Amazon’s Bear Market Problematic for These ETFs

Shares of e-commerce giant Amazon.com (AMZN) are lower by more than 8.5% Friday after the company forecast second-quarter sales $18.1 billion to $19.8 billion. The $18.95 billion midpoint of that range is below the $19.03 billion analysts are expecting.

The company is also forecasting a second-quarter operating loss ranging anywhere from $55 million to $455 million compared with a year-earlier gain of $79 million. Amazon’s light outlook has the stock trading near six-month lows. Heading into Friday, the stock had plunged 13% in the past 90 days, but factor in today’s drop and Amazon has cemented its status as one of a long list of Nasdaq stocks mired in bear market territory. [ETFs Loaded With Bear Market Stocks]

Amazon is a top-10 holding in nearly 25 exchange traded funds, according to S&P Capital IQ data, but several standout as particularly vulnerable to declines in stock.

The PowerShares NASDAQ Internet Portfolio (PNQI) is lower 3.4% at this writing. PNQI features a 9.48% weight to Amazon, making it the ETF’s second-largest holding by just two basis points behind e-Bay (EBAY).

Previously a high flier, PNQI has been under pressure due to post-earnings declines by Netflix (NFLX), Facebook (FB) and now Amazon. [A Possible Bounce for Internet ETFs]

Over the past month, however, PNQI has been slightly better than the rival First Trust Dow Jones Internet Index Fund (FDN) . Amazon is FDN’s largest individual holding at a weight of nearly 7.5% though both classes of Google (GOOG) combine for nearly 10% of the ETF’s weight.

There are is an important difference between FDN and PNQI. That being the latter only holds Nasdaq stocks while FDN holds stocks that trade on the Nasdaq and the New York Stock Exchange. Meaning although Salesforce.com (CRM), LinkedIn (LNKD) and Twitter (TWTR) combine for just 9.2% of FDN’s weight, the average decline of 8.4% over the past month for those stocks is problematic for FDN. Those stocks are not members of PNQI’s lineup.

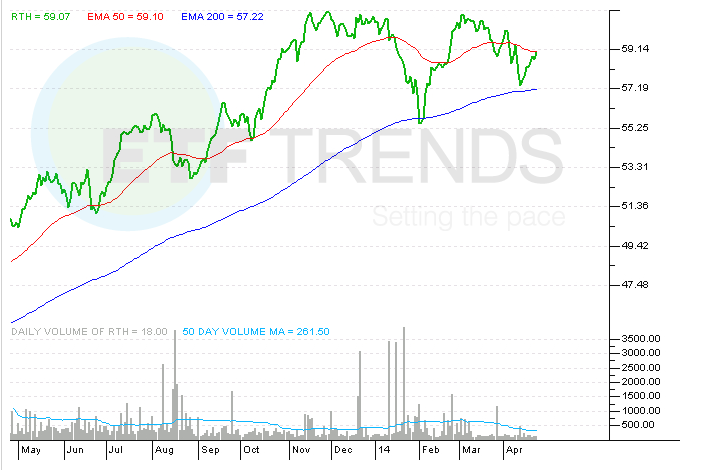

The Market Vectors Retail ETF (RTH) has the largest Amazon allocation of the three ETFs mentioned here at 9.84%, but RTH is also the best performer of the trio today with a loss of just 1.1%.

That is the result of the ETF’s heavy bias towards consumer staples, recently one of the better-performing sectors within the broader market. Wal-Mart (WMT), CVS Caremark (CVS), Walgreen (WAG) and Costco (COST), all familiar holdings in some of the largest staples ETFs, combine for over 28% of RTH’s weight. [Super Staples ETFs]

Market Vectors Retail ETF

Tom Lydon’s clients own shares of Amazon, Facebook and Google.