5 Health Care Stocks in Gurus' Portfolios

According to the GuruFocus All-In-One Screener, as of Friday, the following health care stocks are popular among gurus.

Pacira BioSciences Inc. (PCRX) is held by six gurus

The company which manufactures pharmaceutical products for use in hospitals and ambulatory surgery centers has a market cap of $1.55 billion. Its revenue of $372.48 million has grown 21.40% over a 10-year period.

The stock is trading with a price-earnings ratio of 219.09. The share price of $36.6 is 32.27% below the 52-week high and 6.22% above the 52-week low. Over the last 10 years, it has returned 430.63%.

The company's largest shareholder among the gurus is Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 2.80% of outstanding shares, followed by Jim Simons' (Trades, Portfolio) Renaissance Technologies with 2.62% and John Paulson (Trades, Portfolio) with 2.30%.

Magellan Health Inc. (MGLN) is held by eight gurus

The health care management services provider has a market cap of $1.53 billion. Its revenue of $7.22 billion has grown 15.90% over the past decade.

The stock is trading with a price-book ratio of 1.18. The current share price of $62.6 is 18.54% below the 52-week high and 20.66% above the 52-week low. Over the past decade, it has returned 95.08%.

Simons' firm is the company's largest guru shareholder with 2.37% of outstanding shares, followed by Snow Capital Management's Richard Snow (Trades, Portfolio) with 1.38%, Cohen with 1.17% and Ken Fisher (Trades, Portfolio) with 1.08%.

Brookdale Senior Living Inc. (BKD) is held by five gurus

The company, which provides meals, housekeeping and supplemental-care services to assist residents with daily activities, has a $1.53 billion market cap. Its revenue of $4.25 billion has grown 4.0% over the past decade.

The stock is trading with a price-book ratio of 1.78. The price of $8.1 is 19.0% below the 52-week high and 35.68% above the 52-week low. Over the last 10 years, it has lost 49.02%.

The company's largest guru shareholder is Larry Robbins' (Trades, Portfolio) Glenview Capital Management with 9.94% of outstanding shares, followed by Simons with 6.14%, Cohen with 0.42% and Chuck Royce (Trades, Portfolio) with 0.31%.

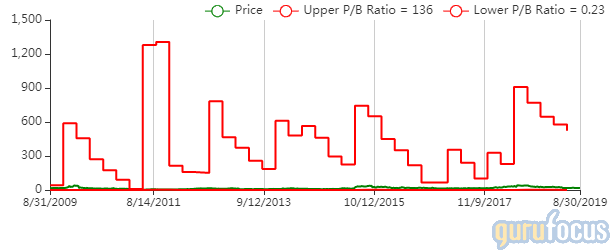

Heron Therapeutics Inc. (HRTX) is held by three gurus

The company, which provides products to address unmet medical needs, has a market cap of $1.50 billion.

The stock is trading with a price-book ratio of 4.87. The share price of $18.75 is 53.18% below the 52-week high and 19.85% above the 52-week low. Over the last 10 years, it has returned 10.29%.

With 0.12% of outstanding shares, the Simons' firm is the company's largest guru shareholder, followed by Fisher with 0.10% and Royce with 0.09%.

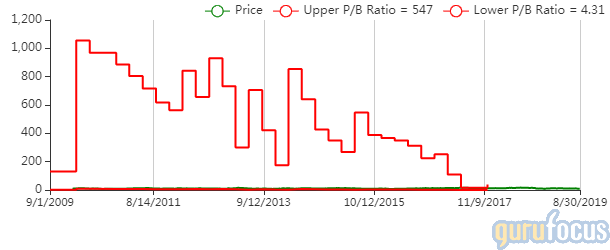

Ironwood Pharmaceuticals Inc. (IRWD) is held by six gurus

The company, which operates human therapeutics segment, has a $1.46 billion market cap. Its revenue of $367.32 million has grown 7.60% over the last 10 years.

The current share price of $9.32 is 52.55% below the 52-week high and 7.75% above the 52-week low. Over the past decade, it has returned a loss of 4.41%.

The company's largest guru shareholder is Vanguard Health Care Fund (Trades, Portfolio) with 6.56% of outstanding shares, followed by Fisher with 0.14%, Joel Greenblatt (Trades, Portfolio)'s Gotham Asset Management with 0.02%, Diamond Hill Capital (Trades, Portfolio) with 0.02% and Michael Price (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Insiders Roundup: Facebook, Community Health Systems

5 Guru Stocks With Predictable Businesses

5 Cheap High-Yield Stocks

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.