Apple (AAPL) to Report Q4 Earnings: What's in the Offing?

Apple AAPL is set to report fourth-quarter fiscal 2021 results on Oct 28.

Apple expects revenues to grow double digits year over year in the September quarter, but to be lower than the June quarter’s revenue growth rate. This is due to the negative impact from foreign exchange, normal growth in the Services segment and supply constraints (iPhone and iPad).

The Zacks Consensus Estimate for revenues is currently pegged at $85.49 billion, indicating growth of 32.1% from the year-ago quarter’s reported figure.

The consensus mark for earnings is currently pegged at $1.23 per share, unchanged over the past 30 days and indicating 70% growth from the figure reported in the year-ago quarter.

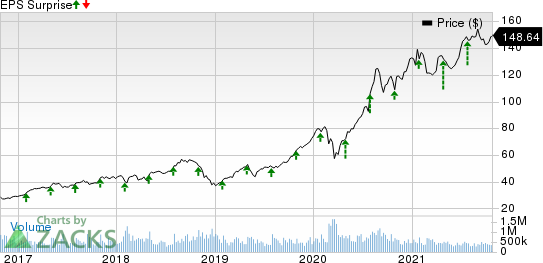

Notably, the company’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the earnings surprise being 23.74%, on average.

Apple Inc. Price and EPS Surprise

Apple Inc. price-eps-surprise | Apple Inc. Quote

Let’s see how things are shaping up for the upcoming announcement.

Strong iPhone 13 Demand to Drive Y/Y Sales Growth

Apple’s fortunes are heavily reliant on the iPhone, which is by far its biggest revenue contributor. The device accounted for 48.6% of net sales in the last-reported quarter, wherein sales increased 49.8% year over year to $39.57 billion.

Strong demand for the 5G-enabled iPhone 13 is expected to have driven the top line in the to-be-reported quarter despite component shortages. Per Canalys, Apple regained the second spot in terms of market share in third-quarter 2021. Samsung led the market with 23% share trailed by Apple’s 15% and Xiaomi’s 14%.

The Zacks Consensus Estimate for iPhone sales currently stand at $42.61 billion, indicating 61.1% growth from the year-ago quarter’s reported figure.

Services Momentum to Boost Top Line

The Services segment became the new cash cow for Apple, which currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The increasing popularity of the App Store has been a key catalyst. Apple currently has more than 700 million paid subscribers across its Services portfolio. App Store continues to grab the attention of prominent developers from around the world, helping the company offer exciting new apps that drive traffic.

Services like Apple TV+, Apple Arcade, Apple News+, Apple Card, Apple Fitness+ and Apple One bundle are expected to have contributed to overall growth.

Apple TV+’s endeavors to expand its streaming content portfolio is expected to have improved Apple’s footprint in the streaming market currently dominated by the likes of Netflix NFLX, Disney+ and Amazon AMZN.

The Zacks Consensus Estimate for Services revenues currently stands at $17.43 billion, indicating 19.8% growth from the year-ago quarter’s reported figure.

Wearables’ Growth to Remain Strong

Apple is dominating the wearables market, thanks to strong adoption of Apple Watch. The company’s Fitness+ subscription service, built on Apple Watch, is a game changer. Fitness+ tracks health- and workout-related data from Apple Watch that users can view on their iPhones, iPads or Apple TVs.

Apple Watch’s adoption rate continues to grow rapidly, thanks to the company’s endeavor to add healthcare features like electrical heart sensor and ECG app, along with Blood Oxygen sensor and app to its smartwatch.

Apple Fitness+ introduced guided Meditation, a simple way to practice mindfulness anywhere and anytime, and Pilates, a new low-impact, body-conditioning workout type, on Sep 27.

Apple Watch’s expanding user base is helping the company steer off competition from the likes of Garmin, Alphabet GOOGL, Xiaomi, Samsung Electronics and Huawei Technologies.

The consensus estimate for Wearables, Home and Accessories revenues currently stands at $9.36 billion, indicating 19% growth from the year-ago quarter’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research