.

Short sellers have already started to target Lincoln National. Short interest on the stock shot up 14.8% in the most recent reporting period to 4.65 million shares. This represents just 2.3% of the stock's float, meaning the bearish bandwagon is far from full. Continued short selling could be an even bigger headwind for LNC stock.

MetLife, Inc. (NYSE:MET) is also set to report earnings after today's close, and the stock shed 2.2% in the session subsequent to its July 31 report. That earnings reaction sparked a month-long slide for MET shares, which settled August down 10.4%.

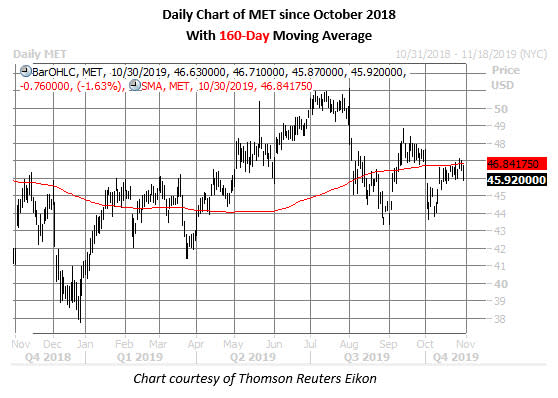

The shares rebounded in the first half of September, before sliding back to their August lows near $44 by early October. A bounce off here now has the stock trading near its 160-day moving average -- last seen down 1.6% at $45.92 -- which has had historically bearish implications for MetLife.

According to White's data, there have been four other times in the past three years the equity has come within one standard deviation of this trendline after trading below it 60% of the time in the last two months. Following these previous signals, MET shares averaged a one-month loss of 5.4%, with not one of the returns positive.

MetLife shorts have been reducing their exposure to the stock lately, with short interest down 15.1% in the two most recent reporting periods to 12.09 million shares. This accounts for just 1.5% of the equity's available float, and would take less than two days to cover, at MET's average pace of trading. This leaves little in the way of sideline cash to help fuel any future rally attempts.