These 3 Cash-Generating Machines Pay Investors Nicely

Everybody loves dividends. After all, few things in life are sweeter than payday.

Dividends help cushion drawdowns in other positions, provide a passive income stream, and provide more than one way to profit from an investment.

Of course, free cash flow is a vital metric to analyze when seeking dividend-paying stocks.

In its simplest form, free cash flow is the cash a company keeps after paying for operating costs and capital expenditures.

A high free cash flow allows for more growth opportunities, a greater potential for share buybacks, consistent dividend payouts, and the ability to pay off debt easily.

Three stocks that pay investors handsomely paired with strong free cash flow include Pfizer PFE, Exxon Mobil XOM, and Verizon Communications VZ.

Below is a year-to-date chart of all three stocks with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

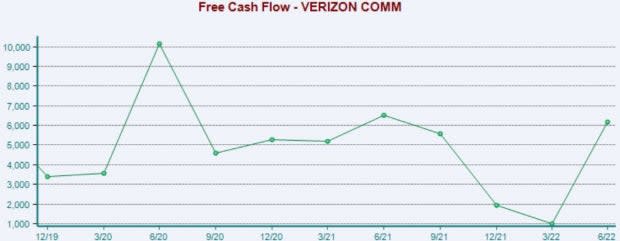

Verizon Communications

Verizon offers communication services in the form of local phone, long-distance, wireless, and data services.

VZ has long been an income investor favorite, and its dividend metrics make it easy to see why – VZ’s annual dividend yields a steep 7.2%, notably higher than its Zacks sector average.

Further, the company has upped its dividend payout five times over the last five years, translating to a 2% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

The company knows how to generate serious cash; in its latest quarter, VZ posted quarterly free cash flow of $6.2 billion, reflecting a massive 520% sequential increase.

Image Source: Zacks Investment Research

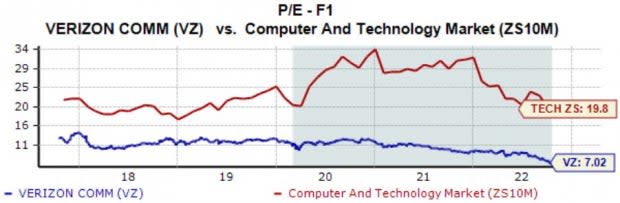

For the cherry on top, Verizon’s valuation multiples could entice value-focused investors, further displayed by its Style Score of an A for Value.

VZ’s forward earnings multiple currently sits at 7.0X, nowhere near its five-year median of 11.6X and reflecting a sizable 65% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

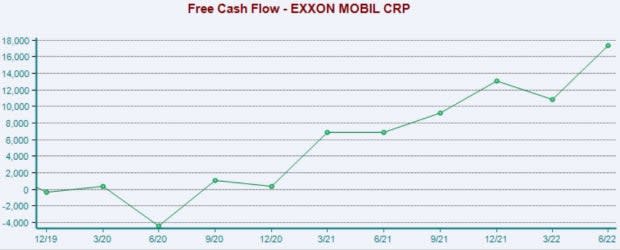

Exxon Mobil

Exxon Mobil is a U.S.-based oil and gas entity, one of the world's largest publicly traded energy companies.

Analysts have had a bullish stance on the company’s earnings outlook as of late, helping land it into a favorable Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

XOM’s annual dividend yield comes in at a strong 3.6%, paired with a payout ratio sitting sustainably at 36% of earnings.

While Exxon Mobil’s annual dividend yield is below its Zacks Sector average, the company’s 2.5% five-year annualized dividend growth rate helps to pick up the slack.

Image Source: Zacks Investment Research

In its latest earnings release, XOM reported quarterly free cash flow of a mighty $17.3 billion, penciling in a sizable 60% sequential uptick and an even more considerable triple-digit 151% year-over-year increase.

Image Source: Zacks Investment Research

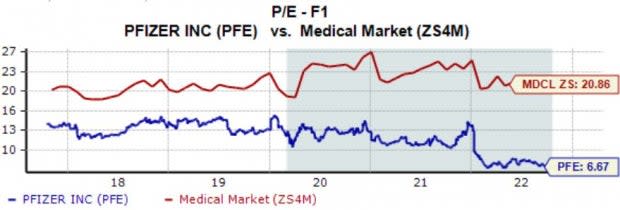

Pfizer

Pfizer is a multinational pharmaceutical and biotechnology corporation headquartered in New York City, well-known for its COVID-19 vaccine.

Pfizer’s dividend metrics would make any income-focused investors happy; its annual dividend yields a sizable 3.7%, notably higher than its Zacks Medical sector average.

Further, the company pays out just 26% of its earnings and carries a strong 4.5% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Pfizer posted quarterly free cash flow of $7.4 billion in its latest earnings release, reflecting a rock-solid 26% sequential increase.

Image Source: Zacks Investment Research

Pfizer shares are more than reasonably priced; shares trade at a 6.7X forward earnings multiple, nearly half of their five-year median of 12.6X and reflecting a sizable 68% discount relative to the Zacks Medical sector.

Image Source: Zacks Investment Research

Bottom Line

Investors love dividends, and for obvious reasons.

In a historically-volatile year in the market so far in 2022, dividends have been a significant perk, helping to shield investors from drawdowns.

Still, investors should look closely at a company’s free cash flow when selecting dividend-paying stocks. Free cash flow strength provides dividend reliability, more growth opportunities, and speaks volumes about a company’s financial footing.

All three stocks above - Pfizer PFE, Exxon Mobil XOM, and Verizon Communications VZ – all reward their shareholders handsomely and are cash-generating machines, making them great considerations for any investor seeking a reliable income stream.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Pfizer Inc. (PFE) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research