Is a Beat Likely for AbbVie (ABBV) This Earnings Season?

AbbVie ABBV, slated to report first-quarter 2022 results on Apr 29, before market open, is expected to beat expectations. In the last reported quarter, the company delivered an earnings surprise of 0.61%.

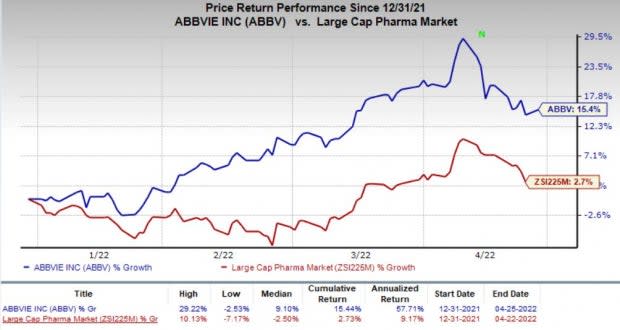

AbbVie’s stock has gained 15.4% so far this year compared with an increase of 2.7% for the industry.

Image Source: Zacks Investment Research

This large drugmaker’s performance has been pretty impressive, with its earnings beating estimates in three of the trailing four quarters and meeting the same once. The company has a four-quarter earnings surprise of 2.55%, on average.

Factors to Consider

Strong demand for immunology drugs, aesthetics and cosmetics products is expected to have driven sales in the first quarter of 2022. Moreover, new drug launches in the past few quarters are likely to have brought additional sales during the first quarter. Currency movements are likely to have hurt sales growth during the first quarter.

First-quarter earnings are expected between $3.10 and $3.14 per share. AbbVie expects adjusted revenues of approximately $13.5 billion, indicating year-over-year growth of more than 4%. The Zacks Consensus Estimate for earnings and revenues stands at $3.15 per share and $13.56 billion, respectively.

In immunology, Humira has been witnessing strong demand trends in the United States. Sales of the drug in the United States are likely to have increased in the first quarter. However, Humira’s international sales are expected to have continued their declining trend due to the impact of biosimilars in Europe. The Zacks Consensus Estimate for Humira stands at $4.83 billion, which is estimated to include $673 million from international markets and the rest from the U.S. market alone.

The sales of new immunology drugs, Skyrizi and Rinvoq, reflected strong uptake during the last few quarters. The strong uptake is expected to have continued in the soon-to-be-reported quarter. The label expansions of Rinvoq and Skyrizi to include new patient populations during the past three quarters in different countries are likely to have driven the sales of the drugs further during the quarter.

In December, AbbVie updated the Rinvoq label to include boxed warnings about an increased risk of serious heart-related events, cancer, blood clots, and even death following a Drug Safety Communication issued by the FDA. The label update is likely to have an unfavorable impact on the drug’s sales in the first quarter of 2022.

In oncology, AbbVie markets Imbruvica in partnership with Johnson & Johnson JNJ and Venclexta with Roche RHHBY. Sales of the J&J and Roche-partnered drugs are likely to have been strong in the soon-to-be-reported quarter. The impact of increasing competition from newer therapies on sales of J&J-partnered drug, Imbruvica, remains to be seen. The Zacks Consensus Estimate for J&J-partnered drug, Imbruvica, and Roche-partnered drug, Venclexta, is pegged at $1.30 billion and $474 million, respectively.

Sales of AbbVie’s new Hepatitis C drug, Mavyret, started recovering from the pandemic impact during the second quarter of 2021, which continued in the last two quarters as well. The recovery trend is likely to have continued in the soon-to-be reported quarter too, boosting sales of the drug. The Zacks Consensus Estimate for Mavyret stands at $386 million.

Sales of AbbVie’s aesthetics products — Botox cosmetic and Juverderm — demonstrated a strong recovery during the last three quarters of 2021, reflecting significant pent-up demand. Moreover, sales of the neuroscience franchise also showed strong growth in 2021. The trend is expected to have continued for both franchises in the soon-to-be-reported quarter. The Zacks Consensus Estimate for aesthetics and neuroscience products stands at $1.29 billion and $1.51 billion, respectively.

Investors’ focus will likely be on AbbVie’s strategies around Humira following its loss of exclusivity in the United States expected next year. They are also likely to ask questions on the rising competition for other drugs, including Imbruvica, on the earnings call.

Earnings Beat Likely

Our proven model predicts an earnings beat for AbbVie this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate ($3.16 per share) and the Zacks Consensus Estimate ($3.15 per share), is +0.18%.

Zacks Rank: AbbVie carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

AbbVie Inc. Price and EPS Surprise

AbbVie Inc. price-eps-surprise | AbbVie Inc. Quote

Another Stock to Consider

Here is another large biotech stock that you may want to consider, as our model shows that it has the right combination of elements to post an earnings beat this season.

Vertex Pharmaceuticals VRTX has an Earnings ESP of +0.87% and a Zacks Rank #2.

Vertex’s stock has surged 23.8% so far this year. VRTX topped earnings estimates in the last four reported quarters. Vertex has a four-quarter earnings surprise of 10.01%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research