3 Model Zacks Buys

No matter what goal you want to achieve in life, it’s always helpful to seek out a model of success to emulate. It could be a person who achieved the same results or a method that has proven successful in the past.

When it comes to building a better portfolio, we’ve got a great tool for you that can serve as a model for higher returns moving forward. In fact, that’s what we named the screen.

Check out the Model Zacks Strong Buys & Buy screen. You’ll find Zacks Rank #1s (Strong Buys) and Zacks Rank #2s (Buys) that are in the Top 50% of the Zacks Industry Rank and have strong Zacks Style Scores. All the building blocks of higher returns.

It's a great place to start on your path toward greater profitability. Here are three names that recently made the screen and are worth watching:

GoPro GPRO

Go ahead and try to attach a smartphone to the handlebars of your dirt bike. The average iPhone or Android is just too sensitive for an active and slightly crazy endeavor like motocross. And let’s not get started on SCUBA diving!

These are activities that require some specialized equipment, such as the HERO 10 Black from GoPro (GPRO). It’s the company’s new flagship camera that uses the GP2 processor, which captures 5.3K video at 60 frames per second, 4K video at 120 frames per second and 2.7K video at 240 frames per second. Eat your heart out Apple!

The HERO 10 Black is one of several reasons why GPRO reported a strong third quarter performance in early November. In addition to the new product launch, the company also credited its impressive results to strong demand and good management of its supply chain and channel inventory.

The company earned 34 cents per share in its third quarter, which beat the Zacks Consensus Estimate by a mighty 70%. Revenue of $316.7 million jumped practically 13% year over year and easily eclipsed the Zacks Consensus Estimate by approximately 8.2%.

Other highlights include subscription revenue soaring 143% and the subscriber count rising 168%.

The GoPro lifestyle is all about packing up some gear and heading out for adventure. This wanderlust was popular during the worst of the pandemic, and will continue to be so as things return to some sort of normal. So analysts are expecting more success in the future.

The Zacks Consensus Estimate for this year is now at 84 cents, which is up 12% over the past 30 days. Next year rose to 95 cents, marking an 8% rise in a month and suggesting a year-over-year improvement of 13%.

Shares of GPRO are up nearly 30% in 2021. As part of the Audio Video Production space, it’s in the top 40% of the Zacks Industry Rank.

Image Source: Zacks Investment Research

Guess?, Inc. GES

After six straight positive surprises (during the worst of the pandemic) and with earnings estimates on the rise; you can see why apparel staple Guess?, Inc. (GES) believes it has reached an “inflection point”. And we’re talking about a positive inflection point that suggests more gains are on the horizon as life returns to normal and people start caring about their appearance again.

As part of the textile-apparel space, GES is in the Top 16% of the Zacks Industry Rank. Its five reportable segments are Europe, Americas Retail, Asia, Americas Wholesale and Licensing. As of Oct 30, 2021, it operated approximately 1052 retail stores.

GES has been seeing strong momentum for its brand all around the world, which was on full display in its fiscal third quarter report from late last month. Earnings per share of 62 cents topped the Zacks Consensus Estimate by nearly 35%, bringing the average surprise over the past four quarters to 97%!

Revenues of $643.1 million soared 13% year over year and were up 4% from the pre-pandemic days back in the fiscal third quarter of 2020. Strong results from European Wholesale, Americas Retail and Licensing drove this performance.

Furthermore, the operating margin was at 10% thanks to strong gross margin expansion.

GES announced a five-year strategic plan in December of 2019 with priorities that include brand relevancy; customer centricity; global footprint; product excellence; and functional capabilities. Meanwhile, it’s brand elevation strategy involves enhancing product quality, visual merchandising and boosting the customer shopping experience across stores and online.

GES still doesn’t feel comfortable in offering a detailed guidance for the full year, except that revenues are expected to dip in the low-single digits versus fiscal 2020. Plus, the operating margin is expected to double to 11% for the current year from fiscal 2020.

Analysts like what they saw in the quarter and raised earnings estimates for this year (ending January 2022) by 8.8% over the past 30 days to $2.97. Expectations for next year (ending January 2023) increased 5.8% in that time to $3.28, which suggests a very encouraging year-over-year profit improvement of 10.4%.

Image Source: Zacks Investment Research

Williams-Sonoma WSM

Hopefully, life will be pretty close to normal sometime next year, but that doesn’t mean our homes will start looking like a dorm during finals week. Once you spend $500 for some flatware, it’s not like you’re going back to plastic knives and forks.

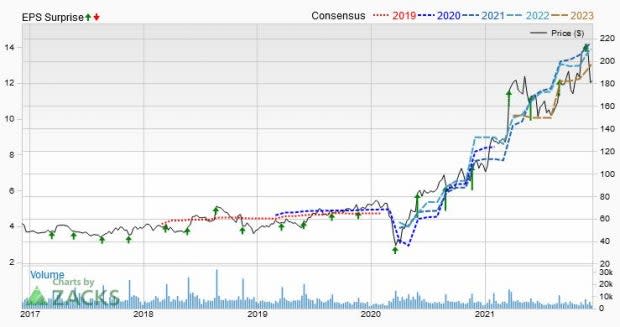

So while Williams-Sonoma (WSM) has put together 16 straight quarters of positive surprises (encompassing the whole of the pandemic); the company continues to see enough strong momentum to raise its full year-outlook… and analysts followed suit.

WSM is a multi-channel specialty retailer of premium quality home products. The company’s five operating segments include Pottery Barn (34.8% of fiscal 2020 total revenues); Williams-Sonoma (23.5%); West Elm (22.3%); Pottery Barn Kids and Teen (14.8%) and Other (4.5%). As part of the retail – home furnishings space, WSM is in the top 13% of the Zacks Industry Rank, while shares have soared 82% in 2021.

The fiscal third quarter saw earnings per share of $3.32, which beat the Zacks Consensus Estimate by nearly 7% and brought the four-quarter average surprise to more than 27%. Revenues of $2.05 billion jumped 16% year over year and topped our expectation by nearly 3%. E-commerce made up 67% of total company revenues as it enjoyed strong growth across all brands.

Comparable brand revenue growth came to 16.9%, thanks to its distinctive positioning in the market and its successful execution of long-term growth strategies. These positive attributes convinced WSM to raise its full-year outlook

Revenue growth is now expected at 22% to 23%, compared to the previous outlook in the high teens to low 20s. Furthermore, non-GAAP operating margin in now expected between 16.9% and 17.1%, instead of just 16% to 17%.

The Zacks Consensus Estimate for this year (ending January 2022) is up to $14.21, which advanced 4.7% in the past 30 days. The year ending January 2023 is only at $13.89 so far, but it has advanced 7% in the past month with plenty of time for further improvement.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GoPro, Inc. (GPRO) : Free Stock Analysis Report

Guess, Inc. (GES) : Free Stock Analysis Report

WilliamsSonoma, Inc. (WSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research