Amgen (AMGN) Q3 Earnings Top, Prolia, Biosimilars Drive Sales

Amgen AMGN reported third-quarter 2020 earnings of $4.37 per share, which beat the Zacks Consensus Estimate of $3.75. Earnings rose 19% year over year driven by higher revenues.

Total revenues of $6.42 billion beat the Zacks Consensus Estimate of $6.38 billion. Total revenues rose 12% year over year.

On the call, the company said that it experienced continued recovery from peak impact of the COVID-19 pandemic as physician interaction and prescription trends improved in the third quarter.

Quarter in Detail

Total product revenues rose 12% from the year-ago quarter to $6.1 billion (U.S.: $4.62 billion; ex-U.S.: $1.49 billion). Higher sales of Prolia, Xgeva, Otezla and biosimilar products were offset by lower sales of some drugs due to COVID-19 and the erosion of mature brands from biosimilar/new competition.

Product sales growth was mostly driven by higher volumes (up 18%) as prices were lower for several drugs.

Other revenues of $319 million rose 16.4% year over year.

Performance of Key Drugs

Prolia revenues came in at $701 million, up 11% from the year-ago quarter driven by volume growth. Volumes of the drug improved as patients returned to treatment after sales were hurt by fewer patient visits in the second quarter as Prolia treats the most at-risk COVID patients. However, the recent increase in infection rates could hurt Prolia sales again in the fourth quarter.

Xgeva delivered revenues of $481 million, up 1% from the year-ago quarter due to a recovery in patients returning to treatment.

Kyprolis recorded sales of $260 million, down 2% year over year, hurt by lower volumes due to fewer new patient starts amid COVID-19.

Repatha generated revenues of $205 million, up 22% year over year, as higher volume was partially offset by unfavorable changes to estimated sales deductions and lower prices due to Amgen’s efforts to improve access and affordability for the product.

Vectibix revenues came in at $193 million, down 2% year over year. Nplate sales rose 9% to $212 million. Blincyto sales increased 5% from the year-ago period to $89 million.

Parsabiv recorded sales of $183 million, up 17% driven by higher demand, which offset the impact of lower selling prices. However, U.S. sales were hurt toward the end of the third quarter in anticipation of changes in healthcare programs with the trend expected to continue in the fourth quarter.

Aimovig recorded sales of $105 million in the quarter, up 59% year over year driven by higher volumes and the impact of unfavorable changes to estimated sales deductions in the prior year.

New osteoporosis drug, Evenity recorded sales of $59 million in the quarter compared with $101 million in the previous quarter as higher sales in United States were offset by lower sales in Japan. Sales declined in Japan due to inventory drawdown following large purchases in the first half.

Sales of Otezla were $538 million in the quarter, up 23% year over year driven by prescription volume growth, which offset the impact of lower inventory levels and unfavorable changes in sales reductions. Please note that Otezla was purchased by Amgen from Celgene in November 2019 as the latter had to divest the drug in order to complete its merger with Bristol-Myers BMY.

Biosimilar generated revenues of $480 million in the quarter supported by share gains of oncology biosimilars, Kanjinti and Mvasi. Sales of Kanjinti (Amgen’s biosimilar of Roche’s [RHHBY] Herceptin) and Mvasi (biosimilar of Roche’s Avastin) were $167 million and $231 million in the quarter, compared with $123 million and $172 million respectively, in the previous quarter. Kanjinti and Mvasi biosimilars were launched by Amgen in the United States in July last year.

Amjevita (biosimilar of AbbVie’s [ABBV] Humira) sales were $80 million in the quarter, up 31% year over year.

However, most of the mature drugs like Enbrel, Aranesp, Epogen, Neupogen and Neulasta declined due to an array of branded and generic competitors. Enbrel revenues of $1.33 billion declined 3% year over year due to lower demand and market share as well as slower growth pace in the rheumatoid arthritis market related to COVID.

Aranesp revenues declined 15% from the prior-year quarter to $384 million. Revenues of the other ESA, Epogen, declined 31% to $149 million. Neulasta revenues declined 22% from the year-ago period to $555 million. Neupogen recorded 20% increase in sales to $65 million in the quarter. Sensipar/Mimpara revenues declined 64% to $39 million.

Operating Margins Increase

Adjusted operating margin rose 100 basis points (bps) to 52.1%. Adjusted operating expenses rose 10% year over year in the quarter to $3.24 billion.

SG&A spend rose 10% to $1.33 billion due to Otezla-related commercial expenses. R&D expenses rose 6% year over year to $1.04 billion as higher spending on Amgen’s oncology pipeline and costs related to Otezla were partially offset by cost recoveries from Amgen’s collaboration with China’s leading pharma company, BeiGene.

2020 Guidance

Amgen narrowed its revenue guidance range from $25.0 billion-$25.6 billion to $25.1 billion-$25.5 billion.

Adjusted earnings per share guidance was raised from a range of $15.10 to $15.75.to $15.80 to $16.15 per share.

Adjusted operating costs are expected to grow in a high single-digit percentage range year over year in 2020.

Our Take

Amgen’s third-quarter results were strong, as it beat estimates for both earnings and sales. Amgen slightly narrowed its previously issued sales guidance for 2020 while raising its earnings range.

Amgen’s stock has declined 10.2% this year so far compared with a decrease of 4.3% for the industry.

Though physician-patient interaction and prescription volumes improved in the third quarter versus the second quarter, it was still below pre-COVID-19 levels. Amgen expects fluctuations in quarterly revenues and earnings due to uncertainty created by the recent resurgence of COVID-19 infections globally. Amgen’s chief executive officer (CEO) Robert Bradway said that the recent resurgent in infection rates could be a potential headwind for the business in the fourth quarter.

Amgen currently has a Zacks Rank #4 (Sell).

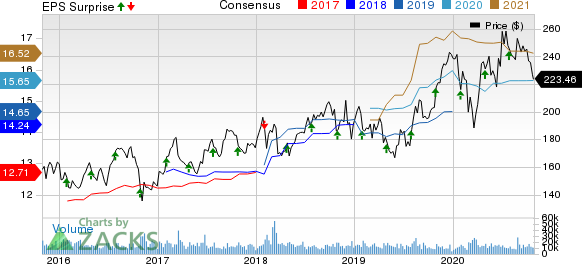

Amgen Inc. Price, Consensus and EPS Surprise

Amgen Inc. price-consensus-eps-surprise-chart | Amgen Inc. Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research