Canadian Natural (CNQ) to Report Q2 Results: What Awaits?

Canadian Natural Resources Limited CNQ is set to release second-quarter 2021 results before the opening bell on Aug 5. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 77 cents per share on revenues of $5.26 billion.

Let’s delve into the factors that might have influenced the independent energy company’s results in the June quarter. But it’s worth taking a look at Canadian Natural Resources’ previous-quarter performance first.

Highlights of Q1 Earnings & Surprise History

In the last-reported quarter, the Calgary, Alberta-based upstream operator beat the consensus mark on increased output from North America, lower costs and higher commodity price realizations. Canadian Natural had reported adjusted earnings per share of 81 cents, comfortably beating the Zacks Consensus Estimate of 67 cents. Total revenues of $5.2 billion had also outperformed the Zacks Consensus Estimate by 6.58%.

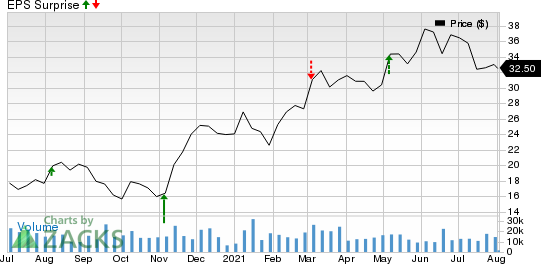

Canadian Natural Resources beat the Zacks Consensus Estimate in each of the last four quarters, delivering an earnings surprise of 134.24%, on average. This is depicted in the graph below:

Canadian Natural Resources Limited Price and EPS Surprise

Canadian Natural Resources Limited price-eps-surprise | Canadian Natural Resources Limited Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the second-quarter bottom line remained the same in the last seven days. The estimated figure indicates a 263.83% surge year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 154.06% increase from the year-ago period.

Factors to Consider

In the first quarter of 2021, the company’s realized natural gas price had surged 54.1% to C$3.42 per thousand cubic feet from the year-ago level of C$2.22. Moreover, realized oil and NGLs price had jumped 103.4% to C$52.68 per barrel from C$25.90 in the first quarter of 2020. The uptick is most likely to have continued in the second quarter, thanks to the sharp rebound in commodity prices that revisited their multi-year highs following the vaccine progress and the ongoing macroeconomic recovery. This price boost is likely to have buoyed the second-quarter revenues and cash flows of Canadian Natural Resources.

On a somewhat bearish note, the company is likely to have faced a decline in North American liquids production. Canadian Natural reported crude oil and NGL production of 211,206 barrels per day in the first quarter, down 7.6% from the prior-year quarter. The downside pressure is most likely to have continued in the second quarter due to natural field declines and last year’s deferred drilling activity. This might have impacted Canadian Natural Resources’ results in the June quarter.

What Does Our Model Say?

The proven Zacks model does not conclusively show that Canadian Natural Resources is likely to beat estimates in the second quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Canadian Natural has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 77 cents per share each.

Zacks Rank: Canadian Natural currently carries a Zacks Rank #3, which increases the predictive power of ESP. However, the company’s 0.00% ESP makes surprise prediction difficult this earnings season.

Stocks to Consider

While an earnings beat looks uncertain for Canadian Natural Resources, here are some firms from the energy space that you may want to consider on the basis of our model:

EOG Resources, Inc. EOG has an Earnings ESP of +0.50% and a Zacks Rank #1. The firm is scheduled to release earnings on Aug 4.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Northern Oil and Gas, Inc. NOG has an Earnings ESP of +1.38% and is Zacks #2 Ranked. The firm is scheduled to release earnings on Aug 5.

Nine Energy Service, Inc. NINE has an Earnings ESP of +2.16% and a Zacks Rank #2. The firm is scheduled to release earnings on Aug 5.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

Northern Oil and Gas, Inc. (NOG) : Free Stock Analysis Report

Nine Energy Service, Inc. (NINE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research