As the Arm Acquisition Falters, NVIDIA's (NASDAQ:NVDA) Valuation Looks More Reasonable

This article first appeared on Simply Wall St News.

The recent market sell-off took many stocks down a notch. One of such examples is NVIDIA Corporation (NASDAQ: NVDA) – one of the biggest winners in 2021, now trading over 30% below the highs.

Yet, our analysis shows that such valuation might be somewhat reasonable.

Check out our latest analysis for NVIDIA

Leading the Market

The following chart shows the performance of NVIDIA against the NASDAQ. The stock has been outperforming on the upside but also leading the downturns.

It is like an overweight position in NVIDIA equals a leveraged position in the NASDAQ.

The implications of the ARM deal

More prominent mergers and acquisitions are one of the hallmarks of the late bull market. However, such acquisitions are like deep-sea exploration – the pressure increases with the depth.

In this case, it is regulatory pressure as the U.S. Federal Trade Commission (FTC) sued to block the US$40b purchase of Arm Holdings. FTC quoted the necessity to preserve the competitive environment to encourage innovation.

While this does hinder NVIDIA plans to an extent, it is a bigger problem for Softbank, an owner of Arm. After the NVIDIA / Arm deal was announced, Qualcomm pursued an acquisition of Nuvia with a plan to pivot from Arm reference designs to pursue their own CPU designs.

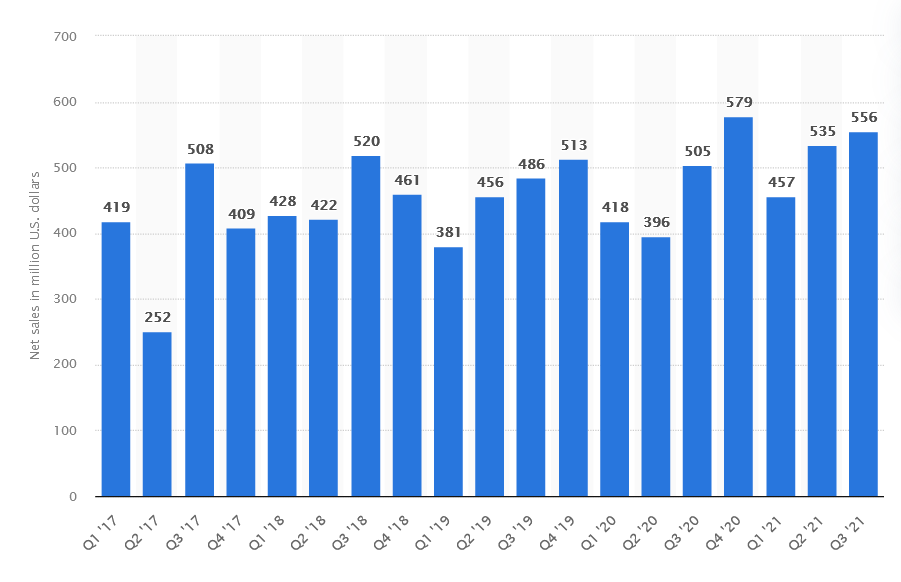

As Softbank acquired Arm for US$32b, they were looking to sell it for US$40b after 5 years, translating into 5% annualized returns – inferior in comparison to broad market returns during that time. Yet, as research & development costs in the industry are surging, Arm revenues remained relatively flat over the period of time – thus, its underperformance is not a surprise.

Meanwhile, the FTC was just one of the hurdles on the potential acquisition, with British, EU, and Chinese regulators following behind. It seems that the largest criticism was NVIDIA's business model that favor's the use of their technologies exclusively for their products.

Is NVIDIA still cheap?

According to our valuation model, NVIDIA seems to be reasonably priced at around 7.6% below my intrinsic value, which means if you buy NVIDIA today, you'd be paying a reasonable price for it. And if you believe that the stock is worth $241, then there isn't much room for the share price to grow beyond what it's currently trading.

Is there another opportunity to buy low in the future? Since NVIDIA's share price is quite volatile, we could potentially see it sink lower (or rise higher) in the future, giving us another chance to buy. This is based on its high beta, which is a good indicator of how much the stock moves relative to the rest of the market.

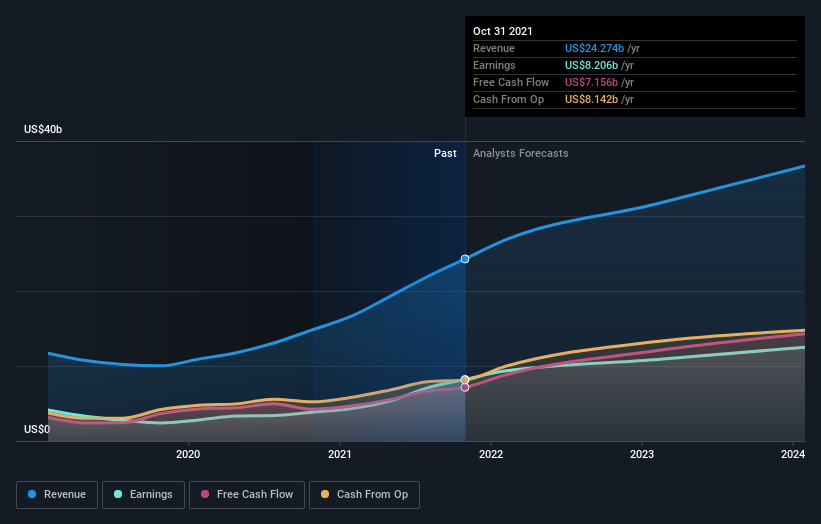

What kind of growth will NVIDIA generate?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a low price is always a good investment, so we need to consider the company's future expectations.

With profit expected to grow by 78% over the next couple of years, the future seems bright for NVIDIA. It looks like higher cash flow is on the cards for the stock, which could feed into a higher share valuation.

What this means for you:

Are you a shareholder? It seems like the market has already priced in NVDA's positive outlook, with shares trading around their fair value. With the big acquisition deal unlikely to happen, positive catalysts are unlikely to occur until the following earnings report, mid-February. However, there are also other important factors that we haven't considered today, such as the company's financial strength. Have these factors changed since the last time you looked at the stock?

Are you a potential investor? If you've been keeping an eye on NVDA, now may not be the most optimal time to buy, given it is trading around our estimate of its fair value. Yet, the positive outlook is encouraging for the company, which means it's worth diving deeper into other factors such as the strength of its balance sheet to take advantage of the next price drop.

With this in mind, we wouldn't consider investing in stock unless we had a thorough understanding of the risks. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of NVIDIA.

If you are no longer interested in NVIDIA, you can use our free platform to see our list of over 50 other stocks with high growth potential.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.