4 Reasons Why The Bancorp (TBBK) Stock is a Must Buy Now

Underlying strength and healthy long-term prospects make Wilmington, DE-based The Bancorp, Inc. TBBK a solid bet now. Also, higher interest rates, decent loan demand and a strong balance sheet position bode well for the future.

Further, analysts are bullish on the stock. Over the past 30 days, the Zacks Consensus Estimate for earnings has moved 6.5% and 6.1% upward for 2023 and 2024, respectively. Currently, the stock sports a Zacks Rank #1 (Strong Buy).

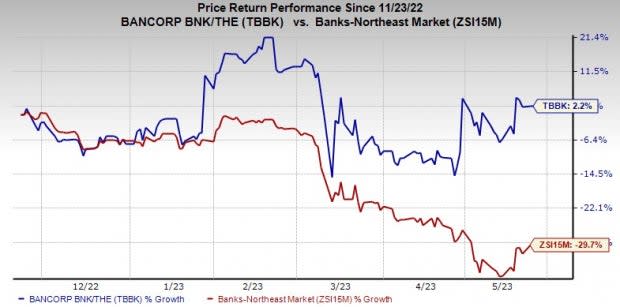

Shares of The Bancorp have gained 2.2% over the past six months against the industry’s 29.7% fall.

Image Source: Zacks Investment Research

Here are the factors that make The Bancorp an attractive investment pick right now:

Earnings Strength: Over the past three to five years, The Bancorp has recorded earnings growth of 35%, significantly higher than the industry average of 12.75%. The momentum is expected to continue in the near term. The bank’s earnings are projected to grow at a rate of 59% this year and 16.9% in the next year.

Further, TBBK has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with the average surprise being 3.50%.

Revenue Growth: The Bancorp’s net revenues have witnessed a CAGR of 12.6% over the last three years (2020-2022). The improvement was backed by strong loan and deposit balances, and high interest rates, along with diversified fee income sources. The trend is likely to continue for the next couple of years, with revenues expected to grow 33.6% in 2023 and 8.9% in 2024.

Strong Balance Sheet Position: As of Mar 31, 2023, The Bancorp had total debt of $143 million, which was significantly lower than the cash and cash equivalent balance of $787.2 million. Also, the company’s debt/equity ratio of 0.17 compares favorably with the industry average of 0.34, thereby reflecting the company’s relatively strong financial health. Thus, we believe that it will perform better than its peers amid the worsening macroeconomic backdrop.

Superior Return on Equity (ROE): The Bancorp’s t trailing 12-month ROE highlights its growth potential. The company's ROE of 21.96% compares favorably with 12.23% ROE of the industry, underlining that it is more efficient in using shareholder funds than its peers.

Other Bank Stocks Worth a Look

A couple of other top-ranked stocks from the banking space are BNP Paribas BNPQY and First Citizens BancShares FCNCA.

The Zacks Consensus Estimate for BNP Paribas’ current-year earnings has been revised 17.3% upward over the past 30 days. Its shares have gained 13.2% in the past six months. Currently, BNPQY sports a Zacks Rank #1.

First Citizens BancShares currently sports a Zacks Rank #1 as well. Its earnings estimates for 2023 have been revised 67% upward over the past 30 days. In the past six months, FCNCA’s shares have rallied 62.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bancorp, Inc. (TBBK) : Free Stock Analysis Report

First Citizens BancShares, Inc. (FCNCA) : Free Stock Analysis Report

BNP Paribas SA (BNPQY) : Free Stock Analysis Report