Best Dividend Paying Stocks

American Railcar Industries, Speedway Motorsports, and Urstadt Biddle Properties have one big thing in common. They are on my list of the best dividend stocks which have generously contributed to my portfolio income over the past couple of months. Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. As a long term investor with a short term temperament, I highly recommend these top dividend stocks.

American Railcar Industries, Inc. (NASDAQ:ARII)

American Railcar Industries, Inc., together with its subsidiaries, designs and manufactures hopper and tank railcars in North America. Formed in 1988, and now led by CEO Jeffrey Hollister, the company size now stands at 2,159 people and with the company’s market cap sitting at USD $767.94M, it falls under the small-cap stocks category.

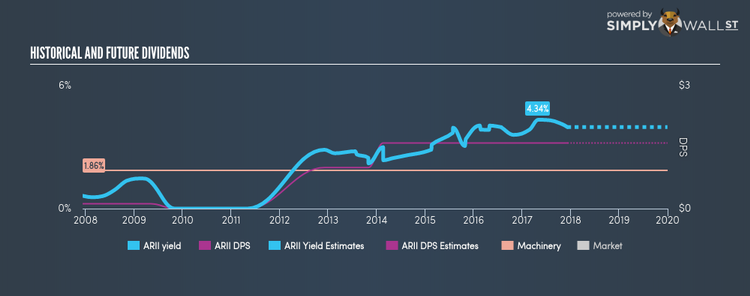

ARII has a good dividend yield of 3.98% and the company has a payout ratio of 58.11% , with analysts expecting the payout in three years to be 68.26%. While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from $0.12 to $1.6. Comparing American Railcar Industries’s PE ratio against the US Machinery industry draws favorable results, with the company’s PE of 14.6 being below that of its industry (23.9).

Speedway Motorsports, Inc. (NYSE:TRK)

Speedway Motorsports, Inc., through its subsidiaries, promotes, markets, and sponsors motorsports activities in the United States. Formed in 1959, and currently headed by CEO Marcus Smith, the company employs 944 people and with the company’s market cap sitting at USD $793.13M, it falls under the small-cap stocks category.

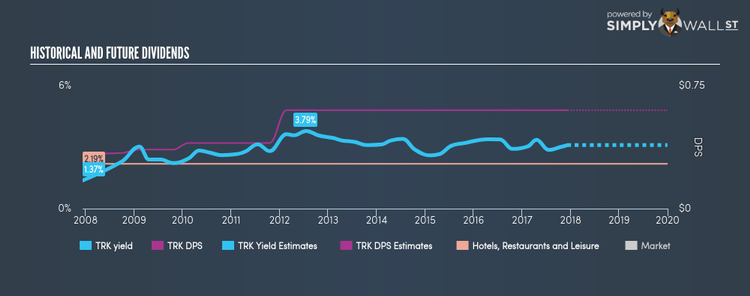

TRK has a good-sized dividend yield of 3.10% and has a payout ratio of 70.67% . TRK’s DPS have risen to $0.6 from $0.335 over a 10 year period. It should comfort existing and potential future shareholders to know that TRK hasn’t missed a payment during this time.

Urstadt Biddle Properties Inc. (NYSE:UBA)

Urstadt Biddle Properties Inc. is a self-administered equity real estate investment trust which owns or has equity interests in 81 properties containing approximately 5.1 million square feet of space. Established in 1969, and currently run by Willing Biddle, the company size now stands at 51 people and with the company’s market capitalisation at USD $818.86M, we can put it in the small-cap category.

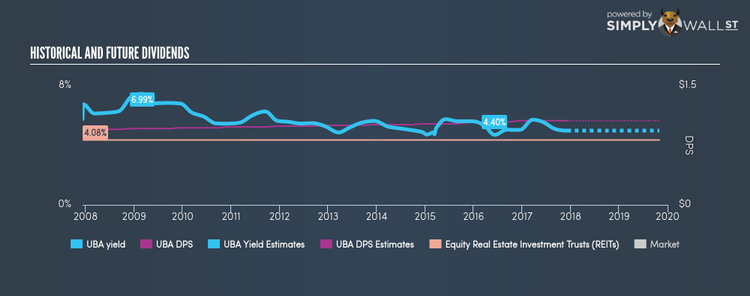

UBA has a sumptuous dividend yield of 4.67% and is currently distributing 98.50% of profits to shareholders , and analysts are expecting a 141.98% payout ratio in the next three years. The company’s dividends per share have risen from $0.92 to $1.06 over the last 10 years. The company has been a reliable payer too, not missing a payment during this time. Urstadt Biddle Properties’s earnings per share growth of % outpaced the US Equity Real Estate Investment Trusts (REITs) industry’s 0.00184% average growth rate over the last year.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.