Announcing: Opiant Pharmaceuticals (NASDAQ:OPNT) Stock Increased An Energizing 249% In The Last Five Years

Opiant Pharmaceuticals, Inc. (NASDAQ:OPNT) shareholders might be concerned after seeing the share price drop 21% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. We think most investors would be happy with the 249% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Only time will tell if there is still too much optimism currently reflected in the share price.

See our latest analysis for Opiant Pharmaceuticals

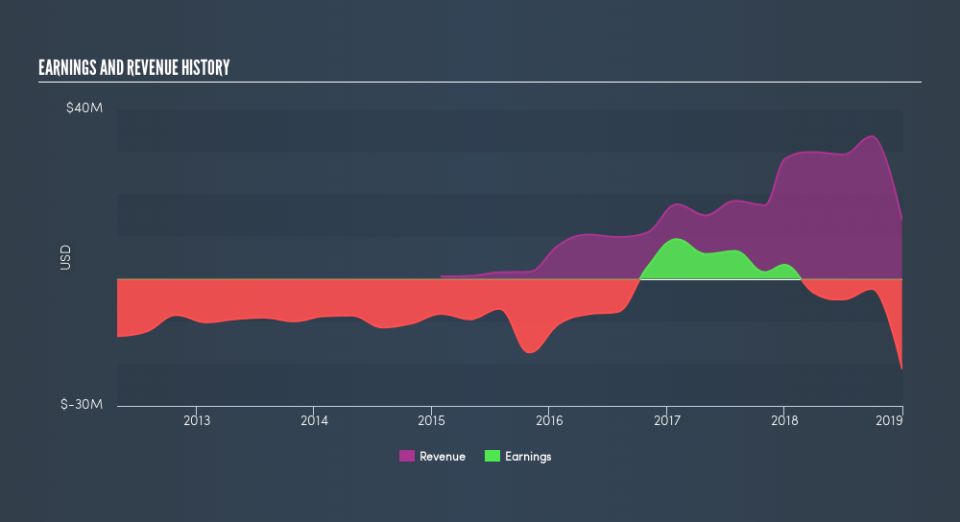

Given that Opiant Pharmaceuticals didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Opiant Pharmaceuticals will earn in the future (free profit forecasts)

A Different Perspective

While the broader market gained around 11% in the last year, Opiant Pharmaceuticals shareholders lost 39%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 28%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

Opiant Pharmaceuticals is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.