Abercrombie (ANF) Q3 Earnings & Sales Top Estimates, Dip Y/Y

Abercrombie & Fitch Co. ANF posted third-quarter fiscal 2022 results, wherein the top and bottom lines declined year over year. However, both metrics surpassed the respective Zacks Consensus Estimate.

The company remains impressed with the improvement in sales trends amid a tough global macroeconomic landscape due to the strength of its brands. Although net sales dipped year over year, the metric remained flat on a constant-currency basis. The company highlighted that average unit retail improved for the tenth straight quarter.

Management is cautious but remains encouraged about the holiday season amid the dynamic environment. In its earnings release, Abercrombie & Fitch stated that it has sufficient inventory on hand to cater to holiday season demand. ANF also curtailed expenditures where necessary. Apart from this, it remains on track with its 2025 Always Forward plan.

Sales & Earnings Picture

Abercrombie reported adjusted earnings of 1 cent per share in the third quarter compared to the Zacks Consensus Estimate of a loss of 13 cents. Our estimate for the bottom line was a loss of 8 cents a share. Third-quarter earnings reflected a significant decline from the year-ago period’s reported figure of 86 cents.

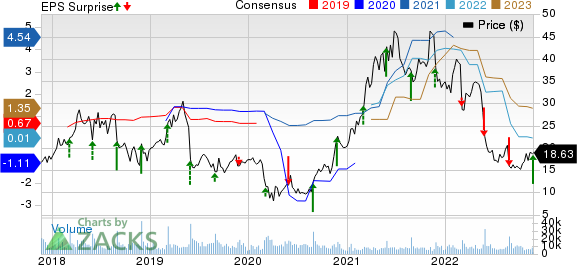

Abercrombie & Fitch Company Price, Consensus and EPS Surprise

Abercrombie & Fitch Company price-consensus-eps-surprise-chart | Abercrombie & Fitch Company Quote

Net sales of $880 million declined 3% year over year but surpassed the Zacks Consensus Estimate of $829 million. Net sales remained flat on a constant-currency basis. Our estimate for the top line was $831.1 million.

Sales by Region and Brands

Sales were strong in the United States, up 3% year over year to $674.6 million. International sales declined 18% year over year to $205.5 million. Sales in the EMEA fell 22% to $139.8 million. In the APAC, sales declined 26% to $28.3 million. Other sales grew 14% to $37.4 million.

Brand-wise, net sales at Hollister declined 12% year over year to $457.8 million, while at Abercrombie, sales advanced 10% to $422.3 million. Our estimates for Hollister and Abercrombie sales were $450.5 million and $380.6 million, respectively.

Margins

The gross margin contracted 450 bps to 59.2%. The decline can be attributed to 370 bps of escalated raw material and freight costs and 60 bps of an unfavorable currency impact.

Operating expenses, excluding other operating income, remained almost in line with the year-ago period. Increased inflation and digital fulfillment expenses were offset by lower marketing and incentive-based compensation.

As a percentage of sales, operating expenses of 57.2% rose 140 bps from 55.8% in the prior-year quarter. The adjusted operating income was $21 million compared with $79 million in the year-ago period.

Other Financials

Abercrombie ended the reported quarter with cash and cash equivalents of $257.3 million, long-term net borrowings of $296.5 million and stockholders’ equity of $646.2 million, excluding non-controlling interests.

The company had liquidity of $617 million at the end of the fiscal third quarter, which included cash and equivalents and borrowing available under the ABL Facility. Net cash used for operating activities was $301 million for the year-to-date period ended Oct 29, 2022.

In the quarter under review, the company repurchased 510,000 shares for about $8 million. Year to date, as of Oct 29, Abercrombie & Fitch repurchased about 4.8 million shares for $126 million. It has $232 million remaining under its share repurchase authorization announced in November 2021.

Store Update

In the fiscal third quarter, the company opened 19 stores, including 11 Hollister and eight Abercrombie stores. It closed one Hollister and Abercrombie store each. As of Oct 29, 2022, its total store base was 751, including 541 stores in the United States and 210 stores internationally.

Outlook

For the fourth quarter of fiscal 2022, management envisions a net sales decline of 2-4% from the fourth-quarter fiscal 2021 reported level of $1.2 billion. The sales view includes a 300-bps impact of adverse currency rates. The company anticipates an operating margin in the 5-7% band.

For fiscal 2022, ANF now expects net sales to dip 2-3% from the year-ago period’s reported figure of $3.7 billion. Earlier, management forecast net sales to decline in the mid-single digits. The sales outlook assumes a negative impact of 250 bps of currency movements compared with the 200-bps impact expected before.

Abercrombie & Fitch expects an operating margin of 2-3% now compared with the prior range of 1-3%. The company expects capital expenditures of $170 million now compared with the old projection of $150 million.

Shares of this Zacks Rank #4 (Sell) company have declined 5.6% in the past three months compared with the industry's decline of 2.2%.

Stocks to Consider

Some better-ranked stocks from the Retail-Wholesale sector are Tecnoglass TGLS, Ross Stores Inc. ROST and Dollar General DG.

Tecnoglass, engaged in the manufacturing and selling of architectural glass and windows and aluminum products for the residential and commercial construction industries, presently sports a Zacks Rank #1 (Strong Buy). TGLS has a trailing four-quarter earnings surprise of 26.9%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current-year sales and EPS suggests growth of 40.5% and 76.4%, respectively, from the year-ago period’s reported numbers. Shares of TGLS have rallied 9.6% year to date.

Ross Stores, an off-price retailer of apparel and home accessories in the United States, currently carries a Zacks Rank #2 (Buy). ROST has an expected EPS growth rate of 10.5% for three to five years. Shares of the company have declined 1.7% year to date.

The Zacks Consensus Estimate for Ross Stores’ current-year sales and EPS suggests declines of 3.9% and 14.5%, respectively, from the year-ago period’s reported figures. ROST has a trailing four-quarter earnings surprise of 10.5%, on average.

Dollar General, one of the largest discount retailers in the United States, has a Zacks Rank of 2 at present. DG has a trailing four-quarter earnings surprise of 2.2%, on average. The stock has risen 9.3% year to date.

The Zacks Consensus Estimate for Dollar General’s current-year sales and EPS suggests growth of 10.8% and 13.8%, respectively, from the year-ago period’s reported numbers. DG has an expected EPS growth rate of 11.1% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report