Can Burlington Stores (BURL) Report Higher Q2 Earnings?

Burlington Stores, Inc. BURL is scheduled to report second-quarter fiscal 2018 results on Aug 30. In the last-reported quarter, this off-price retailer delivered a positive earnings surprise of 15.6%. Further, the bottom line has outperformed the Zacks Consensus Estimate by an average of 17.8% in the trailing four quarters. Let’s see what awaits this quarterly release.

How are Estimates Faring?

Investors are keeping their fingers crossed and hoping for a positive earnings surprise from Burlington Stores in the quarter to be reported. The Zacks Consensus Estimate for the quarter under review is 97 cents, reflecting a year-over-year increase of roughly 35%. We observe that the Zacks Consensus Estimate for earnings has increased by a penny in the past 30 days. Zacks Consensus Estimate for revenues is pegged at $1,492 million, up approximately 9% from the year-ago quarter.

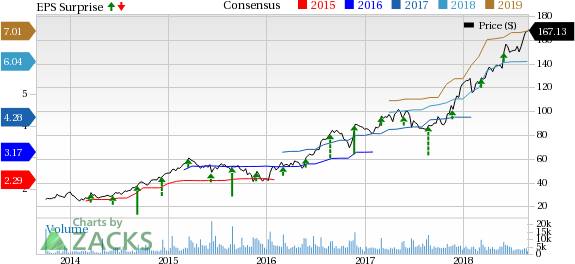

Burlington Stores, Inc. Price, Consensus and EPS Surprise

Burlington Stores, Inc. Price, Consensus and EPS Surprise | Burlington Stores, Inc. Quote

Factors Influencing Quarterly Results

Burlington Stores has started the business as a coat-focused off-price retailer. It is now focusing on “open to buy” off-price model. The current model is helping customers to get nationally branded, fashionable, high quality and right priced products. Further, over the years, the company has increased vendor count, made technological advancements, initiated better marketing approach and focused on localized assortments.

Moreover, Burlington Stores has been focusing on store expansion. It plans to open 35 to 40 net new stores and remodel 34 stores in fiscal 2018. It also believes that there is room to increase the store count to 1,000.

Driven by initiatives, Burlington Stores is not only doing well on the revenue front but also gaining from its consecutive earnings beat. The company expects fiscal second-quarter sales to increase 8-9%, with comps growth of 2-3% compared with 3.5% increase witnessed in the year-ago period. Further, it forecasts adjusted earnings of 91-95 cents a share. Moreover, the gross margin has been impressive and we expect the rising trend to persist in the fiscal second quarter as well.

What the Zacks Model Unveils?

Our proven model shows that Burlington Stores is likely to beat estimates this quarter. A stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Burlington Stores currently has a Zacks Rank #2 and an Earnings ESP of +1.42%. This makes us reasonably confident of an earnings beat.

Other Stocks With Favorable Combination

Here are some other companies that you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

The Michaels Companies, Inc. MIK has an Earnings ESP of +0.94% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Big Lots, Inc. BIG has an Earnings ESP of +5.22% and a Zacks Rank #2.

Ollie's Bargain Outlet Holdings, Inc. OLLI has an Earnings ESP of +2.74% and a Zacks Rank #2.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Big Lots, Inc. (BIG) : Free Stock Analysis Report

The Michaels Companies, Inc. (MIK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research