5 Peter Lynch Growth Stocks to Consider for 2nd Quarter

- By James Li

According to the Peter Lynch Growth Screen, a Premium All-in-One Screener template, five stocks with high financial strength, good revenue growth and are trading below the Peter Lynch earnings line as of Tuesday are Big Lots Inc. (NYSE:BIG), The Cooper Companies Inc. (NYSE:COO), Emergent BioSolutions Inc. (NYSE:EBS), SPAR Group Inc. (NASDAQ:SGRP) and Worthington Industries Inc. (NYSE:WOR).

Lynch, who managed the Fidelity Magellan Fund during the 1980s, wrote in his book "One Up on Wall Street" that one can quickly measure a stock's valuation by comparing the stock's price to a fair value at 15 times earnings. A stock is undervalued if it trades below a price-earnings ratio of 15.

GuruFocus' Peter Lynch Growth Screen also looks for stocks with 10-year revenue growth of at least 6% and a business predictability rank of at least two stars out of five. To further narrow the list of companies to high-quality stocks, one can require a financial strength rank of at least 6.

The Screener listed five companies meeting the above criteria as of Tuesday.

Big Lots

Shares of Big Lots (NYSE:BIG) traded around $69.65, approximately 4.38 times its earnings per share. The stock's price-earnings ratio outperforms over 98% of global competitors.

GuruFocus ranks the Columbus-based discount retailer's profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, a three-year revenue growth rate that outperforms over 73% of global competitors and an operating margin that tops more than 80% of global defensive retail companies.

Big Lots' financial strength ranks 6 out of 10 on the back of a high Altman Z-score of 4.11 and debt ratios outperforming over 66% of global competitors. Gurus with large holdings in Big Lots include Pioneer Investments (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio)'s GMO.

The Cooper Companies

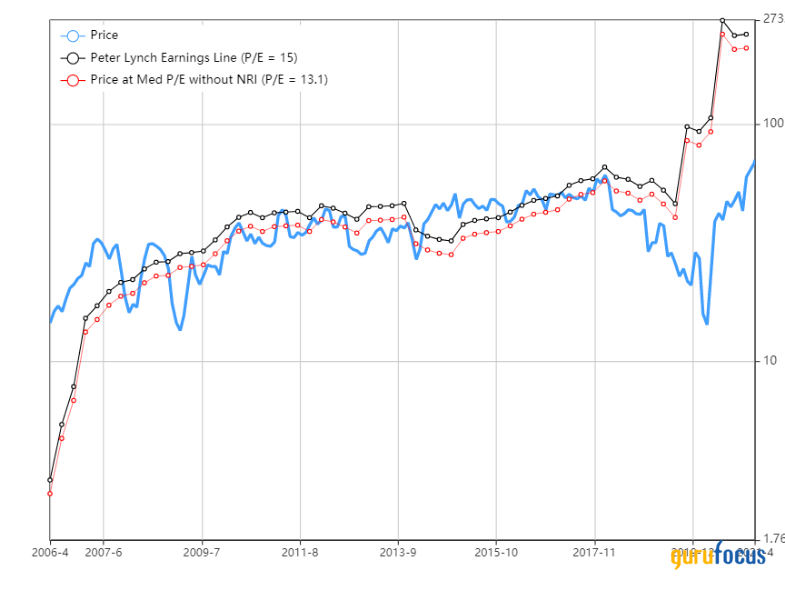

Shares of The Cooper Companies (NYSE:COO) traded around $388.98, approximately 8.98 times its earnings per share. The company's price-earnings ratio is near a 10-year low and outperforms more than 91% of global medical device companies.

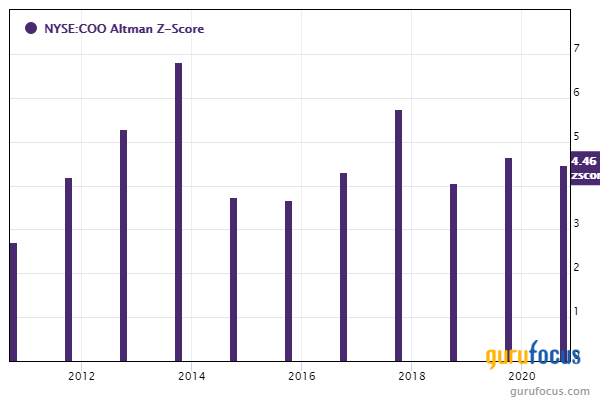

GuruFocus ranks the San Ramon, California-based medical company's financial strength 6 out of 10 on the back of a strong Altman Z-score of 5.19 despite debt ratios underperforming over 60% of global competitors.

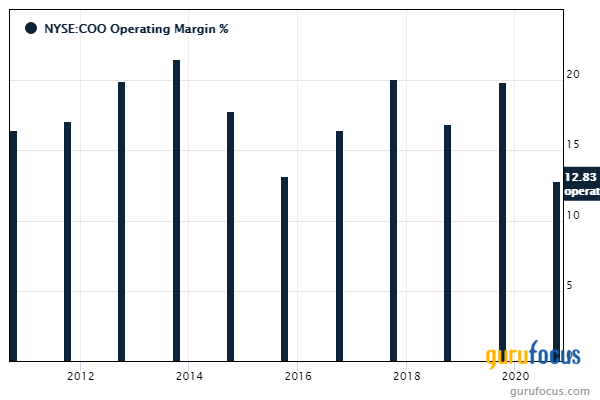

Cooper's profitability ranks 8 out of 10 on several positive investing signs, which include expanding operating margins and a five-star business predictability rank.

Emergent BioSolutions

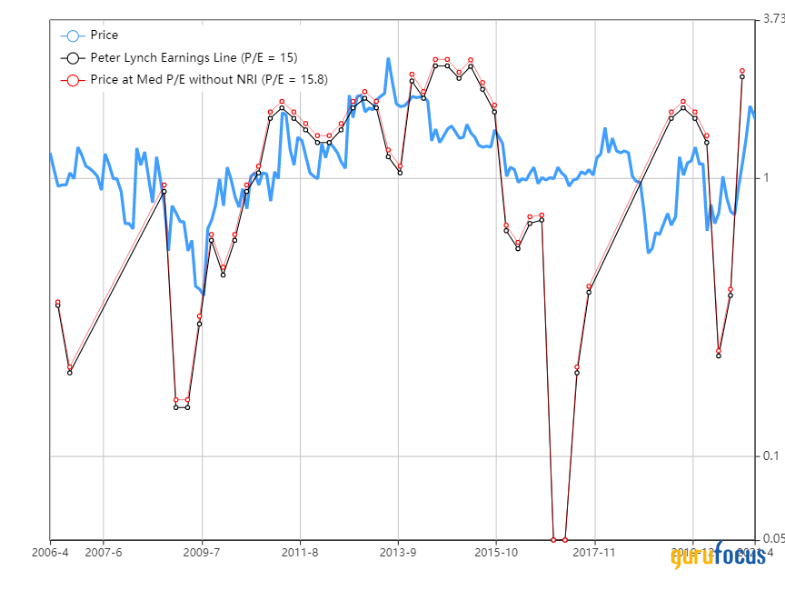

Shares of Emergent BioSolutions (NYSE:EBS) traded around $79.25, approximately 14 times its earnings per share. Despite this, the stock's price-earnings ratio is near a five-year low; further, the stock is significantly undervalued based on Tuesday's price-to-GF Value ratio of 0.66.

GuruFocus ranks the Gaithersburg, Maryland-based drug manufacturer's profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank, a high Piotroski F-score of 7 and profit margins and returns outperforming over 88% of global competitors.

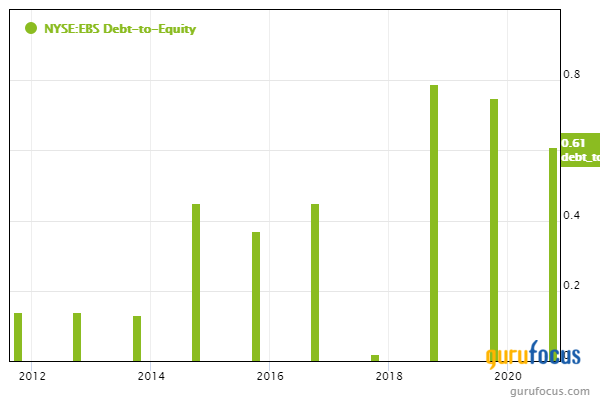

Emergent BioSolutions' financial strength ranks 6 out of 10 on the heels of a strong Altman Z-score of 3.48 despite debt ratios underperforming more than 60% of global competitors.

SPAR Group

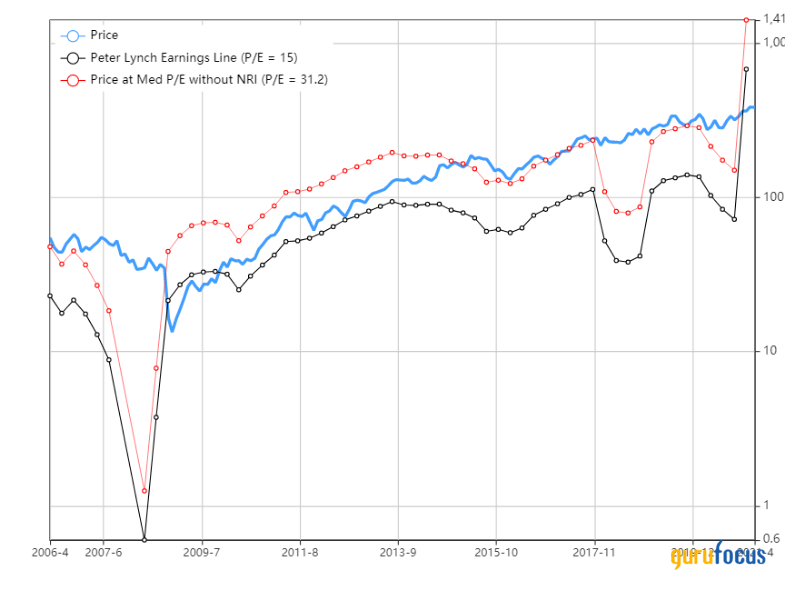

Shares of SPAR Group (NASDAQ:SGRP) traded around $1.65, approximately 10.66 times its earnings per share.

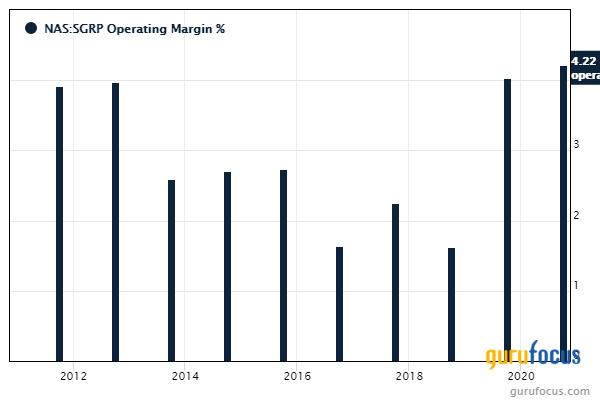

GuruFocus ranks the White Plains, New York-based merchandising and marketing company's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8, a three-star business predictability rank and an operating margin that has increased approximately 13.8% per year on average over the past five years.

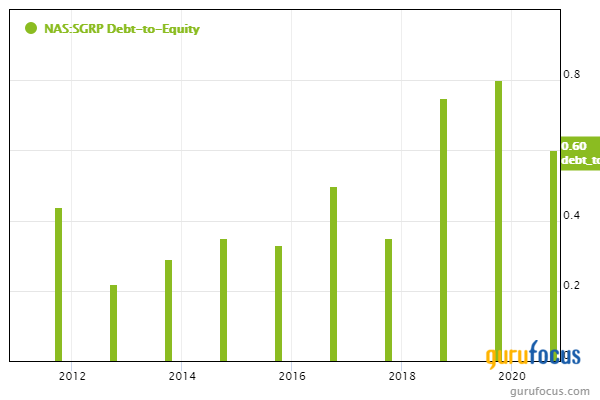

SPAR Group's financial strength ranks 6 out of 10 on the back of debt-to-Ebitda ratios outperforming over 60% of global competitors.

Worthington Industries

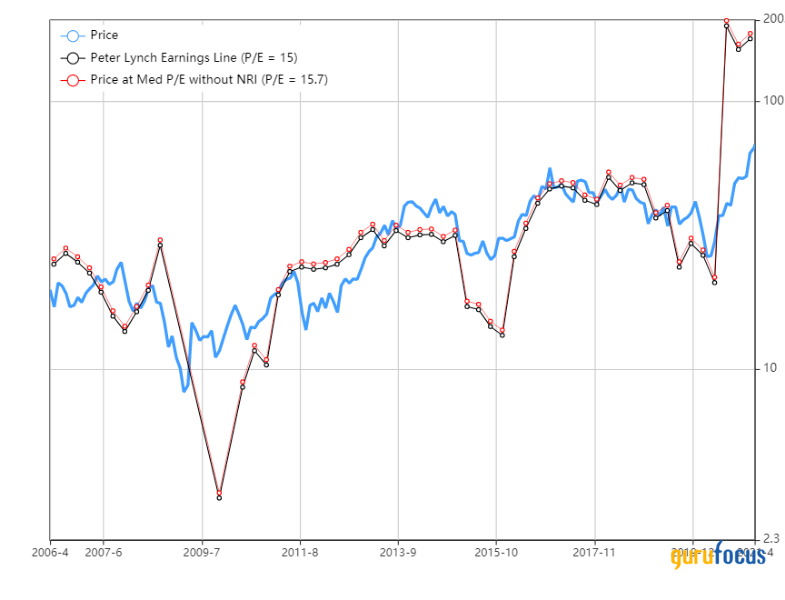

Shares of Worthington Industries (NYSE:WOR) traded around $68.90, approximately 6.05 times its earnings per share. The company's price-earnings ratio outperforms over 96% of global competitors.

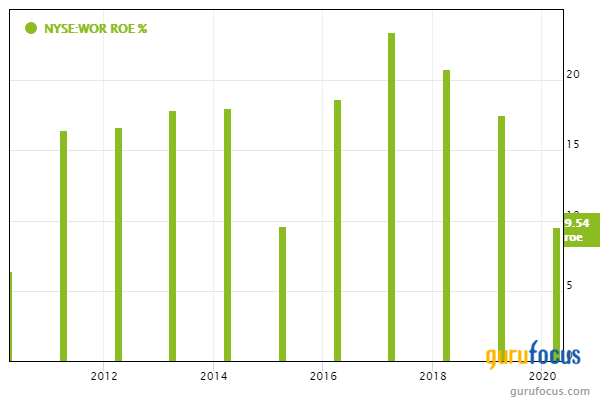

GuruFocus ranks the Columbus-based manufacturing company's profitability 7 out of 10 on the back of a high Piotroski F-score of 7 and returns outperforming over 98% of global competitors despite operating margins topping just over half of global industrial companies.

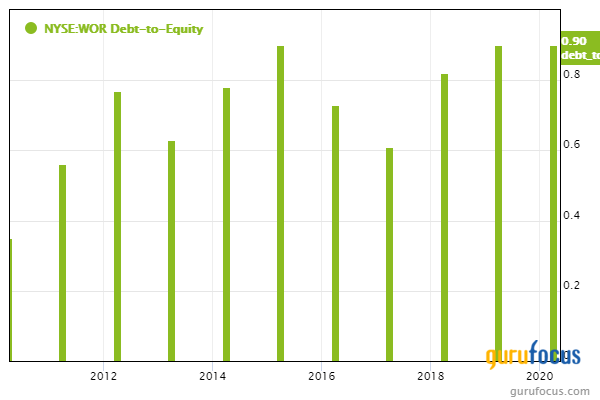

Worthington's financial strength ranks 6 out of 10 due to a strong Altman Z-score of 3.44 and a debt-to-Ebitda ratio that outperforms more than 70% of global competitors.

Disclosure: The author has no positions in the stocks mentioned. The mention of stocks in this article do not constitute a recommendation. Investors must do their own diligent research before investing in the stock market.

Different valuation methods may produce different valuation zones: A stock may be undervalued based on the Peter Lynch earnings line yet overvalued based on its price-sales ratio or our exclusive GF Value method.

Read more here:

Charlie Munger's Daily Journal Subscribes to Alibaba

Value Screeners Identify Opportunities for 2nd Quarter

Leith Wheeler Canadian Equity Fund's Top 5 Trades in 2nd Half of 2020

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.