6 Undervalued Stocks Growing Earnings

- By Tiziano Frateschi

Companies that are growing their earnings are often good investments because they can return a solid profit to investors. According to the discounted cash flow calculator, the following undervalued companies have grown their earnings over a five-year period.

Warning! GuruFocus has detected 2 Warning Sign with SRAX. Click here to check it out.

The intrinsic value of ROST

The earnings per share of Ross Stores Inc. (ROST) have grown 15% annually over the last five years.

According to the DCF calculator, the stock is undervalued and is trading with a 33 % margin of safety at $82.61 per share. The price-earnings ratio is 19. 20 . The share price has been as high as $ 104.35 and as low as $ 73.76 in the last 52 weeks; it is currently 2 1.82 % below its 52-week high and 10.60 % above its 52-week low.

The discount apparel and home fashions chain has a market cap of $ 30.23 billion and an enterprise value of $ 29.2 8 billion.

Ross Stores' largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 3.33 % of outstanding shares, followed by the Pioneer Investments (Trades, Portfolio) with 1 .4 % and David Rolfe (Trades, Portfolio) with 0.2%.

Energy Transfer LP's (ET) earnings per share have grown 37% per year over the last five years.

According to the DCF calculator, the stock is undervalued and is trading with a 27% margin of safety at $13 per share. The price-earnings ratio is 11.01. The share price has been as high as $19.34 and as low as $11.68 in the last 52 weeks; it is currently 33.97% below its 52-week high and 9.33% above its 52-week low.

The owner of natural gas gathering systems has a market cap of $33.42 billion and an enterprise value of $109.93 billion.

With 0.17% of outstanding shares, David Tepper (Trades, Portfolio) is the company's largest guru shareholder, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.11%, Leon Cooperman (Trades, Portfolio) with 0.09% and T Boone Pickens (Trades, Portfolio)' BP Capital with 0.01%.

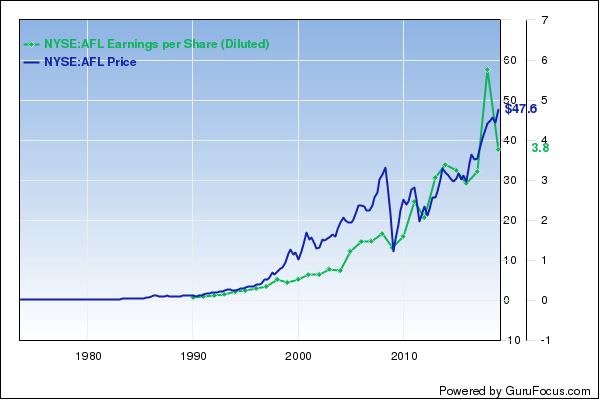

The earnings per share of Aflac Inc. (AFL) have grown 9% per year over the last five years.

According to the DCF calculator, the stock is undervalued and is trading with a 58% margin of safety at $44.95 per share. The price-earnings ratio is 7.11. The share price has been as high as $48.19 and as low as $41.41 in the last 52 weeks; it is currently 6.72% below its 52-week high and 8.55% above its 52-week low.

The general business holding company has a market cap of $34.22 billion and an enterprise value of $36.07 billion.

With 0.31% of outstanding shares, Smead Capital Management, Inc. (Trades, Portfolio) is the company's largest guru shareholder, followed by John Rogers (Trades, Portfolio) with 0.29%, Pioneer Investments with 0.08% and Jeremy Grantham (Trades, Portfolio) with 0.04%.

Baxter International Inc.'s (BAX) earnings per share have grown 7% per year over the last five years.

According to the DCF calculator, the stock is overpriced by 174% at $65.21 per share. The price-earnings ratio is 29.51. The share price has been as high as $78.38 and as low as $61.05 in the last 52 weeks; it is currently 16.80% below its 52-week high and 6.81% above its 52-week low.

The provider of hospital products has a market cap of $34.7 billion and an enterprise value of $35.31 billion.

The company's largest guru shareholder is Daniel Loeb (Trades, Portfolio) with 5.26% of outstanding shares, followed by the Vanguard Health Care Fund (Trades, Portfolio) with 1.08% and Bill Nygren (Trades, Portfolio) with 1%.

The earnings per share of Sherwin-Williams Co. (SHW) have grown 24% per year over the last five years.

According to the DCF calculator, the stock is undervalued and is trading with a 13% margin of safety at $390 per share. The price-earnings ratio is 19.45. The share price has been as high as $479.64 and as low as $355.28 in the last 52 weeks; it is currently 18.78% below its 52-week high and 9.56% above its 52-week low.

The provider of architectural paint and paint-related products has a market cap of $36.47 billion and an enterprise value of $45.96 billion.

The largest guru shareholder of the company is Steven Cohen (Trades, Portfolio) with 0.09% of outstanding shares, followed by Ron Baron (Trades, Portfolio) with 0.04%, Ray Dalio (Trades, Portfolio) with 0.02% and Diamond Hill Capital (Trades, Portfolio) with 0.01%.

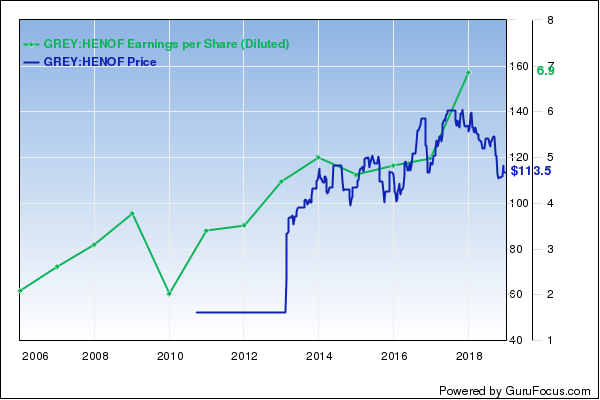

Henkel AG & Co. KGaA's (HENOF) earnings per share have grown 11% per year over the last five years.

According to the DCF calculator, the stock is overpriced by 17% at $113.5 per share. The price-earnings ratio is 15.14. The share price has been as high as $140 and as low as $109 in the last 52 weeks; it is currently 18.99% below its 52-week high and 3.94% above its 52-week low.

The chemical and consumer goods company has a market cap of $44.04 billion and an enterprise value of $47.32 billion.

Disclosure: I do not own any stocks mentioned in this article.

Read more here:

6 Guru Stocks With a Growing Book Value

6 Undervalued Stocks With Predictable Business

6 Guru Stocks With Low Price-Earnings Ratios

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with SRAX. Click here to check it out.

The intrinsic value of ROST