Asbury (ABG) Q3 Earnings Surpass Estimates, Rise 39% Y/Y

Asbury Automotive Group ABG reported impressive third-quarter 2022 adjusted earnings of $9.23 per share, which increased 39% year over year and topped the Zacks Consensus Estimate of $9.19. This outperformance can be primarily attributed to higher-than-expected gross profit from the Parts & Services and Finance & Insurance units. In the reported quarter, revenues amounted to $3,866 million, surging 61% year over year. The top line, however, fell short of the Zacks Consensus Estimate of $3,970 million.

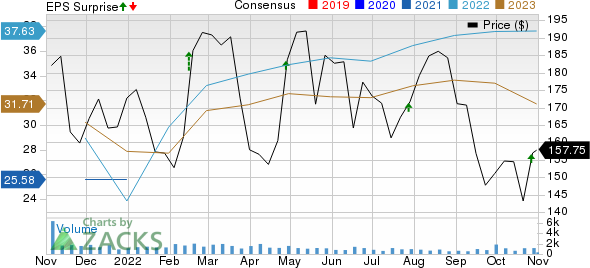

Asbury Automotive Group, Inc. Price, Consensus and EPS Surprise

Asbury Automotive Group, Inc. price-consensus-eps-surprise-chart | Asbury Automotive Group, Inc. Quote

Segment Details

In the quarter, new-vehicle revenues jumped 59% year over year to $1,799 million but missed the Zacks Consensus Estimate of $1,911 million. Gross profit from the segment came in at $201 million, soaring 60% from the prior-year quarter but missing the consensus mark of $213 million.

Used-vehicle revenues rose 51% from the year-ago figure to $1,330.7 million, beating the consensus mark of $1,287 million. Gross profit from the segment came in at $82.1 million, which rose 14% but lagged the Zacks Consensus Estimate of $86 million.

Net revenues in the finance and insurance business amounted to $200 million, increasing 99% from the year-ago quarter and outpacing the consensus mark of $185 million. Gross profit was $186.9 million, rising 86% year over year and beating the consensus estimate of $177 million.

Revenues from the parts and service business rose 80% from the prior-year quarter to $536.1 million and topped the consensus mark of $502 million. Gross profit from this segment came in at $298 million, rising 64% year over year and crossing the consensus estimate of $283 million.

Other Tidbits

Adjusted selling, general & administrative (SG&A) expenses as a percentage of gross profit rose to 57.1%, marking an increase of 180 basis points year over year. Asbury sold nearly 6,800 vehicles, an uptick of 13% from the prior year quarter through the “end-to-end” online sales platform, Clicklane.

As of Sep 30, the company had cash/cash equivalents of $141.3 million, down from $178.9 million as of Dec 31, 2021. It had long-term debt of $3,325.5 million as of Sep 30, falling from $3,582.6 million on Dec 31, 2021.

ABG carries a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Peer Releases

Lithia Motors LAD: Lithia reported third-quarter 2022 adjusted earnings of $11.08 per share, which decreased a marginal 1% from the prior-year quarter’s $11.21. The bottom line also missed the Zacks Consensus Estimate of $11.91. Total revenues jumped 18.2% year over year to $7,295.7 million. The top line, however, missed the Zacks Consensus Estimate of $7,369 million.

Lithia had cash and cash equivalents of $233 million as of Sep 30, 2022, up from $174.8 million as of Dec 31, 2021. Long-term debt was $5,222.3 million, marking an increase from $3,185.7 million as of Dec 31, 2021. The company approved a dividend of 42 cents per share, which is to be payable on Nov 18, 2022, to shareholders of record on Nov 11, 2022.

Penske Automotive PAG: Penske reported third-quarter 2022 adjusted earnings of $4.61 per share, increasing 3% year over year from $4.46 and surpassing the Zacks Consensus Estimate of $4.38. The auto retailer registered net sales of $6,920.7 million, which topped the Zacks Consensus Estimate of $6,855 million. The top line rose 7% from the year-ago quarter.

Penske had cash and cash equivalents of $92.3 million as of Sep 30, 2022, down from $100.7 million in 2021 end. The long-term debt amounted to $1,561.9 million, up from $1,392 million as of Dec 31, 2021. During the quarter under discussion, PAG repurchased 2.8 million shares of common stock for $309.4 million. PAG also increased its share repurchase authorization by $250 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Penske Automotive Group, Inc. (PAG) : Free Stock Analysis Report

Asbury Automotive Group, Inc. (ABG) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research