Best-In-Class Industrial Dividend Stocks

Industrial names generally suffer from deep cyclicality which can affect companies operating in areas ranging from machinery to aerospace to construction. As such, the position a company has relative to the economic cycle drives its level of profitability. This impacts cash flows which in turn determines the level of dividend payout. During times of growth, these industrial names could provide a strong boost to your portfolio income. If you’re a long term investor, these high-dividend industrials stocks can boost your monthly portfolio income.

Wai Kee Holdings Limited (SEHK:610)

610 has a juicy dividend yield of 5.94% and their payout ratio stands at 22.86% . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from HK$0.12 to HK$0.26. Wai Kee Holdings’s earnings per share growth of 36.33% over the past 12 months outpaced the hk construction industry’s average growth rate of -7.17%. Continue research on Wai Kee Holdings here.

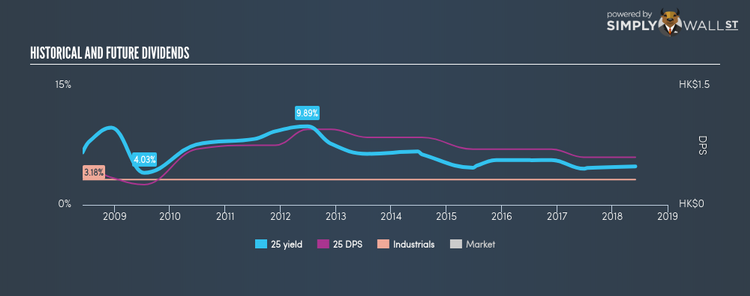

Chevalier International Holdings Limited (SEHK:25)

25 has a substantial dividend yield of 4.84% and their payout ratio stands at 15.87% . Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again. Chevalier International Holdings’s earnings per share growth of 216.16% outpaced the hk industrials industry’s 30.94% average growth rate over the last year. Dig deeper into Chevalier International Holdings here.

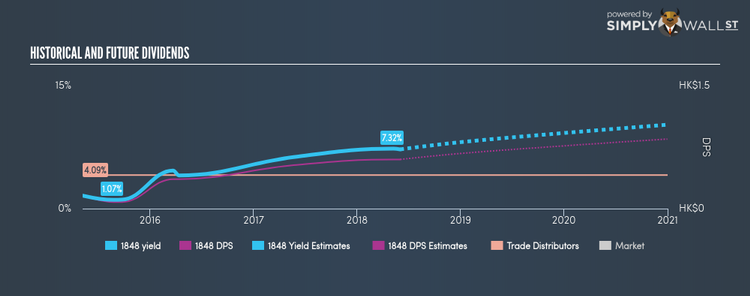

China Aircraft Leasing Group Holdings Limited (SEHK:1848)

1848 has a sumptuous dividend yield of 7.23% and distributes 55.17% of its earnings to shareholders as dividends . 1848’s dividend alone will put you better off than your bank interest, but the company’s yield isn’t only higher than the low risk savings rate. It’s also amongst the market’s top dividend payers. More detail on China Aircraft Leasing Group Holdings here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.