6 Stocks Trading Below Peter Lynch Value

Several gurus are focusing on stocks whose Peter Lynch fair values are above their current prices, according to the GuruFocus All-in-One Screener. As of Monday, the following companies are trading with wide margins of safety and have had positive performances over the last 12 months.

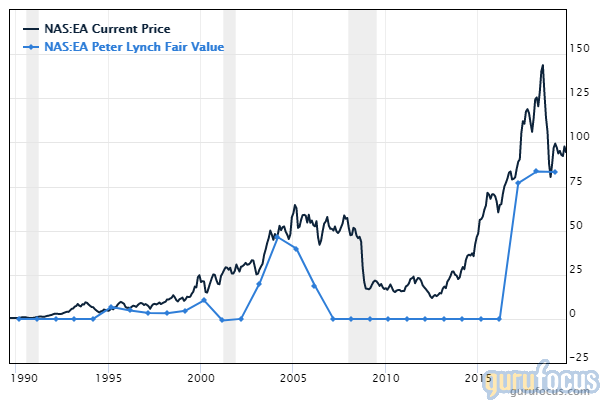

Electronic Arts Inc. (NASDAQ:EA) is trading around $96.76 per share. The Peter Lynch value gives the stock a fair price of $137.4, which suggests it is undervalued with a 30% margin of safety. Over the past three months, the stock has registered a positive performance of 7.87%.

The video game publisher has a market cap of $28.52 billion and an enterprise value of $24.38 billion.

The stock is trading with a price-earnings ratio of 13.57, which is higher than 76% of companies in the Application Software industry. The share price is currently 11.07% below its 52-week high and 30.92% above its 52-week low. The price-book ratio is 4.43.

The company's largest guru shareholder is Pioneer Investments (Trades, Portfolio) with 0.91% of outstanding shares, followed by Philippe Laffont (Trades, Portfolio) with 0.56% and PRIMECAP Management (Trades, Portfolio) with 0.34%.

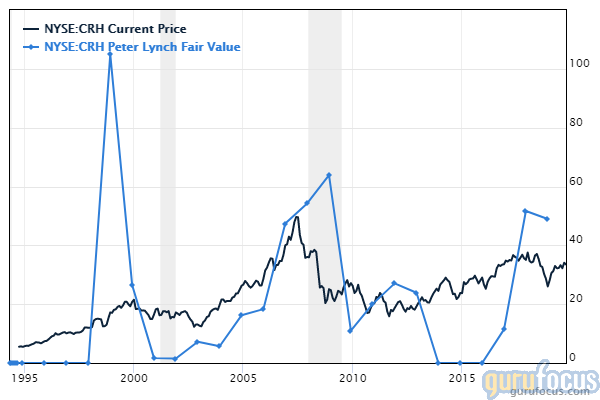

CRH PLC (NYSE:CRH) is trading around $35 per share. The Peter Lynch value gives the stock a fair price of $40.3, which suggests it is undervalued with a 13% margin of safety. The stock registered a positive three-month performance of 7.87%.

The building materials provider has a market cap of $27.69 billion and an enterprise value of $40.10 billion.

The stock is trading with a price-earnings ratio of 15.69, which is lower than 56% of companies in the Building Materials industry. The share price is currently 1.58% below its 52-week high and 41.92% above its 52-week low. The price-book ratio is 1.59.

Jim Simons (Trades, Portfolio)' Renaissance Technologies is the company's largest guru shareholder with 0.20% of outstanding shares, followed by Charles Brandes (Trades, Portfolio) with 0.12% and Jeremy Grantham (Trades, Portfolio) with 0.03%.

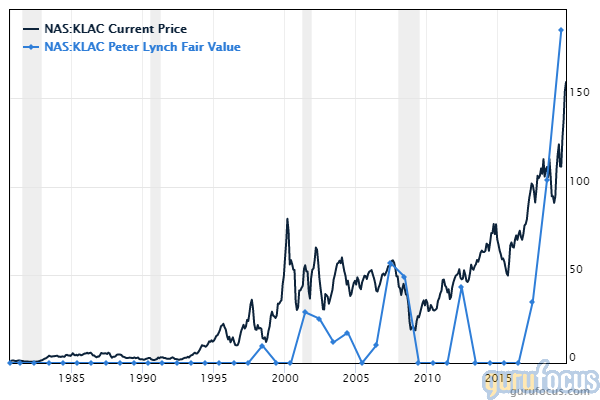

KLA Corp. (NASDAQ:KLAC) is trading around $162 per share. The Peter Lynch value gives the stock a fair price of $188.5, which suggests it is undervalued with a 14% margin of safety. Over the past three months, the stock has risen 6%.

The company, which manufactures yield-management and process-monitoring systems, has a market cap of $25.59 billion and an enterprise value of $27.30 billion.

The stock is trading with a price-earnings ratio of 21.42, which is lower than 53% of companies in the Semiconductors industry. The share price is currently 3.83% below its 52-week high and 100.26% above its 52-week low. The price-book ratio is 9.83.

The company's largest guru shareholder is PRIMECAP Management with 6.50% of outstanding shares, followed by Pioneer Investments with 0.30% and Steven Cohen (Trades, Portfolio) with 0.18%.

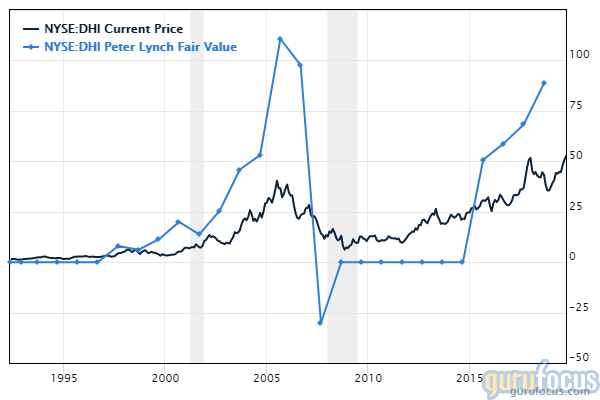

D.R. Horton Inc. (NYSE:DHI) is trading around $54 per share. The Peter Lynch value gives the stock a fair price of $90.41, which suggests it is undervalued with a 41% margin of safety. Over the past three months, the stock has registered a positive performance of 18.67%.

The American homebuilder has a market cap of $19.78 billion and an enterprise value of $22.54 billion.

The stock is trading with a price-earnings ratio of 12.83, which is higher than 55% of companies in the Homebuilding and Construction industry. The share price is currently 1.69% below its 52-week high and 65.14% above its 52-week low. The price-book ratio is 2.07.

Steve Mandel (Trades, Portfolio) is the company's largest guru shareholder with 3.36% of outstanding shares, followed by George Soros (Trades, Portfolio) with 0.44% and Glenn Greenberg (Trades, Portfolio) with 0.34%.

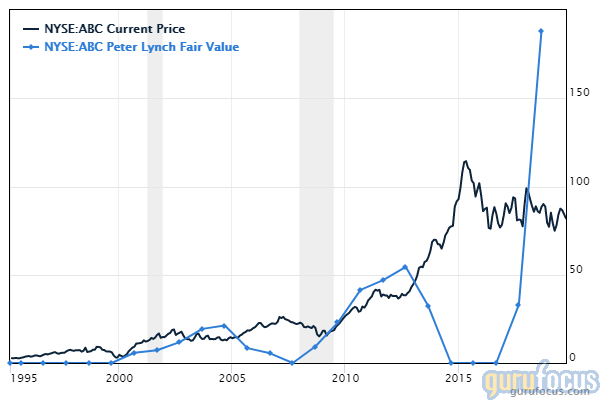

AmerisourceBergen Corp. (NYSE:ABC) is trading around $86 per share. The Peter Lynch value gives the stock a fair price of $190.5, which suggests it is undervalued with a 53% margin of safety. Over the past three months, the stock has risen 5.20%.

The American pharmaceutical distributor has a market cap of $18.65 billion and an enterprise value of $19.95 billion.

The stock is trading with a price-earnings ratio of 19.93, which is lower than 57% of companies in the Medical Distribution industry. The share price is currently 4.84% below its 52-week high and 90.09% above its 52-week low. The price-book ratio is 6.82.

The company's largest guru shareholder is Seth Klarman (Trades, Portfolio) with 1.05% of outstanding shares, followed by Larry Robbins (Trades, Portfolio) with 0.77%, Pioneer Investments with 0.36% and the Smead Value Fund (Trades, Portfolio) with 0.14%.

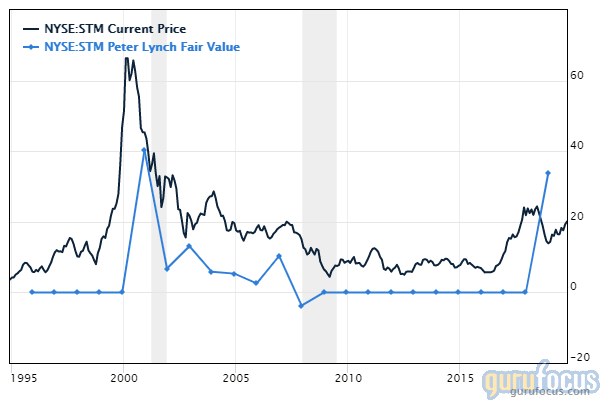

STMicroelectronics NV (NYSE:STM) is trading around $21.17 per share. The Peter Lynch value gives the stock a fair price of $25.58, which suggests it is undervalued with a 17% margin of safety. Over the past three months, the stock has registered a positive performance of 19.40%.

The semiconductor company has a market cap of $18.74 billion and an enterprise value of $18.62 billion.

The stock is trading with a price-earnings ratio of 16.38, which is higher than 59% of companies in the Semiconductors industry. The share price is currently 2.12% below its 52-week high and 76.58% above its 52-week low. The price-book ratio is 2.80.

Grantham is the company's largest guru shareholder with 0.52% of outstanding shares, followed by Simons' firm with 0.06%.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

6 Stocks Outperforming the Market

Insiders Roundup: Facebook, Vir Biotechnology

6 Guru Stocks That Could Grow Fast

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.