Is BBX Capital Corporation’s (BBX) Balance Sheet A Threat To Its Future?

BBX Capital Corporation (NYSE:BBX) is a small-cap stock with a market capitalization of USD $814.24M. While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. There are always disruptions which destabilize an existing industry, in which most small-cap companies are the first casualties. Here are few basic financial health checks to judge whether a company fits the bill or there is an additional risk which you should consider before taking the plunge. Check out our latest analysis for BBX Capital

How does BBX’s operating cash flow stack up against its debt?

While failure to manage cash has been one of the major reasons behind the demise of a lot of small businesses, mismanagement comes into the light during tough situations such as an economic recession. These adverse events bring devastation and yet does not absolve the company from its debt. Fortunately, we can test the company’s capacity to pay back its debtholders without summoning any catastrophes by looking at how much cash it generates from its current operations. Last year, BBX’s operating cash flow was 0.08x its current debt. An annual operating cash flow of less than a tenth of the overall debt raises red flags, although short-term obstacles and business cyclicality may temporarily impact BBX’s ability to generate cash.

Can BBX meet its short-term obligations with the cash in hand?

What about its other commitments such as payments to suppliers and salaries to its employees? During times of unfavourable events, BBX could be required to liquidate some of its assets to meet these upcoming payments, as cash flow from operations is hindered. We test for BBX’s ability to meet these needs by comparing its cash and short-term investments with current liabilities. Our analysis shows that BBX does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

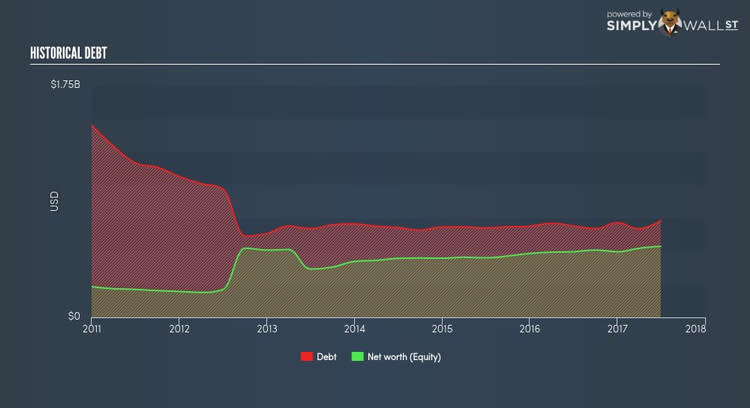

Is BBX’s level of debt at an acceptable level?

Debt-to-equity ratio tells us how much of the asset debtors could claim if the company went out of business. For BBX, the debt-to-equity ratio stands at above 100%, which means that it is a highly leveraged company. This is not a problem if the company has consistently grown its profits. But during a business downturn, as liquidity may dry up, making it hard to operate. While debt-to-equity ratio has several factors at play, an easier way to check whether BBX’s leverage is at a sustainable level is to check its ability to service the debt. A company generating earnings at least three times its interest payments is considered financially sound. BBX’s profits amply covers interest at 3.24 times, which is seen as relatively safe. Debtors may be willing to loan the company more money, giving BBX ample headroom to grow its debt facilities.

Next Steps:

Are you a shareholder? BBX’s cash flow coverage indicates it could improve its operating efficiency in order to meet demand for debt repayments should unforeseen events arise. However, its high liquidity ensures the company will continue to operate smoothly should unfavourable circumstances arise. Given that BBX’s financial situation may change. I recommend keeping on top of market expectations for BBX’s future growth on our free analysis platform.

Are you a potential investor? BBX’s high debt level indicates room for improvement. Furthermore, its cash flow coverage of less than a quarter of debt means that operating efficiency could also be an issue. However, the company exhibits an ability to meet its near term obligations should an adverse event occur. As a following step, you should take a look at BBX’s past performance analysis on our free platform to figure out BBX’s financial health position.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.