Biomea (BMEA) Up 99% on Upbeat Data From Type II Diabetes Study

Shares of Biomea Fusion BMEA surged 99.0% on Mar 28 after management announced initial positive topline data from the first two cohorts of the ongoing phase II portion of the COVALENT-111 study.

The COVALENT-111 is a phase I/II study, which is evaluating its lead pipeline candidate BMF-219 in patients with type 2 diabetes (T2D). The initial data from cohort 3 of the COVALENT-111 study showed that after four weeks of treatment with a once-daily 100mg dose of BMF-219 taken without food, 89% of patients achieved a reduction in A1c. In fact, 78% of participants achieved at least a 0.5% reduction in A1c, while 56% achieved at least a 1% reduction in A1c.

Data from cohort 2 also showed that after four weeks of treatment with a once-daily 100mg dose of BMF-219 taken with food, 30% of study participants achieved an A1c reduction between 0.5% and 1%.

Overall, data from these two cohorts showed that treatment with BMF-219 demonstrated a robust glucose-lowering response. In fact, initial observations of study participants administered BMF-219 also showed continued glycemic control, even after four weeks of the last BMF-219 dose. The drug also had a well-tolerated safety profile since none of the study participants discontinued treatment and completed a four-week treatment with the drug.

Based on this data, Biomea will continue dosing study participants in the COVALENT-111 study. Management also plans to explore additional dosing periods greater than four weeks to evaluate the optimal duration of glycemic control. Biomea also plans to explore the BMF-219’s potential in type I diabetes.

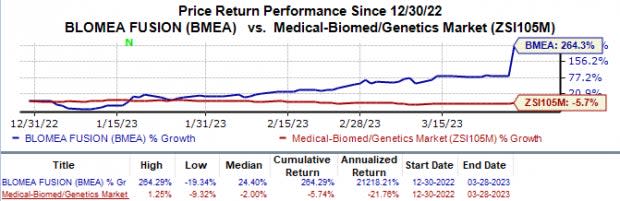

In the year so far, shares of Biomea have skyrocketed 264.3% against the industry’s 5.7% fall.

Image Source: Zacks Investment Research

BMF-219 is an investigational covalent menin inhibitor developed by Biomea using its proprietary FUSION system. This inhibitor has been designed to address the root factor for the biological cause of diabetes and its inevitable progression – the loss of insulin-producing beta cells. Management believes that treatment with BMF-219 will enable regeneration, reactivation and preservation of functional beta cells.

Apart from the COVALENT-111 study, Biomea is also evaluating BMF-219 across two other ongoing early-stage studies – COVALENT-101 and COVALENT-102 – across liquid and solid tumor indications.

The COVALENT-101 study is evaluating BMF-219 in four liquid tumor cohorts – acute lymphocytic and myeloid leukemias (ALL/AML), diffuse large B-cell lymphoma (DLBCL), multiple myeloma (MM) and chronic lymphocytic leukemia (CLL). COVALENT-102 study is evaluating BMF-219 in patients with KRAS-mutated solid tumors, including non-small cell lung cancer (NSCLC), colorectal cancer (CRC) and pancreatic ductal adenocarcinoma (PDAC).

Biomea Fusion is also advancing its pre-clinical candidate BMF-500, an FLT3 inhibitor, towards clinical studies. An investigational new drug (IND) filing is expected in first-half 2023.

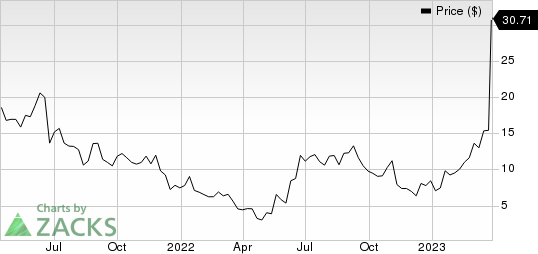

Biomea Fusion, Inc. Price

Biomea Fusion, Inc. price | Biomea Fusion, Inc. Quote

Zacks Rank & Other Stock to Consider

Biomea currently carries a Zacks Rank #2 (Buy). Some other top-ranked stocks in the overall healthcare sector include Certara CERT, CRISPR Therapeutics CRSP and EQRx EQRX. While Certara sports a Zacks Rank #1 (Strong Buy), CRISPR Therapeutics and EQRx carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Certara’s 2023 earnings per share have increased from 46 cents to $1.24. During the same period, the earnings estimates per share for 2024 have risen from 54 cents to $1.85. Shares of Certara are up 48.1% in the year-to-date period.

Earnings of Certara missed estimates in two of the last four quarters, beating the mark on one occasion while meeting the mark on another. On average, the company’s earnings witnessed a negative surprise of 3.25%. In the last reported quarter, Certara’searnings beat estimates by 14.29%.

In the past 60 days, estimates for CRISPR Therapeutics’ 2023 loss per share have narrowed from $8.21 to $7.54. Shares of CRISPR Therapeutics have risen 7.9% in the year-to-date period.

Earnings of CRISPR Therapeutics beat estimates in two of the last four quarters while missing the mark on the other two occasions, witnessing an earnings surprise of 3.19%, on average. In the last reported quarter, CRISPR Therapeutics’ earnings beat estimates by 39.22%.

In the past 60 days, estimates for EQRx’s 2023 loss per share have narrowed from 66 cents to 58 cents. In the year so far, shares of EQRx have declined 26.4%.

Earnings of EQRx beat estimates in each of the last four quarters, witnessing an earnings surprise of 34.99%, on average. In the last reported quarter, EQRx’s earnings beat estimates by 73.68%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CRISPR Therapeutics AG (CRSP) : Free Stock Analysis Report

Certara, Inc. (CERT) : Free Stock Analysis Report

Biomea Fusion, Inc. (BMEA) : Free Stock Analysis Report

EQRx, Inc. (EQRX) : Free Stock Analysis Report