Arista Networks: Robust Fundamentals and Undervalued

- By Robert Abbott

How can a mid-cap like Arista Networks Inc. (NYSE:ANET), with a market cap of $15.5 billion, compete with larger companies such as Cisco Systems Inc. (NASDAQ:CSCO), which has a market cap of $162 billion?

Mainly by focusing more intently on the cloud. As the 10-K for 2019 explains, "Arista Networks pioneered software-driven, cognitive cloud networking for large-scale datacenter and campus environments."

Recently, Arista added another service, announcing on Sept. 28 that it will be acquiring cybersecurity company Awake Security. Awake is described in a news release as "a Network Detection and Response (NDR) platform provider that combines artificial intelligence (AI) with human expertise to autonomously hunt and respond to insider and external threats."

Cloud networks have become a key part of the new technology landscape, providing enormous capabilities to companies with heavy data needs, including Amazon.com (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT). The latter is also a partner with Arista and it accounted for more than 23% of Arista's sales in 2019. Facebook (NASDAQ:FB) accounted for 17% of sales.

However, their contributions to Arista's revenue are likely to be lower this year because they were based on one-time contracts in 2019 rather than ongoing sales.

Still, Arista is an ambitious company with direct sales reps and channel partners looking for new opportunities. And it should be able to find them because of the growth of cloud-networking. It offered this explanation in its 10-K:

"Cloud computing is fundamentally changing the way IT infrastructure is built and how applications are delivered.

Nearly all consumer applications today are delivered as cloud services. Enterprise applications are rapidly moving to the cloud as well, since cloud services are easier and more cost effective to deploy, scale and operate than traditional applications.

Our cloud networking platform enables data center networks to scale to hundreds of thousands of physical servers and millions of virtual machines with the least number of switching tiers. We achieve this by leveraging standard protocols to meet the scale requirements of cloud computing."

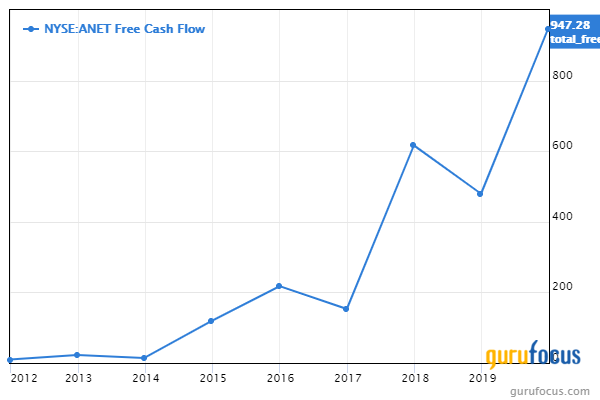

Since Arista builds those high-speed network switches (and routers), it should be able to keep growing along with the broader cloud platform. Of course, that assumes it generates enough free cash flow to invest in research and development. This chart suggests it will have the resources it needs:

In 2019, the company invested $462.8 million, almost 20% of revenue, into research and development. That's up from just under $350 million in 2017.

Arista expects to grow its total addressable market by 36% by the end of 2024, according to a presentation in the first quarter (PICs = places in the cloud):

And beyond free cash flow, it is going forward with the fundamentals on its side.

Financial strength

Arista may have some debt, but the amount is relatively insignificant. Note the cash-to-debt ratio of 37.46, meaning the company has more than $37 in cash, cash equivalents and marketable securities for each dollar of total debt.

Over the past 12 months, its cash accounts have averaged $2.78 billion, while its long-term debt has averaged $74 million (it has no short-term debt).

The Piotroski F-Score is that of a financially stable company, while the Altman Z-Score is almost as high as the scale goes.

What's particularly impressive on this table, though, is the ROIC versus WACC score. The company's weighted average cost of capital is just 6.75%, while it generates a return on invested capital of 60.65%. It is creating a lot of value for shareholders.

Profitability

The reason we saw such strong free cash flow results comes back to this table. A company that generates high margins has a foundation for outperformance on the financial statements.

Both the return on equity and return on assets confirm the company's vigor. The high ROE also suggests it has a wide moat or competitive advantage. That will help ensure it continues to be profitable.

On the three growth lines at the bottom of the table, Arista posts enviable results as well. The three-year average annual growth rate of revenue comes in just under 25%, while both Ebitda and earnings per share before non-recurring items are higher.

Valuation

Surprisingly, for a company doing this well, its price is considered modestly undervalued. That's confirmed by a current price-earnings ratio that is well below Arista's 10-year median; the current ratio is 21.69 compared to the median of 42.94.

The PEG ratio, which is based on the price-earnings ratio divided by the five-year average Ebitda growth rate, comes in at 0.73, which is within the undervalued range.

The undervaluation assessment is in line with the price chart (which begins in 2014, the year the company went public):

The share price topped out at $326.14 on April 15, 2019, and has since dropped back to around the $200 mark.

The relatively stalled share price, despite strong fundamental metrics, suggests a stock that has fallen out of favor with the market temporarily.

Dividend and share buybacks

The company does not pay a dividend. Over the past three years, it has issued more new shares than it has bought back.

Gurus

At least some of the investing gurus agree the company has potential. They've been buying more than they've been selling for the past year:

The top three guru positions begin with Ruane Cunniff (Trades, Portfolio) & Goldfarb (managers of the Sequoia Fund), which owned 1,978,002 shares as of June 30. That was good for a 2.60% stake in Arista. The firm reduced its holding during the quarter by 1.32%.

Jim Simons (Trades, Portfolio)' Renaissance Technologies had the second-largest position of 1,366,500 shares after adding 34.86% during the quarter. Pioneer Investments (Trades, Portfolio) rounded out the top three with 383,425 shares after a reduction of 16.57%.

Conclusion

Because of its early entry into the business of providing switches for cloud-based networking, Arista Networks has been able to carve out a profitable niche for itself. It is also widening its niche with strategic acquisitions that fit its areas of expertise.

Its debt is minor in comparison to its cash, cash equivalents and marketable securities. Its return on invested capital far surpasses its weighted average cost of capital, and it is currently undervalued according to three metrics.

That undervaluation and low level of debt will attract the interest of value investors who see both a margin of safety and attractive potential. Growth investors may want to look at the stock later, when it gets out of the price doldrums that began roughly a year and a half ago. Income investors will need to look elsewhere since Arista does not pay a dividend.

Disclosure: I do not own shares in any of the companies named in this article.

Read more here:

Abiomed: Driven by Demographics and Innovation

MetLife: A Strong Dividend and Modest Undervaluation

McDonald's: Profitable but Pricey

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.