7 Marijuana Penny Stocks to Consider for Those Who Can Handle Risk

[Editor’s note: This story will be updated each week with new stocks and analysis. Please check back often for Mark’s latest take on marijuana penny stocks.]

Marijuana penny stocks can be very attractive to those who like to invest in this highly risky sector of the equity markets. Given the growth potential of the industry, it is reasonable to assume that there are some stocks out there that will turn people into millionaires.

You have to be very careful when investing in penny stocks. After all, they are penny stocks for a reason. Many of these companies will not survive, and the stock will ultimately become worthless.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

The following companies may have some potential. They are either at support or in uptrends. But please note, these are not buy recommendations. I just wanted to give you some insights that may help you with your own investments.

Without further ado, the marijuana penny stocks to watch this week are:

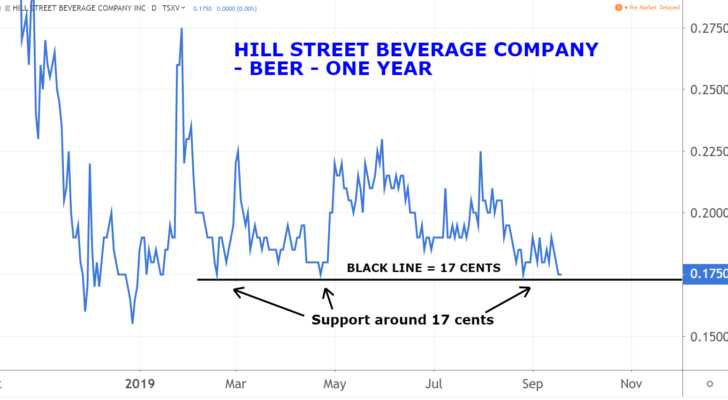

Marijuana Penny Stocks: Hill Street Beverage Company Inc (BEER)

Hill Street Beverage Company (TSE:BEER) produces and sells alcohol-free beer and wine.

This company has a concept that I think could be very successful. It will make alcohol free beverages that are infused with cannabis as soon as cannabis edibles are legal in Canada. The beverages will be designed to emulate the intoxicating effects that alcoholic beverages produce. But its products will have what some consider significant advantages over traditional beverages.

The benefits of Hill Streets beverages is that they have significantly less calories than regular beer or wine. In addition, consumption will not cause hangovers or ruin your liver. One of the most common effects that alcohol has on consumers is making them overweight due to the large amount of calories in beer and wine. Hill Street may have a solution to this problem.

I expect alcohol-free, cannabis-infused beverages to eventually capture a large share of the traditional alcoholic beverage market.

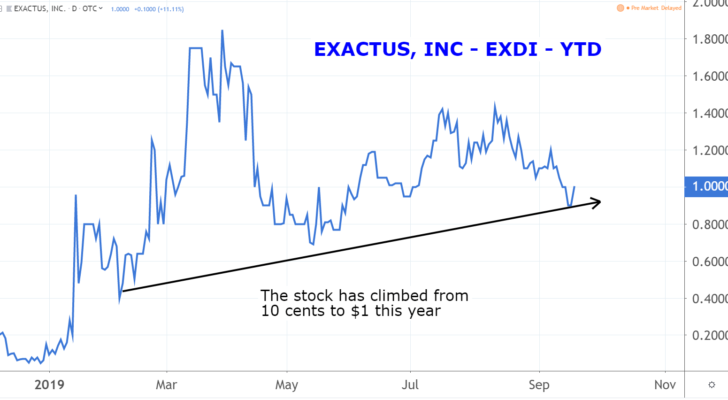

Exactus (EXDI)

Exactus (OTCMKTS:EXDI) produces and sells hemp-derived cannabidiol products under its brand name and also to third-party resellers. It is also invested in hemp farms in Oregon.

The company recently announced that it will exceed its initial production estimates of 20,000 lbs. of top flower. It also announced that it will begin to start taking orders from customers.

In addition to this seemingly positive news, Exactus also announced that compliance testing on all of its fields conducted by the Oregon Department of Agriculture resulted in a 100% pass rate for all of the tested samples.

Companies that grow cannabis on farms, as opposed to those that grow in greenhouses or indoor growing facilities, will have a large cost advantage. The costs associated with outdoor growing on farms can be as low as 10%-20% of the other methods.

The Flowr Corporation (FLWPF)

The Flowr Corporation (OTCMKTS:FLWPF) grows and sells cannabis in Canada.

After its recent selloff, FLWPF stock found support around the $2.15 level. There was support here because it is where the lows were in December.

Flowr just announced that it has made significant changes to its management team. Obviously it is too soon to know if this will turn the stock around, but it may be a step in the right direction.

Ivan Latysh joined the company as chief technology officer. Most recently, he was with MedReleaf, one of Flowr’s competitors. Bringing in a senior executive from a rival company could be a good move.

Flowr also just announced that it has completed its acquisition of Holigen Holdings. This adds operations in Portugal and Australia. The company expects this to add annual capacity of 500,000 kilograms and allow it to become a significant producer in these countries.

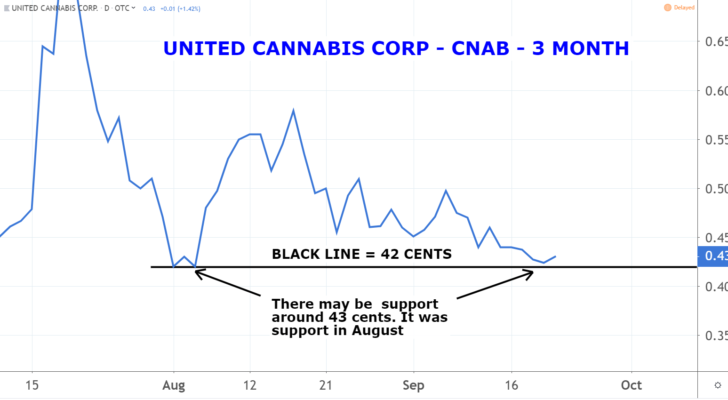

United Cannabis Corporation (CNAB)

United Cannabis Corporation (OTCMKTS:CNAB) owns intellectual properties related to growth, production and distribution of medical and recreational marijuana and marijuana infused products.

CNAB is trading just above support around 43 cents. This level is where the lows were in August.

One of the interesting things about this company is that it was recently granted a license to begin cultivation in Jamaica. United believes that there is significant market opportunities there. In addition, some marijuana enthusiasts believe that some of the best cannabis is the world is grown there. This may provide certain strategic benefits to the company.

United Cannabis also just announced that is has appointed Dr. Gregory Gerdeman as chief scientific officer. His experience and knowledge will benefit the company’s research efforts.

MediPharm Labs Corporation (MEDIF)

MediPharm Labs Corporation (OTCMKTS:MEDIF) produces and sells pharma-grade cannabis oil and concentrates for derivative products in Canada and Australia.

Despite the recent volatility, MEDIF has appreciated by 400% this year.

The company just announced that it received Organic Certification for Cannabis Oil and Extracts from one of North America’s leading certifiers of organic products, Pro-Cert Organic Systems. Organic products will be in big demand in the cannabis markets — even more so because of the vaporizing crisis that we are seeing. There are increasing demands for the FDA to implement quality control testing procedures. There is no doubt that having this Organic Certification will be a benefit for MediPharm.

In addition to this, the company also just announced that it has signed a multi-year manufacturing agreement with Cronos. MediPharm will be filling and packaging vaporizer devices for Cronos Group’s adult use brand, COVE.

48North Cannabis (NRTH)

48North Cannabis (TSE:NRTH) operates as a cannabis company in the female health and wellness market in Canada. It owns a large marijuana farm.

This company interests me because it focuses on growing cannabis on farms, as opposed to in greenhouses or indoor growing facilities. As previously mentioned, farming is significantly cheaper than the other methods. In addition, some cannabis connoisseurs believe that when it is grown under natural sunlight in soil, the quality is better.

48 North recently announced that it is getting 1,000,000,000 mg of high-quality active CBD oil from Iverson Family Farms in Oregon.

Ross and Dorothy Iverson started this farm in 1950. Tragically, Ross developed terminal liver cancer. When this happened, the family used CBD to treat his pain. This experience is what led the family to start growing high-CBD hemp in 2016. Iverson currently operates one of the largest vertically integrated operations in the world.

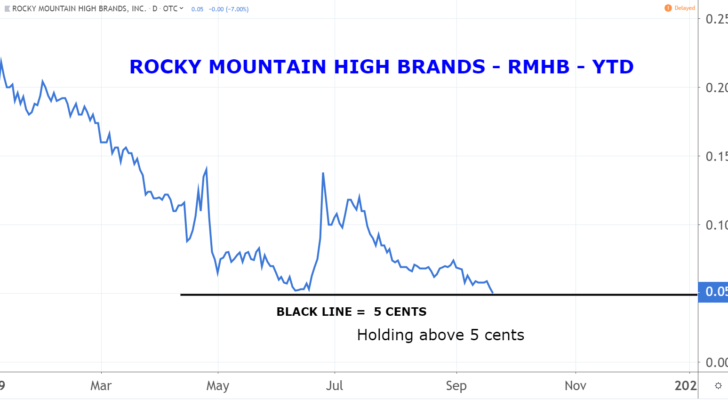

Rocky Mountain High Brands (RMHB)

Rocky Mountain High Brands (OTCMKTS:RMHB) is a lifestyle brand management company that produces and markets CBD- and hemp-infused products to health-conscious consumers.

This company had a 1 for 20 reverse split in the spring. Since then it has held support around the 5 cent level. It is too soon to know if this will help to turn things around but it may help.

Rocky Mountain recently announced that it has entered into an agreement with Water Event Pure Water Solutions in Texas to distribute hemp-derived CBD products to its customers. Water Event has over 15,000 home, office and retail customers.

The owner of Water Event, Brian Rose said, “Now that Texas has passed a law allowing the sale of CBD oil, there is a tremendous opportunity in this exciting product category. It is important to have the right CBD products on my trucks. I chose Rocky Mountain High Brands due to their high standards and involvement with the U.S. Hemp Roundtable.”

This relationship could be a great strategic move for Rocky Mountain.

As of this writing, Mark Putrino did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 7 Marijuana Penny Stocks to Consider for Those Who Can Handle Risk appeared first on InvestorPlace.