4 Magic Formula Stock Picks Among Restaurants

As the restaurant industry attempts to recover from the coronavirus outbreak in China, several restaurant companies have high earnings yields and return on capital according to the Greenblatt Magic Formula Screen, one of our value screens for Premium members. The top four restaurants according to the list are Denny's Corp. (NASDAQ:DENN), Restaurant Brands International Inc. (NYSE:QSR), Jack In The Box Inc. (NASDAQ:JACK) and Yum Brands Inc. (NYSE:YUM).

Major restaurants report earnings amid coronavirus outbreak, sending Starbucks shares lower

Shares of McDonald's Corp. (NYSE:MCD) traded near an intraday high of $216.42 on Wednesday, up approximately 1.8% from Tuesday's close of $210.39 on the heels of reporting earnings that topped analyst estimates. On the other hand, shares of Starbucks Corp. (NASDAQ:SBUX) tumbled over 2% on its warning that the coronavirus outbreak could materially affect the Seattle-based coffee retailer's revenue and earnings results for fiscal 2020, especially for the international segment.

Starbucks said that it closed over 50% of its stores in China due to the coronavirus outbreak. Further, the company continues to monitor and modify the opening hours to help ensure the health and safety of its employees and customers. CEO Kevin Johnson said in a CNBC interview that the company could close additional stores in China if the situation worsens.

Greenblatt formula identifies good restaurant stocks

As the industry grapples with the virus outbreak, investors can seek restaurant stocks with high earnings yield and return on capital according to Joel Greenblatt (Trades, Portfolio)'s magic formula. Greenblatt defines earnings yield as the reciprocal of the EV-to-Ebit ratio and the return on capital as earnings before interest and taxes divided by the average of net fixed assets plus net working capital.

Denny's

Denny's offers breakfast, lunch and dinner options 24 hours per day through its network of owned and franchised restaurants. The Spartanburg, South Carolina-based company said on Jan. 13 that it closed six restaurants in 2019, bringing the total restaurant count to 1,703.

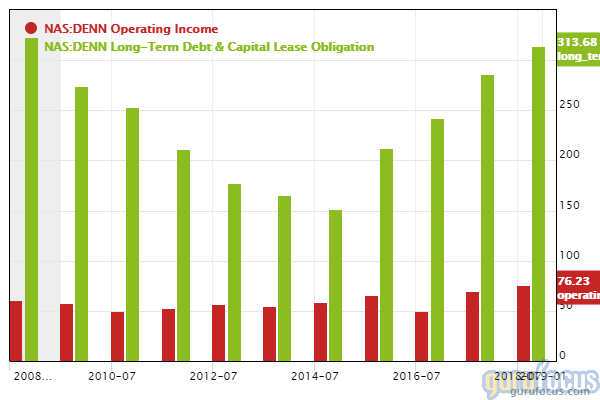

GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a Greenblatt return on capital that outperforms 91.50% of global competitors and a Greenblatt earnings yield that outperforms 86.76% of global restaurants. Despite this, Denny's' financial strength ranks a weak 3 out of 10 on the heels of increasing long-term debt over the past three years and an interest coverage ratio that underperforms 74.4% of global peers.

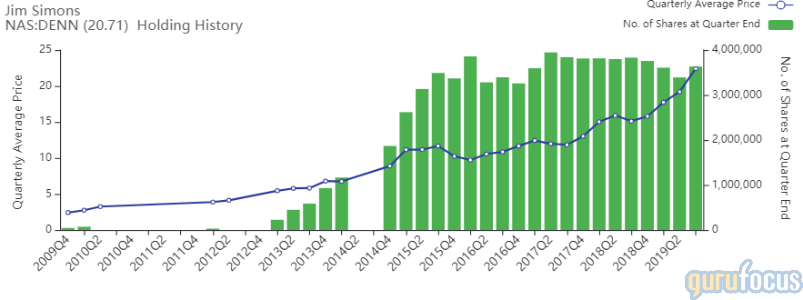

Gurus with holdings in Denny's include Lee Ainslie (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

Restaurant Brands International

Restaurant Brands International operates a network of quick-service restaurants through brands that include Burger King, Tim Hortons and Popeyes Louisiana Kitchen. According to GuruFocus, the Toronto-based company's operating margin outperforms over 96% of global competitors, suggesting good profitability.

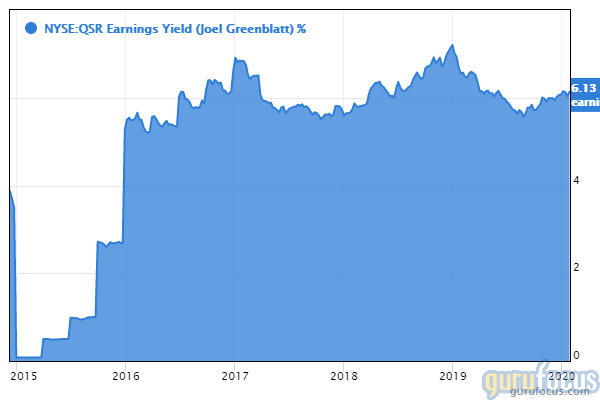

Other good investing signs include a Greenblatt return on capital the outperforms 89.44% of global competitors and a Greenblatt earnings yield that is near a 10-year high of 6.21% and outperforms 73.24% of global restaurants.

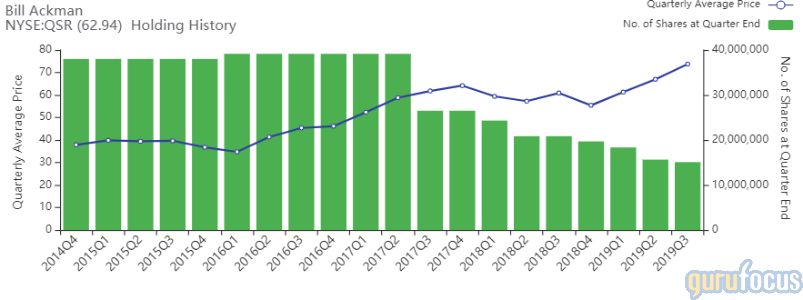

Gurus with holdings in Restaurant Brands International include Bill Ackman (Trades, Portfolio)'s Pershing Square and Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B).

Jack in the Box

Jack in the Box operates fast-casual restaurants through its Jack in the Box and Qdoba Mexican Eats brands, selling products like burgers, tacos, quesadillas and specialty sandwiches. GuruFocus ranks the San Diego-based company's profitability 8 out of 10 on several positive investing signs, which include a Greenblatt return on capital that outperforms 84.16% of global competitors and profit margins that outperform over 89% of global restaurants.

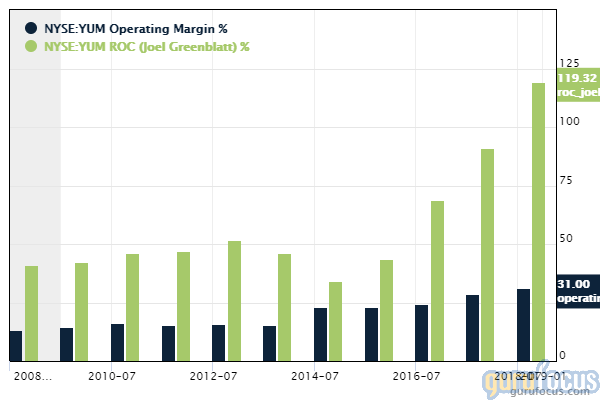

Yum Brands

Yum Brands operates fast casual restaurant chains like Kentucky Fried Chicken, Pizza Hut and Taco Bell. GuruFocus ranks the Louisville, Kentucky-based company's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, expanding profit margins and a Greenblatt return on capital that outperforms 95.31% of global competitors.

Disclosure: No positions.

Read more here:

Warren Buffett's Apple Soars on 4th-Quarter Earnings Beat

4 Homebuilders With the Strength to Weather Volatile Housing Market

5 US and Asian Health Care Companies With Good Financial Strength

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.