3 High Yield Stock Picks for the Dividend Investor

Dividend investors may be interested in the following stocks, as they are currently significantly outperforming the S&P 500 index in terms of higher dividend yields. The benchmark for the U.S. market grants an average yield of 1.78% as of Aug. 7.

Furthermore, Wall Street sell-side analysts have issued positive recommendation ratings for these stocks, suggesting that their share prices are expected to trade higher.

AbbVie Inc

The first company that makes the cut is AbbVie Inc (NYSE:ABBV), a U.S. drug major based in North Chicago, Illinois.

Based on Thursday's closing price of $92.57 per share, AbbVie Inc grants a trailing 12-month dividend yield of 4.96% and a forward dividend yield of 5.08%. Currently, the company distributes a quarterly dividend of $1.18 per common share. AbbVie Inc has paid dividends for nearly seven years.

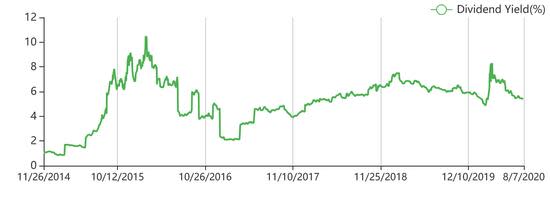

AbbVie's current dividend yield is high compared to its historical values, indicating that the stock is a profitable investment.

GuruFocus assigned the company a moderate score of 4 out of 10 for its financial strength rating and a remarkably high score of 9 out of 10 for its profitability.

The stock has an overweight recommendation rating and an average target price of $110.14 per share on Wall Street.

The share price has risen by 41.44% over the past year for a market capitalization of $163.37 billion and a 52-week range of $62.55 to $101.28.

The stock is closer to oversold than overbought levels, as it has a 14-day relative strength index of 35.

The Interpublic Group of Companies Inc

The second company that qualifies is The Interpublic Group of Companies Inc (NYSE:IPG), a New York-based provider of advertising and marketing services worldwide.

Based on Thursday's closing price of $18.53 per share, The Interpublic Group of Companies Inc offers a trailing 12-month dividend yield of 5.29% and a forward dividend yield of 5.51%. The advertising agency is currently paying a quarterly dividend of 25.5 cents per common share. The Interpublic Group of Companies Inc has paid dividends for more than 20 years.

The Interpublic Group of Companies Inc's current dividend yield is high compared to its historical values, which suggests that the stock is a profitable investment.

GuruFocus assigned the company a moderate financial strength rating of 4 out of 10 and a very good profitability rating of 7 out of 10.

The stock has a hold recommendation rating with an average target price of $20.11 per share on Wall Street.

The share price has fallen by nearly 14% over the past year, determining a market capitalization of $7.23 billion and a 52-week range of $11.63 to $25.20.

The 14-day relative strength index of 57 indicates that the stock is neither overbought nor oversold.

Atlantica Sustainable Infrastructure PLC

The third company to consider is Atlantica Sustainable Infrastructure PLC (NASDAQ:AY), a British operator of renewable energy, natural gas and water assets as well as manager of distribution infrastructures in North America, Mexico and a few other countries internationally.

Based on Thursday's closing price of $29.93 per share, Atlantica Sustainable Infrastructure PLC grants a trailing 12-month dividend yield of 5.45% and a forward dividend yield of 5.48%. Currently, the company pays a quarterly dividend of 41 cents per common share. Atlantica Sustainable Infrastructure PLC has been paying dividends for more than five years.

Atlantica Sustainable Infrastructure PLC's current dividend yield is about average compared to its historical values.

GuruFocus assigned the company a low financial strength rating of 3 out of 10 and a positive profitability rating of 6 out of 10.

The stock has an overweight recommendation rating on Wall Street and an average target price of $32.50 per share.

The share price has risen by 27.42% over the past year, determining a market capitalization of $3.04 billion and a 52-week range of $17.74 to $32.50.

The 14-day relative strength index of 57 indicates that the stock is neither overbought nor oversold.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.