Best Growth Stocks to Buy for July 29th

Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, July 29th:

Suncor Energy SU: This Canada's premier integrated energy company with operations including oil sands development and upgrading, conventional and offshore crude oil and gas production, petroleum refining, and product marketing, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 18.2% over the last 60 days.

Suncor Energy Inc. Price and Consensus

Suncor Energy Inc. price-consensus-chart | Suncor Energy Inc. Quote

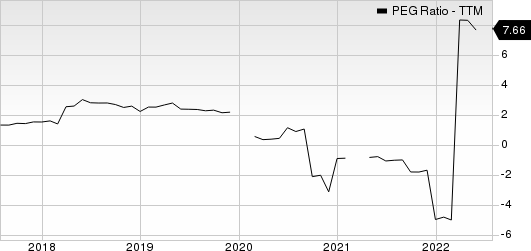

Suncor Energy has a PEG ratio of 0.50 compared with 0.52 for the industry. The company possesses a Growth Score of A.

Suncor Energy Inc. PEG Ratio (TTM)

Suncor Energy Inc. peg-ratio-ttm | Suncor Energy Inc. Quote

Pebblebrook Hotel Trust PEB: This internally managed hotel Investment company which acquires and invests in hotel properties located primarily in large United States cities with an emphasis on the major coastal markets, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 24.8% over the last 60 days.

Pebblebrook Hotel Trust Price and Consensus

Pebblebrook Hotel Trust price-consensus-chart | Pebblebrook Hotel Trust Quote

Pebblebrook Hotel Trust has a PEG ratio of 0.73 compared with 3.10 for the industry. The company possesses a Growth Score of B.

Pebblebrook Hotel Trust PEG Ratio (TTM)

Pebblebrook Hotel Trust peg-ratio-ttm | Pebblebrook Hotel Trust Quote

Kite Realty Group Trust KRG: This vertically integrated real estate investment trust which focuses primarily on the development, construction, acquisition, ownership and operation of high-quality neighborhood and community shopping centers in selected growth markets in the United States, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.1% over the last 60 days.

Kite Realty Group Trust Price and Consensus

Kite Realty Group Trust price-consensus-chart | Kite Realty Group Trust Quote

Kite Realty Group Trust has a PEG ratio of 1.17 compared with 2.0 for the industry. The company possesses a Growth Score of B.

Kite Realty Group Trust PEG Ratio (TTM)

Kite Realty Group Trust peg-ratio-ttm | Kite Realty Group Trust Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

Pebblebrook Hotel Trust (PEB) : Free Stock Analysis Report

Kite Realty Group Trust (KRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research