Bitcoin and Ethereum – Weekly Technical Analysis – October 25th, 2021

Bitcoin

Bitcoin, BTC to USD, fell by 1.07% in the week ending 24th October. Following a 12.48% rally from the week prior, Bitcoin ended the week at $60,847.0.

A mixed start to the week saw Bitcoin fall to a Monday low $59,883.0 before making a move.

Steering clear of the major support levels, Bitcoin rallied to a Wednesday all-time high and intraweek high $66,958.0.

Bitcoin broke through the first major resistance level at $64,990 before falling to a Saturday intraweek low $59,755.0.

Continuing to steer clear of the first major support level at $55,928, Bitcoin revisited $61,000 levels before falling back into the red.

4 days in the green that included a 3.66% rally on Tuesday delivered the upside for the week. A 5.76% slide on Thursday limited the upside, however.

For the week ahead

Bitcoin would need to move through the $62,520 pivot to support a run the first major resistance level at $65,285

Support from the broader market would be needed for Bitcoin to break back through to $65,000 levels.

Barring an extended crypto rally, the first major resistance level and last week’s all-time high $66,958.0 would likely cap any upside.

In the event of an extended breakout, Bitcoin could test resistance at $70,000 before any pullback. The second major resistance level sits at $69,723.

Failure to move through the $62,520 pivot would bring the first major support level at $58,082 into play.

Barring an extended sell-off, Bitcoin should steer clear of the sub-$55,000 levels. The second major support level at $55,317 should limit the downside.

At the time of writing, Bitcoin was up by 1.53% to $61,778.8. A mixed start to the week saw Bitcoin fall to an early Monday low $60,632.0 before rising to a high $62,111.0.

Bitcoin left the major support and resistance levels untested early on.

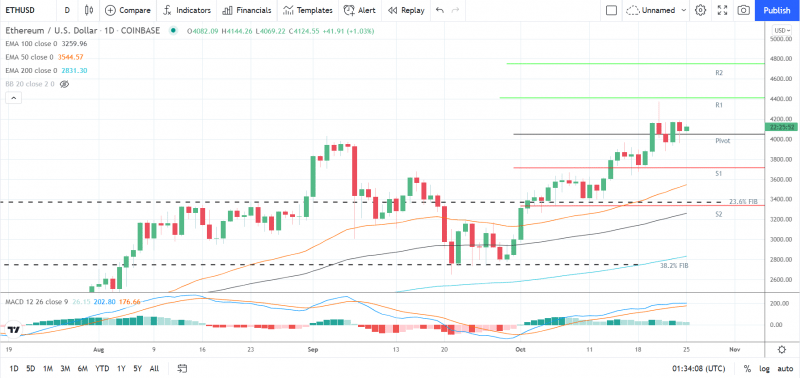

Ethereum

Ethereum rose by 6.11% in the week ending 24th October. Following a 12.66% rally from the previous week, Ethereum ended the week at $4,082.64.

A bearish start to the week saw Ethereum fall to a Monday intraweek low $3,676.35 before making a move.

Steering clear of the first major support level at $3,491, Ethereum rallied to a Thursday intraweek high $4,374.95.

Ethereum broke through the first major resistance level at $4,086 and the second major resistance level at $4,325.

Bearish going into the weekend, Ethereum fell back through the resistance levels to sub-$4,000.

A bullish Saturday, however, saw Ethereum break back through the first major resistance level to revisit $4,100 levels before easing back.

3-days in the green that included a 7.32% jump on Wednesday and a 4.96% rally on Saturday delivered the upside in the week.

For the week ahead

Ethereum would need avoid the $4,045 pivot level to support a run at the first major resistance level at $4,413.

Support from the broader market would be needed, however, for Ethereum to break out from May’s all-time high $4,384.30.

Barring an extended crypto rally, the first major resistance level would likely cap any upside.

In the event of another extended breakout, Ethereum could test resistance at $5,000 levels before any pullback. The second major resistance level sits at $4,743.

A fall through the $4,045 pivot would bring the first major support level at $3,714 into play.

Barring an extended sell-off in the week, Ethereum should steer clear of sub-$3,500 levels. The second major support level sits at $3,346.

At the time of writing, Ethereum was up by 1.03% to $4,124.55. A mixed start to the week saw Ethereum fall to an early Monday low $4,069.22 before rising to a high $4,144.26.

Ethereum left the major support and resistance levels untested early on.

This article was originally posted on FX Empire

More From FXEMPIRE:

Crude Oil Price Update – Sustained Move Over $85.25 Will Officially Put $90.00 on the Radar

EOS, Stellar’s Lumen, and Tron’s TRX – Daily Analysis – October 25th, 2021

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – Reaction to 15378.75 Pivot Sets the Tone

E-mini S&P 500 Index (ES) Futures Technical Analysis – Trade Through 4515.25 Shifts Momentum to Down