3 High-Quality Picks for the Value Investor

- By Alberto Abaterusso

Benjamin Graham, the pioneer of value investing, suggested investors search for securities that have a current ratio of over 2 and more working capital than long-term debt.

When the current ratio is more than 2, the company has produced sufficient cash to pay its short-term creditors. The ratio is calculated by dividing the total current assets by the total current liabilities.

When the working capital exceeds the long-term debt by a wide margin, it means that the business is likely able to meet all of its long-term debt obligations. The working capital is the difference between total current assets and total current liabilities.

Thus, investors may want to consider the following stocks since they meet the above criteria.

Nike

The first company that makes the cut is Nike Inc. (NYSE:NKE), the Beaverton, Oregon-based designer and seller of athletic footwear and accessories.

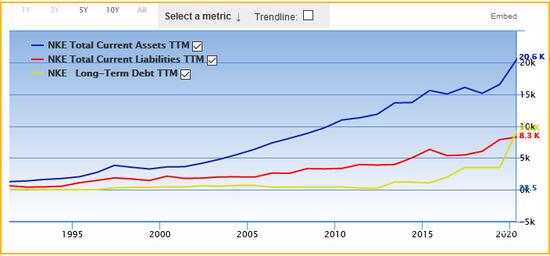

The stock has a current ratio of 2.55, which is more appealing than the industry median of 1.63.

Nike has a trailing 12-month working capital of about $12.3 billion and long-term debt of about $9.4 billion as of the most recent fiscal year.

GuruFocus assigned a rating of 6 out of 10 for the company's financial strength and a rating of 8 out of 10 for its profitability.

The stock closed at $134.7 per share on Tuesday for a market capitalization of $211.46 billion, a price-book ratio of 22.85 and a 52-week range of $60 to $136.35.

Wall Street issued a buy rating with an average target price of $146.97 per share for this stock.

Cie Financiere Richemont

The second company that qualifies is Cie Financiere Richemont SA (CFRUY), a Swiss designer, manufacturer and seller of luxury goods in Europe and internationally.

The stock has a current ratio of 2.87, which is more appealing than the industry median of 1.47.

Cie Financiere Richemont has trailing 12-month working capital of about $12.1 billion and long-term debt of about $4.4 billion as of the most recent fiscal year.

GuruFocus assigned a rating of 5 out of 10 for the company's financial strength and a rating of 8 out of 10 for its profitability.

The stock traded at $8.56 per American depositary receipt at close on Tuesday for a market capitalization of $48.37 billion, a price-book ratio of 2.5 and a 52-week range of $4.76 to $8.6.

Wall Street issued an overweight rating for this stock.

Micron Technology

The third company that meets the criteria is Micron Technology Inc. (NASDAQ:MU), a Boise, Idaho-based semiconductor manufacturer.

The stock has a current ratio of 2.71, which is more appealing than the industry median of 2.3.

Micron has trailing 12-month working capital of about $11.33 billion and long-term debt of nearly $6 billion as of the most recent fiscal year.

GuruFocus assigned a rating of 7 out of 10 for the company's financial strength and a rating of 8 out of 10 for its profitability.

The stock closed at $63.95 per share on Tuesday for a market capitalization of $71.19 billion, a price-book ratio of 1.83 and a 52-week range of $31.13 to $64.5.

Wall Street issued an overweight rating with an average target price of $65.47 per share.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.