Bill Ackman Loads Up on Howard Hughes Corp

Bill Ackman (Trades, Portfolio) is an activist investor who is the founder and investment manager at Pershing Square Capital Management. He is known for his relentless contrarian style. However, I believe Ackman is also a value investor at heart, as he has a focused style of investing. At Pershing Square, his goal is to maximize its long-term compound annual rate of growth in intrinsic value per share." This may sound simple, but very few investors have managed to accomplish this over a long period of time.

That's why I wanted to do a deep dive into Howard Hughes Corp. (NYSE:HHC), one of Ackman's holdings that he has recently added more to according to GuruFocus Real-Time Picks, a Premium feature. What's really interesting is that Ackman once tried to buy the entire company! Just what is it about this business that he likes so much? Let's take a look.

Trading history

According GuruFocus Real-Time Picks, Ackman bought more shares of Howard Hughes on Dec. 5 and Dec. 22. The billionaire investor increased his position by 4.33% on the 5th and another 0.32% on the 22nd of the month.

SEC regulations state that if an investor owns a greater than 5% stake in a company, they must report any additional transactions in a Form 4 report within two days. This is how we know about the extra trades Ackman has been making into the stock outside of the normal quarterly 13F filings.

Prior to this recent transaction, Ackman has owned the stock since at least the fourth quarter of 2010 based on available SEC data, with a huge increase in the position in the first quarter of 2020.

Ackman owns approximately 15.9 million shares of the stock as of this writing with a market value of ~$1.191 billion. The GuruFocus ownership screen indicates that Ackman is now the largest shareholder in the company, owning 31.86% of all shares outstanding.

Ackman has previously offered to buy out the minority shareholders of the company at $60 per share. In addition, he has taken an active role in the company, pushing it to simplify its business model and positioning it for long-term value creation." He is also the chairman of the company, which means he has substantial insight into the business and its value.

What does the company do?

Howard Hughes is a real estate development and management company based in Texas. The company owns over 118,000 acres, with over 9 million square feet of office and retail space, as well as over 5,587 residential units. This is spread across a multitude of states from Texas to Maryland, Nevada, New York and even Hawaii. When it comes to its residential units, Howard Hughes owns masterplan communities. In addition, the company owns a series of iconic operating assets such as the Las Vegas BallPark, the Bank of America (NYSE:BAC) Tower in Chicago and the Woodlands Resort in Texas.

The company uses an interesting value creation strategy in which it sells land to home builders, which then generates demand for commercial assets. Howard Hughes then develops commercial assets, which further increases the demand for residential units.

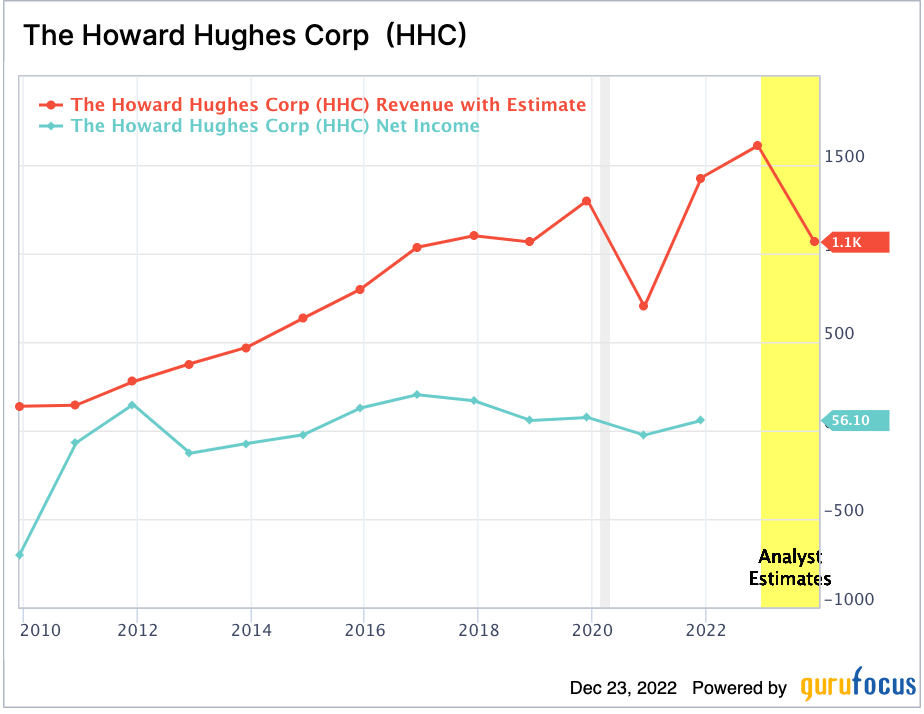

Mixed financials

Howard Hughes reported mixed financial results for the third quarter of 2022. Revenue was $639.59 million, which missed analyst expectations by $30 million, despite increasing by a staggering 191% year over year.

Its operating asset segment generated $61 million in net operating income, which declined by 3% year over year. This was mainly due to the sale of its non core assets such as three Woodlands-based hotels and the Riverwalk outlet in New Orleans. These assets combined generated revenue of $3 million in the prior quarter, but management believes it can get a greater return elsewhere.

The company reported a large 27% increase in net operating income for its multifamily assets at $12 million in the quarter. This was driven by an increase in leases signed for its newest communities with 90% leased despite macroeconomic issues.

Howard Hughes develops high-end homes and condos which are still very popular with its clientele. I noticed from its website that its marketing is strong, as the company aims to create a community feel for its facilities which will attract successful people.

In the latest quarter, the business executed 94,000 square feet in new office leases and its properties such as Woodland Forest are now ~59% leased.

Howard Hughes has a strong balance sheet with $354.6 million in cash and short term investments compared to long term debt of $4.6 billion. This debt is mostly fixed-rate and its debt profile is staggered and thus manageable.

Valuation

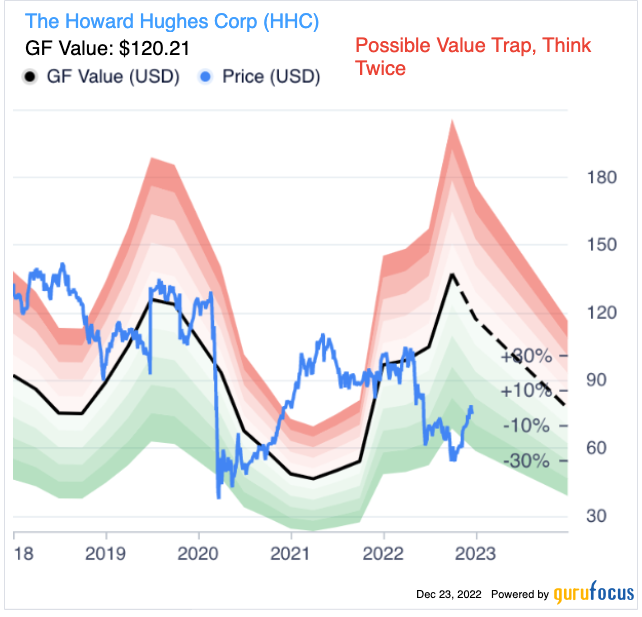

The stock price of Howard Hughes fell of a cliff in 2020 as the value of commercial real estate declined. The stock price plummeted from $125 per share in February 2020 to just $40 per share by March 2020. However, Ackman had faith in the company, and it stock price has recovered by approximately 85% since those low levels.

Howard Hughes trades at a non-GAAP price-earnings ratio of 15.6, which is 43% cheaper than the real estate sector average. The company also trades at a price-to-funds-from-operation ratio (P/FFO) of 7.35, which is 45% cheaper than its five-year average.

The GF Value chart indicates a fair value of $120 per share for the stock, making it look undervalued at the time of writing. However, the chart does warn of a possible value trap, which is likely due to the profitability issues. But as mentioned prior, the company has been selling assets to raise cash, so I think it should be able to recover.

Final thoughts

Bill Ackman (Trades, Portfolio) manages a focused portfolio of what he believes to be high-quality stocks, and as an activist investor, he is not afraid to get hands-on with companies. In this case, I think Ackman's choice is a solid one. The companys fixed-rate debt profile means it should be in a solid position despite the rising interest rate environment.

This article first appeared on GuruFocus.