5 Top Stock Trades for Thursday — Trading FANG Stocks and Tilray

Tech was a bit sleepy on Wednesday, but overall the U.S. stock market continued to push higher on the day. Despite a growing list of trade concerns, equities — led by pot stocks — continue to push higher. Let’s look at the leader of that movement, as well as some FANG stocks as part of our top stock trades.

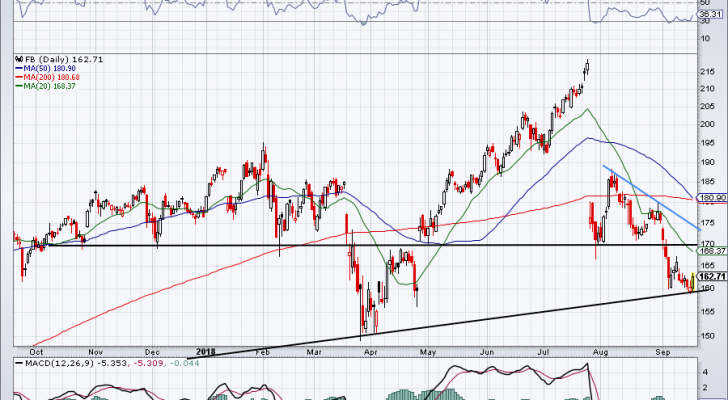

Top Stock Trades for Tomorrow #1: Facebook

I’ve been hearing a lot of chatter about a possible bottom in Facebook (NASDAQ:FB). It’s totally possible that that’s the case, particularly with shares consolidating nicely near that $160 area.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Unfortunately we won’t know if Facebook has bottomed until we’re looking back at the charts in hindsight. What I will say is that, for it bottom, this level needs to hold up for bulls. Should it fail, we will likely get a flush down toward $150, the March/April lows from the Cambridge Analytica situation.

If $160 holds for now, see how Facebook does against resistance. Specifically, see how it handles the 20-day moving average, the $170 level and downtrend resistance (blue line).

Bulls can go long now and target these levels on the upside. A tight stop-loss can be used below the recent lows. Those who want an investment and not a trade can use a stop-loss on a close below the March/April lows.

Top Stock Trades for Tomorrow #2: Tilray

What do we even say about this company? Tilray (NASDAQ:TLRY) is expected to do $41 million in sales this year and has a $25 billion valuation. It’s up more than 60% just since Tuesday’s open and even at $217 is more than 27% off its highs — as it hit $300 per share earlier in the session.

The cost to borrow for shorting is astronomical and put premiums are insane. No way would I buy or sell this thing right now. I’ve seen too many people (even ones I know!) blow up their accounts by shorting Tilray already.

This is one to observe folks, not trade, in my humble opinion.

Top Stock Trades for Tomorrow #3: Amazon

We’re finally seeing some weakness in FANG juggernaut Amazon (NASDAQ:AMZN).

Heading into the second half of the year and with the cloud industry going so strong right now, I wouldn’t count Amazon out for long.

More than $200 off its highs, investors can justify an entry in AMZN near current levels. It all but tested its 50-day a few days ago, although cautious bulls may wait for a complete test before going long.

It is below its recent uptrend of support, and a lower high earlier this month put AMZN in a short-term downtrend (blue line). If it rallies and can’t push through those trends, more downside could be on the way.

Be nimble with Amazon as it’s a trend stock. When the trend breaks, we need to let the dust settle.

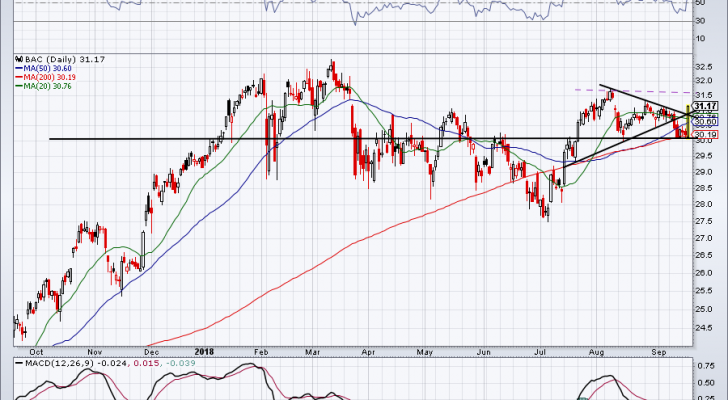

Top Stock Trades for Tomorrow #4: Bank of America

The bank stocks are suddenly back with a vengeance. It’s notable on a day where tech is weak and banks are running. JPMorgan (NASDAQ:JPM), Goldman Sachs (NYSE:GS) and Bank of America (NYSE:BAC) are all jumping, with BAC stock up more than 3%.

Will the rotation last? That’s the big question. The one thing banks have going for them is the Fed meeting on September 25th and 26th. The Fed is expected to raise rates and investors could be bidding these names higher into the event.

If so, it may setup as a sell-the-news move. But for now, it was huge for BAC to get above its short-term downtrend mark and back above uptrend support. Over $30.75 to $31 and it’s hard to be too bearish.

If it continues higher, see how it handles $31.50, its highs from August.

Top Stock Trades for Tomorrow #5: Shopify

Shopify (NASDAQ:SHOP) has been trading great lately, after testing the 200-day moving average and reversing.

With a high valuation momentum stock like Shopify, keep it simple. Over this $150 to $155 level and investors can stay long. Above this mark and SHOP can likely retest its prior highs near $175.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell is long BAC and JPM.

More From InvestorPlace

The post 5 Top Stock Trades for Thursday — Trading FANG Stocks and Tilray appeared first on InvestorPlace.