April Top Defensive Stocks To Buy

Defensive investment strategies are those that maintain holdings in safe assets, which include stocks that meet a certain criteria that avoids losses in market value. To do this successfully, there are certain fundamentals that you should look for, which include but are not limited to: financial health, liquidity and reliable earnings capacity. I suggest starting with Associated British Foods, NEXT and Computacenter.

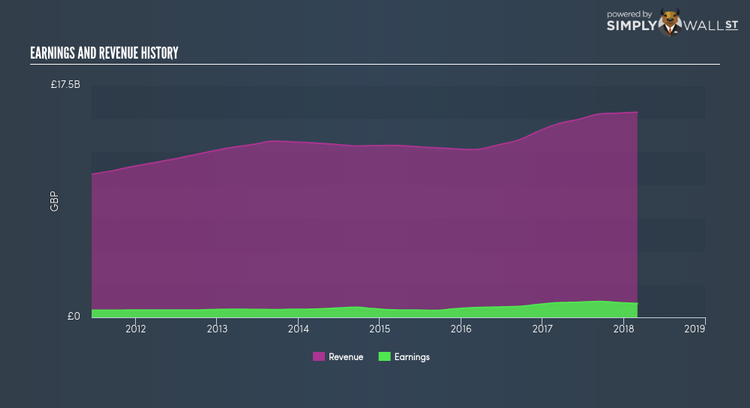

Associated British Foods plc (LSE:ABF)

Associated British Foods plc operates as a diversified food, ingredients, and retail company worldwide. Established in 1935, and currently run by George Weston, the company now has 133,000 employees and with the company’s market cap sitting at GBP £20.74B, it falls under the large-cap category.

The company’s capital structureis attractive , due to the high ratio of current assets to long-term liabilities, which is currently at 3.48x. Its operating cash flow position also reached a solid 172.91% of total borrowings, which makes investor capital robust against adverse market conditions. Furthermore, at a UK£20.74B market cap , more buyers and sellers exist for the stock than there would be if it were smaller, helping curtail the rate of decline in share price during periods of mass selling. With positive annual earnings growth of 12.07% over the past 5 years and an industry-beating 8.41% trailing 12-month ROA, ABF contains many of the valuable traits in a defensive stock. Continue research on Associated British Foods here.

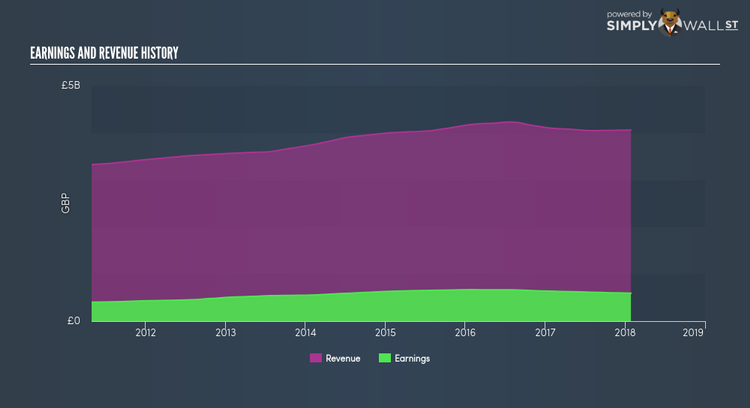

NEXT plc (LSE:NXT)

NEXT plc engages in the retail of clothing, footwear, accessories, and home products in the United Kingdom, rest of Europe, the Middle East, Asia, and internationally. Founded in 1864, and currently headed by CEO Simon Wolfson, the company currently employs 28,318 people and has a market cap of GBP £7.15B, putting it in the mid-cap category.

NXT’s financial management makes the company a solid defensive candidate as current assets surpass total liabilities by 1.54x. Additionally, operating cash flow is at a good level relative to overall debt at 55.88%, meaning if economic conditions dampen the company’s ability to grow earnings, NXT should still be able to service debt. With NEXT’s market value of UK£7.15B and a PE of 12.53x, greater liquidity is offered at a good price relative to the market, helping curtail the rate of decline in share price during periods of mass selling. With positive annual earnings growth of 6.63% over the past 5 years and an attractive 122.63% trailing twelve month ROE, NXT is a fundamentally strong defensive company. Continue research on NEXT here.

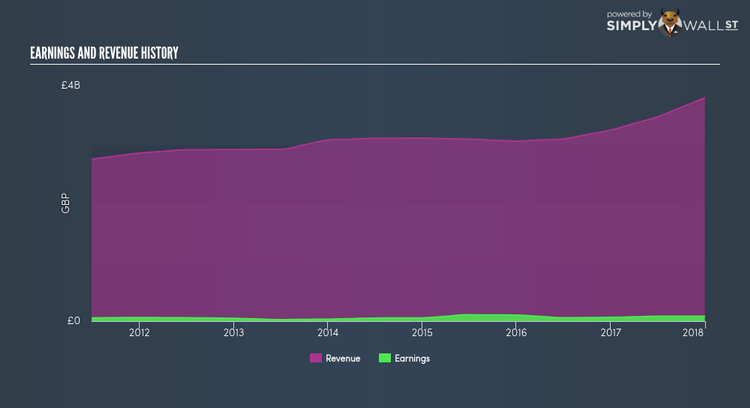

Computacenter plc (LSE:CCC)

Computacenter plc, through its subsidiaries, provides information technology (IT) infrastructure services in the United Kingdom, Germany, France, and Belgium. Established in 1981, and now run by Mike Norris, the company now has 14,026 employees and with the company’s market capitalisation at GBP £1.40B, we can put it in the small-cap stocks category.

CCC is well-postioned financially , due to high liquidity with current assets covering liabilities by 64.96x. Additionally, operating cash flow is higher than total debt by over 200%, creating greater safety for investors in a fickle market. Furthermore, at a UK£1.40B market cap , more buyers and sellers exist for the stock than there would be if it were smaller, which minimises the potential for rapid share price falls in down cycles. Seeing that last year’s earnings growth continues the previous 5 years’ positive annual growth trajectory at 27.51% and 9.53% respectively, CCC has some of the necessary characteristics to maintain value during a cyclical downfall in the market. More detail on Computacenter here.

For more robust companies to add to your portfolio, explore this interactive list of defensive stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.