Aon's (AON) Q2 Earnings Fall Short of Estimates, Improve Y/Y

Aon plc’s AON second-quarter 2019 operating earnings of $1.87 per share missed the Zacks Consensus Estimate of $1.88 by 0.5% due to poor performance by its Retirement Solutions segment. However, the metric improved 9.4% year over year, primarily backed by the company’s strong organic revenue growth, decreased expenses and an operating margin improvement.

Total revenues inched up 2% to $2.6 billion including 6% organic revenue growth. However, this uptick was partially offset by a 3% unfavorable impact from foreign currency translation along with 1% dip associated with divestitures, net of acquisitions.

Adjusted operating margin expanded 240 basis points to 24.4%.

Total operating expenses declined 15% to $2.2 billion, primarily owing to lower non-cash impairment charge, reduced legacy litigation costs, fall in restructuring costs and a favorable impact from the foreign currency translation, etc.

The adjusted effective tax rate on a comparable basis for the second quarter of 2019 was 18% compared with 14.7% in the prior-year quarter. This upside was primarily driven by a net unfavorable effect from discrete items.

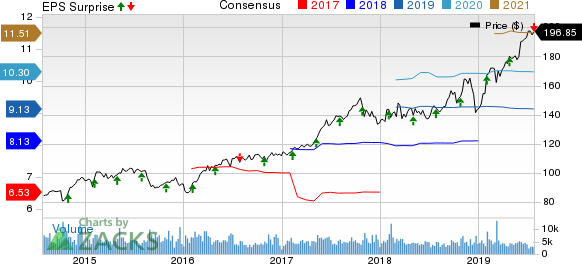

Aon plc Price, Consensus and EPS Surprise

Aon plc price-consensus-eps-surprise-chart | Aon plc Quote

Organic Revenue Catalysts

Commercial Risk Solutions: Organic revenues rose 6% on the back of strong growth across every major geography including the United States, EMEA and the Pacific, boosted by new business opportunities as well as renewal book portfolio management. The segment’s total revenues of $1.1 billion were in line with the prior-year quarter’s figure.

Reinsurance Solutions: Organic revenues improved 12%, attributable to a constant net new business generation in treaty along with robust growth in facultative placements and capital market transactions. Moreover, the market impact was modestly favorable to second-quarter results. However, total revenues for the segment improved 11% year over year to $420 million.

Retirement Solutions: Organic revenues inched up 1% year over year, aided by growth in delegated investment management and rewards and assessment businesses within the Human Capital practice. This upside was countered by an adverse impact from certain businesses divested in the second quarter along with the timing of a few revenues in actuarial business and from the performance fees in the delegated investment management business.

Total revenues for the segment dipped 3% year over year to $419 million.

Health Solutions: Organic revenues were up 6% year over year, led by solid growth in health and benefits brokerage, especially bolstered by a sturdy uptrend in Asia and continental Europe plus upside in the active healthcare exchange business for off-cycle enrollments.

Total revenues for the segment climbed 3% to $317 million.

Data & Analytic Services: Organic revenues for this segment grew 4% year over year owing to prosperity in Affinity business, particularly in the United States across both business and consumer solutions. However, total revenues of the segment increased 3% to $286 million.

Financial Position

For the first half of 2019, the company’s cash flow from operations decreased 13% to $361 million while free cash flow decreased 16% to $255 million.

The company exited the second quarter with total assets of $29.8 billion, up 12.8% from the level on Dec 31, 2018.

As of Jun 30, 2019, long-term debt of the company stands at $6.7 billion, up 12.5% from 2018-end level.

Share Repurchase and Dividend Update

In the quarter under review, Aon bought back 5.8 million Class A Ordinary Shares for a value of around $1.05 billion. It also hiked its quarterly cash dividend by 10%.

As of Jun 30, 2019, Aon had $2.8 billion remaining under its authorized share buyback plan.

Zacks Rank

Aon carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Of the insurance industry players that have already reported second-quarter results, the bottom-line figures of The Progressive Corporation PGR and RLI Corp. RLI beat the respective Zacks Consensus Estimate for the metric. However, The Travelers Companies, Inc.’s TRV earnings missed the same.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aon plc (AON) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research