4 Stocks to Buy From the Thriving Refining & Marketing Industry

Since coming out of the pandemic, the Zacks Oil and Gas - Refining & Marketing industry has witnessed strong demand across all product lines. While the rise in inflation throughout 2022 has driven costs up materially, the space continues to benefit from strength in fundamentals and strong margins. As global product supply is expected to remain constrained for some time due to capacity reductions, downstream operators should enjoy a bullish landscape in the near-to-medium term. With the trends looking promising, refining and marketing firms like Marathon Petroleum MPC, Valero Energy VLO, PBF Energy PBF and Murphy USA MUSA have lots of upside left and are likely to see impressive revenue and cash flow growth.

Industry Overview

The Zacks Oil and Gas - Refining & Marketing industry consists of companies involved in selling refined petroleum products (including heating oil, gasoline, jet fuel, residual oil, etc.) and a plethora of non-energy materials (like asphalt, road salt, clay and gypsum). Some of the companies also operate refined products’ terminals, storage facilities and transportation services. The primary activity of these firms involves buying crude/other feedstocks, and processing them into a wide variety of refined products. Refining margins are extremely volatile and generally reflect the state of petroleum product inventories, demand for refined products, imports, regional differences, and capacity utilization in the refining industry. Other major determinants of refining profitability are the light/heavy and sweet/sour spreads. Refiners are also prone to unplanned outages.

3 Trends Defining the Oil and Gas - Refining & Marketing Industry's Future

Growing Fuel Demand: Of late, refiners have been supported by a marked improvement in refined products’ consumption — primarily gasoline and diesel — on the back of increasing travel and mobility. Per the U.S. Energy Department's latest release, gasoline inventories are around 5% below the five-year average, signaling robust oil product usage in the market. In other words, this indicates surging consumption of gasoline, diesel and other refined products. As economic activity remains hot (with no visible sign of an imminent recession) and Americans take to the road with a vengeance amid post-pandemic recovery, refined products’ usage should continue to gain traction throughout 2023. The refiners should also benefit from increased driving and accelerating international travel.

Strong Margins: The industry’s improved fundamentals in the form of constrained supply and robust demand have led to rising refining profitability for the players involved. With product inventories running low and no near-term solution to replenish them, margins (especially for diesel and jet fuel) logged all-time highs in 2022. While margins have moderated from those spectacular levels, they are still reasonably high. Overall, elevated consumption paired with considerably lower refining capacity in the OECD countries should provide a tailwind for refinery profits throughout the year. In particular, constrained Russian fuel exports in the wake of the Ukraine conflict have further tightened refining fundamentals.

Inflation in the Marketplace: Despite the bullish energy landscape and improved demand environment, the industry has not been immune to supply-chain disruptions and cost inflation. Macro issues like higher transportation expenses, driver scarcity and labor shortages have limited refiners’ ability to ship packaged volumes to their customers. Most operators have also felt the impact of inflation, which is rolling through the cost structure. What’s worse is that these headwinds across the system and the subsequent hit to profitability (due to difficulty in passing through the increased costs to clients) are expected to continue in the near future.

Zacks Industry Rank Indicates a Sunny Outlook

The Zacks Oil and Gas - Refining & Marketing is a 16-stock group within the broader Zacks Oil - Energy sector. The industry currently carries a Zacks Industry Rank #47, which places it in the top 19% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates fairly strong near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are highly optimistic about this group’s earnings growth potential. In fact, the industry’s earnings estimates for 2023 have increased 79.6% in the past year.

Considering the encouraging dynamics of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and the current valuation first.

Industry Outperforms Sector & S&P 500

The Zacks Oil and Gas - Refining & Marketing industry has fared better than the broader Zacks Oil - Energy sector as well as the Zacks S&P 500 composite over the past year.

The industry has gained 21.8% over this period compared with the broader sector’s increase of 17%. Meanwhile, the S&P 500 has lost 6.8%.

One-Year Price Performance

Industry's Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of noncash expenses.

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA), the industry is currently trading at 2.32X, significantly lower than the S&P 500’s 12.22X. It is also below the sector’s trailing-12-month EV/EBITDA of 3.23X.

Over the past five years, the industry has traded as high as 6.90X, as low as 1.89X, with a median of 4.46X, as the chart below shows.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio (Past Five Years)

4 Top Stocks to Buy Now

Murphy USA: It is a leading independent retailer of motor fuel and convenience merchandise in the United States. The proximity of Murphy USA’s fuel stations to Walmart supercenters helps the company to leverage the strong and consistent traffic that these stores attract. MUSA’s acquisition of QuickChek Corporation — a family-owned food and beverage chain located — is expected to help improve its offerings.

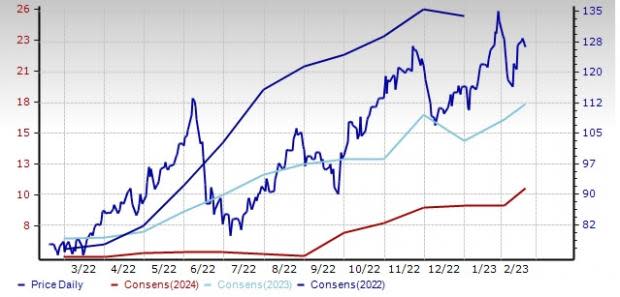

Over the past 30 days, this El Dorado, AR-based Murphy USA has seen the Zacks Consensus Estimate for 2023 improve 6%. MUSA beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters, the average being 43.4%. The company carries a Zacks Rank #1 (Strong Buy). Shares of MUSA are up 48.6% in a year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: MUSA

Marathon Petroleum: The company is a leading independent refiner, transporter and marketer of petroleum products. MPC’s $23.3 billion acquisition of Andeavor has integrated the premier assets of both companies, bolstering the scale and leadership position of the combined entity in the United States. As it is, Marathon Petroleum's access to lower cost of crude in the Permian, Bakken, and Canada helps it to benefit from the differentials.

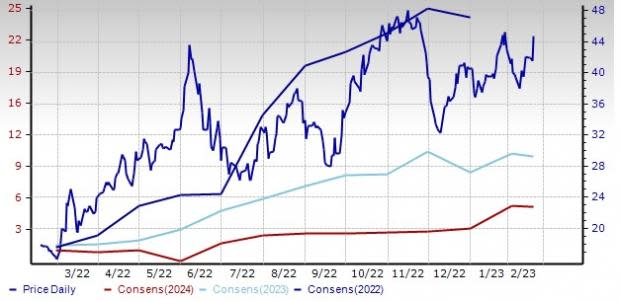

Marathon Petroleum has an expected earnings growth rate of 237.6% for the current quarter. MPC beat the Zacks Consensus Estimate for earnings in each of the trailing four quarters, the average being 20.9%. Valued at around $59.6 billion, the Zacks Rank #2 (Buy) Marathon Petroleum has gained 64.3% in a year.

Price and Consensus: MPC

PBF Energy: PBF Energy has one of the most complex refining systems in the United States. As a result, the firm has the capacity to generate lighter and better grades of refined products. PBF’s daily processing capacity of 1,000,000 barrels of crude is higher than most of its peers.

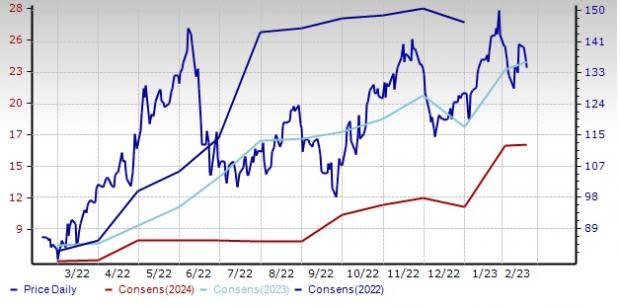

The 2022 Zacks Consensus Estimate for this Parsippany, NJ-based firm indicates 1,055.6% year-over-year earnings per share growth. PBF Energy beat the Zacks Consensus Estimate for earnings in each of the last four quarters, the average being 49%. The Zacks #2 Ranked PBF’s shares are up 149.5% in a year.

Price and Consensus: PBF

Valero Energy: Among all the independent refiners, Valero offers the most diversified refinery base with a capacity of 3.1 million barrels per day in its 15 refineries located throughout the United States, Canada and the Caribbean. The majority of VLO’s refining plants are located in the Gulf coast area, from where there is easy access to the export facilities.

The Zacks Consensus Estimate for Valero’s 2023 earnings has been revised 17.4% upward over the past 30 days. VLO, headquartered in San Antonio, TX, has a projected earnings growth rate of 198.7% for the current quarter. It has a Zacks Rank #2. Shares of VLO are up 54.6% in a year.

Price and Consensus: VLO

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

PBF Energy Inc. (PBF) : Free Stock Analysis Report