Aflac (AFL) Q1 Earnings Beat on Higher US Sales, Lower Costs

Aflac Incorporated AFL reported first-quarter 2022 adjusted earnings per share of $1.42, which surpassed the Zacks Consensus Estimate of $1.38. The bottom line, however, declined 7.2% year over year.

AFL’s total revenues of $5,272 million fell 10.2% year over year. Yet, the top line beat the consensus mark by 2.3%.

The better-than-expected first-quarter results were driven by improved returns from alternative investments. The uptick in sales across the Aflac U.S. segment coupled with reduced benefits and expenses also contributed to the upside. Yet, a year-over-year decline in net earned premiums from Japan operations partially offset the positives.

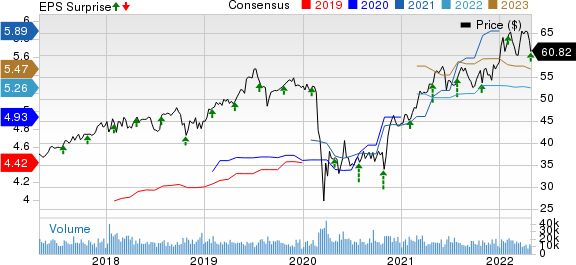

Aflac Incorporated Price, Consensus and EPS Surprise

Aflac Incorporated price-consensus-eps-surprise-chart | Aflac Incorporated Quote

Q1 Performance

Adjusted net investment income declined 3.9% year over year to $879 million for the first quarter.

Total net benefits and claims of $2,487 million slipped 9.1% year over year. Total acquisition and operating expenses of $1,509 million slipped 1.4% year over year. As such, total benefits and expenses declined 6.3% year over year to $3,996 million.

Aflac Japan

Total adjusted revenues of $3,413 million decreased 11.1% year over year in the segment, mainly due to a 12.8% decline in net earned premiums and a 3.5% decrease in adjusted net investment income. Pretax adjusted earnings of the segment decreased 2.8% year over year to $862 million for the quarter under review. New annualized premium sales amounted to $103 million, which declined 14.8% year over year. First-quarter benefit ratio came in at 67.1%.

Aflac U.S.

Total adjusted revenues inched up 0.7% year over year to $1,639 million for the first quarter owing to 4.5% growth in adjusted net investment income, partly offset by a 0.6% decline in net earned premiums. Pretax adjusted earnings of the segment totaled $325 million, which declined 27% year over year as total benefits and adjusted expenses jumped 11.2%. Aflac U.S. sales of $299 million improved 19% year over year for the first quarter. First-quarter benefit ratio came in at 44%.

Financial Position (as of Mar 31, 2022)

Total cash and cash equivalents of $4,275 million decreased from $5,051 million at 2021-end.

Total investments and cash of $132.6 billion fell from the 2021-end level of $143 billion. Total assets declined to $147 billion from $157.5 billion at 2021-end.

Adjusted debt amounted to $7,403 million at first quarter-end, down from $7,568 million at 2021-end. Total shareholders' equity decreased to $29.5 billion from $33.3 billion at 2021-end. Adjusted debt to adjusted capitalization was recorded at 23.5%.

While it has no debt maturities in less than one year, $2,532 million of total debt maturities is expected within the next five years.

Adjusted book value per share improved 6.9% year over year to $37.08 for the first quarter. Adjusted return on equity declined 280 basis points to 14.2%.

Capital Deployment

In the first quarter, Aflac bought back 8 million shares worth $500 million. At quarter-end, it had 47.8 million shares left for buyback.

It paid $260 million in dividends in the March quarter. The company intends to pay 40 cents per share of dividend in the second quarter, which is flat with the first-quarter level. It has increased dividends for 39 consecutive years.

Outlook

Sales at Japan operations are impacted by the pandemic situation, which affected its ability to meet face-to-face with clients. With an improvement in the current situation, the company expects sales to improve in second-half 2022. Productivity at Japan Post is expected to improve in the near future.

Other Companies Expected to Beat Estimates

Similar to Aflac, which currently carries a Zacks Rank #3 (Hold), here are three other companies from the Finance space that you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat this time around:

Armada Hoffler Properties, Inc. AHH has an Earnings ESP of +2.84% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Armada Hoffler’s bottom line for the to-be-reported quarter indicates a 7.7% year-over-year rise. Armada Hoffler beat earnings estimates in each of the last four quarters, with an average of 8.1%.

American Equity Investment Life Holding Company AEL has an Earnings ESP of +1.06% and is a Zacks #3 Ranked player.

The Zacks Consensus Estimate for American Equity Investment’s earnings per share for the to-be-reported quarter indicates a 120.9% year-over-year rise. American Equity Investment beat earnings estimates twice in the last four quarters and missed on the other two occasions, with an average surprise of 36.6%.

Cigna Corporation CI has an Earnings ESP of +6.26% and a Zacks Rank #2.

The Zacks Consensus Estimate for Cigna’s bottom line for the to-be-reported quarter indicates an 8.5% year-over-year increase. Cigna beat earnings estimates in each of the last four quarters, with an average of 6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aflac Incorporated (AFL) : Free Stock Analysis Report

Cigna Corporation (CI) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Armada Hoffler Properties, Inc. (AHH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research