Biotech Stock On The Radar: Alkermes At A Crossroads

Alkermes Plc (NASDAQ: ALKS), an actively traded, mid-cap biotech, has lost about 32% year-to-date.

Dublin, Ireland-based Alkermes is a global biopharma company developing innovative medicines for central nervous system diseases.

The company has identified high-value opportunities in CNS and oncology as its two core areas in R&D, Alkermes CEO Richard Pops said during the company's recent earnings call. In oncology, the company is building on its scientific strengths in cytokine engineering.

Its commercial portfolio includes:

Aristada, a long-acting atypical antipsychotic approved for the treatment of schizophrenia in adults.

Vivitrol, a once-monthly medication, for the treatment of alcohol dependence as well as for the prevention of relapse to opioid dependence following opioid detoxification.

Vumerity, or droximel fumarate, for multiple sclerosis; Vumerity is being developed under a licensing and collaboration agreement with Biogen Inc (NASDAQ: BIIB).

The FDA OK'ed Vumerity Oct. 30. The FDA approval has kicked in a milestone payment of $150 million from Biogen to Alkermes. Biogen is also liable to pay a mid-teens percentage royalty on worldwide net commercial sales of the drug.

Source: Alkermes

The company has also licensed its proprietary technologies to other companies to develop products for which it receives royalties and/or manufacturing revenues.

In the U.S., such licensing partnerships are forged with:

AstraZeneca plc (NYSE: AZN) for Bydureon, a once-weekly injectable suspension for type 2 diabetes

Johnson & Johnson (NYSE: JNJ)'s Janssen unit for Ampyra to treat schizophrenia and bipolar I disorder

Janssen's Invega Sustenna for treating schizophrenia and schizoaffective disorder

Janssen's Invega Trinza for treating schizophrenia in patients after they have been adequately treated with Invega Sustenna for at least four months

EU-Approved Products Using Alkermes Technology Include:

AstraZeneca's Bydureon

Acorda Therapeutics Inc (NASDAQ: ACOR)'s Fampyra

Janssen's Risperdal Consta, Trevicta and Xeplion

Related Link: Attention Biotech Investors: Mark Your Calendar For These November PDUFA Dates

The Clinical Pipeline

Alkermes has a late-stage candidate in development: ALKS 3831 for schizophrenia. It also has an early stage immuno-oncology asset known as ALKS 4230. ALKS 4230 is being evaluated in two studies dubbed ARTISTRY-1 and ARTISTRY-2.

Financials

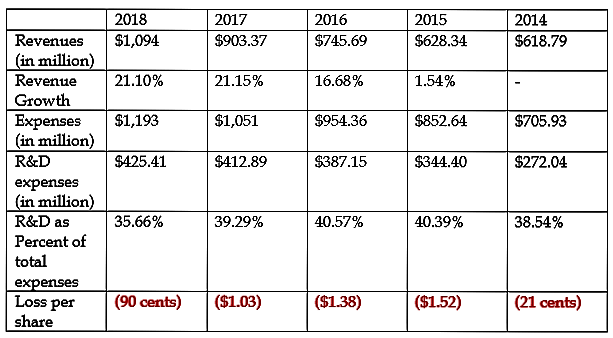

Unlike clinical-stage biotech companies, Alkermes is revenue-earning, generating 20%-plus revenue growth in recent years. That said, the bottom line is still in the red.

Source: 10-K filing

For the recent third quarter, the company reported revenue of $255.2 million, up 2.6% year-over-year. Product revenues accounted for about 54.4% of the total and rose a solid 20%.

Manufacturing and royalty revenues slid about 11% due to generic competition hurting Ampyra revenues.

The loss per share widened from 22 cents to 34 cents, while on a non-GAAP basis, the company reversed from a profit of 7 cents per share to a loss of 4 cents per share.

As of Sept. 30, the company had cash, cash equivalents and total investments of about $608.53 million.

Right-Sizing For Growth

Following a review of operations, costs structure and growth opportunities, the company recently enacted a restructuring plan that included the elimination of about 160 jobs and a reduction in near-term hiring plans and cost-saving measures related to external spend.

Alkermes said it expects cost savings of about $150 million from these efforts.

Forward Expectations

In its third-quarter report, Alkermes guided to full-year 2019 revenue of $1.14 billion to $1.19 billion, which includes a $150-million milestone payment from Biogen for Vumerity; $330 million to $340 million from Vivitrol; and $185 million to $190 million from Aristada.

Alkermes upwardly revised its full-year non-GAAP EPS estimate from 25-43 cents to 44-57 cents.

Upcoming Catalysts

Society for Immunotherapy of Cancer, or SITC, Presentations: Phase 1/2 data for ALKS 4230 as a monotherapy as well as in combination with Merck & Co.'s (NYSE: MRK) Keytruda in solid tumors: Nov. 6-10.

NDA submission for ALKS 3831: fourth quarter of 2019

Stock Take

Alkermes stock has had a tough go over the past year, with a negative Adcom verdict on its ALKS 5461 as an adjunctive treatment for major depressive disorder — and the subsequent FDA rejection — sending the shares spiraling lower.

The technical picture isn't very encouraging, with the stock trading below the 50-day SMA, currently at $19.67, and 200-day SMA, at $26.01.

The sell side is mixed on Alkermes, with half of those covering the stock bullish on its prospects and the rest in wait-and-watch mode, according to the Yahoo database.

The average analyst price target for the shares is $25.25, suggesting roughly 30% upside from current levels.

H.C. Wainwright has a Buy rating and $28 price target for Alkermes.

0

See more from Benzinga

© 2019 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.