5 Stocks Beating the Market

According to the GuruFocus All-in-One Screener, the following stocks have outperformed the Standard & Poor's 500 Index over the past 12 months.

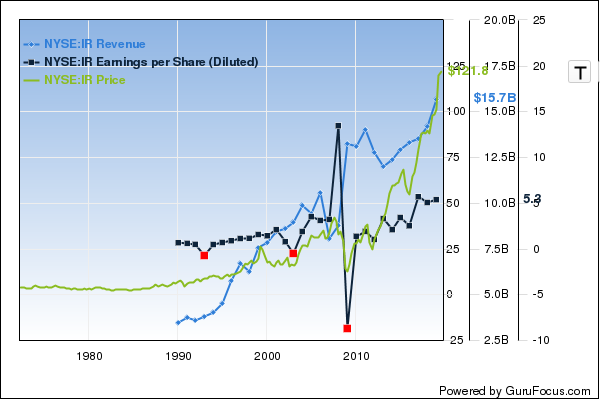

Ingersoll-Rand PLC (NYSE:IR) has a market cap of $30.03 billion. It has outperformed the S&P 500 by 18.95% over the past year.

Shares are trading with a price-earnings ratio of 21.40. According to the discounted cash flow calculator, the stock is overpriced by 99.92% at $124.32. As of Monday, the price was 46% above the 52-week low and 3.11% below the 52-week high.

The company has a profitability and growth rating of 7 out of 10. The return on equity of 20.28% and return on assets of 7.5% are outperforming 69% of companies in the Industrial Products industry. Its financial strength is rated 5.2 out of 10. The cash-debt ratio of 0.15 is below the industry median of 0.75.

Al Gore (Trades, Portfolio) is the company's largest guru shareholder with 1.18% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.82% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.14%.

With a market cap of $29.91 billion, O'Reilly Automotive Inc. (NASDAQ:ORLY) has outperformed the S&P 500 by 10.85% over the past 12 months.

Shares are trading with a price-earnings ratio of 22.86. According to the DCF calculator, the stock is undervalued with a 18% margin of safety at $384 per share. As of Monday, the price was 24.42% above the 52-week low and 5.74% below the 52-week high.

The company, which sells automotive parts, tools and accessories, has a profitability and growth rating of 8 out of 10. The return on equity of 382.35% and return on assets of 15.28% are outperforming 90% of companies in the Retail - Apparel and Specialty industry. Its financial strength is rated 4.4 out of 10. The cash-debt ratio of 0.01 is below the industry median of 0.51.

The company's largest guru shareholder is Chuck Akre (Trades, Portfolio) with 2.47% of outstanding shares, followed by Pioneer Investments with 0.98% and David Abrams (Trades, Portfolio) with 0.68%.

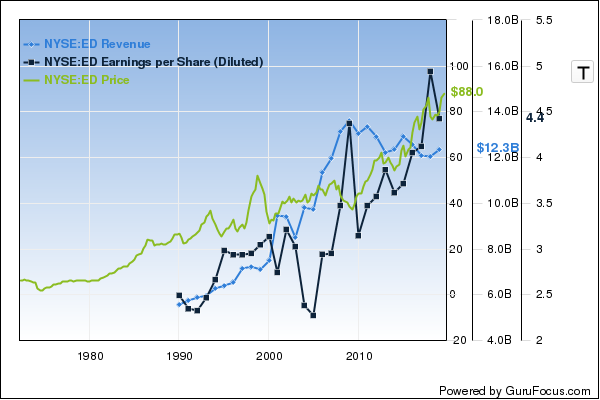

Consolidated Edison Inc. (NYSE:ED) has a market cap of $29.83 billion. It has outperformed the S&P 500 by 11.35% over the past year.

Shares are trading with a price-earnings ratio of 21.33. According to the DCF calculator, the stock is overpriced by 99% at $89.81. As of Monday, the price was 22.53% above the 52-week low and 1.93% below the 52-week high.

The company has a profitability and growth rating of 7 out of 10. The return on equity of 8.05% and return on assets of 2.55% are underperforming 65% of companies in the Utilities - Regulated industry. Its financial strength is rated 3.8 out of 10. The cash-debt ratio of 0.04 is below the industry median of 0.23.

The company's largest guru shareholder is Simons' firm with 0.33% of outstanding shares, followed by Pioneer Investments with 0.11%.

With a market cap of $29.50 billion, PT Telekomunikasi Indonesia (NYSE:TLK) has outperformed the S&P 500 by 27.61% over the past 12 months.

Shares are trading with a price-earnings ratio of 20.42. According to the DCF calculator, the stock is overpriced by 73% at $30 per share. As of Monday, the price was 28.86% above the 52-week low and 5.40% below the 52-week high.

The telecommunications company has a profitability and growth rating of 8 out of 10. The return on equity of 21.32% and return on assets of 9.63% are outperforming 78% of companies in the Communication Services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.33 is above the industry median of 0.3.

Simons' firm is the company's largest guru shareholder with 0.45% of outstanding shares, followed by the Matthews Pacific Tiger Fund (Trades, Portfolio) with 0.17%.

Paychex Inc. (NASDAQ:PAYX) has a market cap of $29.30 billion. It has outperformed the S&P 500 by 9.01% over the past 12 months.

Shares are trading with a price-earnings ratio of 28.54. According to the DCF calculator, the stock is overpriced by 120% at $81.62 per share. As of Monday, the price was 33.11% above the 52-week low and 7.70% below the 52-week high.

The company, which operates in the payroll outsourcing industry, has a profitability and growth rating of 7 out of 10. The return on equity of 41.76% and return on assets of 12.61% are outperforming 81% of companies in the Business Services industry. Its financial strength is rated 6.8 out of 10. The cash-debt ratio of 0.9 is above the industry median of 0.65.

The company's largest guru shareholder is Joel Greenblatt (Trades, Portfolio) with 0.11% of outstanding shares, followed by Pioneer Investments with 0.11%, Tom Gayner (Trades, Portfolio) with 0.04% and Jeff Auxier (Trades, Portfolio) with 0.01%.

Disclosure: I do not own any of the stocks mentioned.

Read more here:

6 Cheap Stocks With a Margin of Safety

5 Health Care Stocks Gurus Are Buying

Largest Insider Trades of the Week

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.