ADTRAN (ADTN) Misses Earnings & Revenue Estimates in Q3

ADTRAN, Inc. ADTN reported unimpressive third-quarter 2021 results, wherein both the bottom and the top lines missed the Zacks Consensus Estimate.

Net Loss

On a GAAP basis, net loss in the September quarter was $10.4 million or a loss of 21 cents per share against a net income of $5.5 million or 11 cents per share in the prior-year quarter. The deterioration was due to an operating loss, net investment loss, and higher income tax.

Non-GAAP net loss was $0.8 million or a loss of 2 cents per share against a net income of $7.9 million or 16 cents per share in the year-ago quarter. The bottom line missed the Zacks Consensus Estimate of earnings of 10 cents.

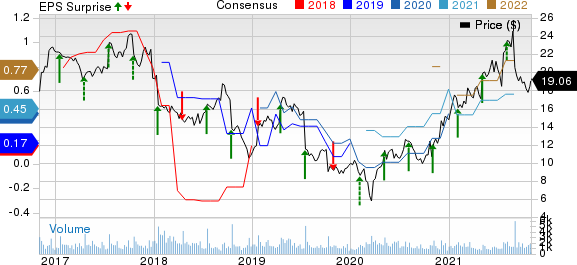

ADTRAN, Inc. Price, Consensus and EPS Surprise

ADTRAN, Inc. price-consensus-eps-surprise-chart | ADTRAN, Inc. Quote

Revenues

Quarterly total revenues grew to $138.1 million from $133.1 million in the prior-year quarter, driven by the increasing demand for ADTRAN’s network solutions. The top line, however, missed the consensus estimate of $144 million.

The company is experiencing solid demand, underscored by its record-setting bookings in the quarter, which is up 43% year over year. It continues to add customers, including three new Tier 1 operators since the beginning of the third quarter. ADTRAN also witnessed a 61% year-over-year growth rate in customers deploying its Software-as-a-Service applications.

Revenues from Network Solutions were $120.8 million compared with $115.2 million in the year-ago quarter. ADTRAN’s end-to-end solutions simplify the deployment of fiber-based broadband services and provide a better customer experience. Services and Support revenues were $17.3 million, down from $17.9 million.

Other Details

The total cost of sales increased from $74.2 million to $90.4 million. Gross profit came in at $47.7 million compared with $59 million in the prior-year quarter. Operating loss in the quarter was $10.1 million against an operating income of $4.5 million in the year-ago quarter.

ADTRAN announced that its board of directors approved a cash dividend of 9 cents per share for the third quarter of 2021. The amount is payable on Nov 30 to shareholders on record as of Nov 16.

Cash Flow & Liquidity

During the first nine months of 2021, ADTRAN generated $28.9 million of cash from operating activities against cash utilization of $5.3 million in the prior-year period.

As of Sep 30, 2021, the company had $75.5 million in cash and cash equivalents with $28.3 million of deferred compensation liability.

Zacks Rank & Stocks to Consider

ADTRAN currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader industry are Ooma, Inc. OOMA, Nokia Corp. NOK, and SeaChange International, Inc. SEAC. While Ooma sports a Zacks Rank #1 (Strong Buy), Nokia and SeaChange carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ooma delivered a trailing four-quarter earnings surprise of 55.2%, on average.

Nokia pulled off a trailing four-quarter earnings surprise of 209.4%, on average.

SeaChange delivered a trailing four-quarter earnings surprise of 28.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADTRAN, Inc. (ADTN) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

SeaChange International, Inc. (SEAC) : Free Stock Analysis Report

Ooma, Inc. (OOMA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research