Carvana (CVNA) Buys ADESA U.S. Auction Unit for $2.2 Billion

Carvana Co. CVNA recently announced its acquisition of ADESA’s U.S. physical auction business from KAR Global. The deal, valued at $2.2 billion, consists of 56 ADESA U.S. locations, covering nearly 6.5 million square feet of buildings on more than 4,000 acres. Citi and J.P. Morgan Securities LLC acted as financial advisors while Kirkland & Ellis LLP served as legal counsel for the company.

The buyout will bolster Carvana’s growth opportunities. The deal seeks to improve experiences of the ADESA U.S. physical auction customers and target unit economic improvements.

ADESA is enthusiastic about the collaboration and hopes to positively impact the largest retail sector in the country in order to better serve buyers, sellers and consumers across the automotive industry.

However, volatility and uncertainty have been battering the car market for a long time, fueled by the ongoing parts shortage and the recent war. This has forced Carvana to lay off 12% of its workers, as per media reports.

The company saw a business boom during the pandemic as consumers transitioned away from brick-and-mortar car yards. Carvana witnessed fast growth and a quick climb up the success ladder to become the third-fastest company to reach the Fortune 500.

But in recent times, serious impediments have come to cripple its supremacy. All-time-high car prices have slowed down sales to recession levels, which have kept Carvana’s growth below its original forecasts. High rates of interest and inflation have reduced demand. In this light, according to the company, a decision for lay-off is needed to bring back the balance.

Per internal communications, the company will pay all laid-off employees four weeks of severance pay, plus an additional week of pay for each year they have been with Carvana. Moreover, healthcare will also be extended for three months for affected individuals.

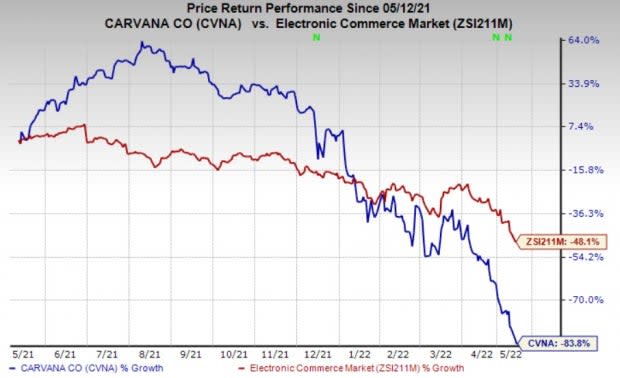

Shares of CVNA have lost 83.8% over the past year compared to its industry’s 48.1% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

CVNA currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked players in the auto space include BRP Group, Inc. DOOO, sporting a Zacks Rank #1 (Strong Buy) and Dorman Products DORM and Standard Motor Products SMP, each carrying a Zacks Rank #2 (Buy), currently. You can see the complete list of today’s Zacks #1 Rank stocks here.

BRP Group has an expected earnings growth rate of 9.2% for fiscal 2023. The Zacks Consensus Estimate for current-year earnings has been revised around 7.3% upward in the past 60 days.

BRP Group’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. DOOO pulled off a trailing four-quarter earnings surprise of 68%, on average. The stock has declined 8.7% over the past year.

Dorman Products has an expected earnings growth rate of 18.8% for the current year. The Zacks Consensus Estimate for current-year earnings has been marginally revised 0.7% upwards in the past 60 days.

Dorman Products’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same in one. DORM pulled off a trailing four-quarter earnings surprise of 3.1%, on average. The stock has lost 2.3% over the past year.

Standard Motor has an expected earnings growth rate of 1.4% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised around 2% upward in the past 60 days.

Standard Motor’s earnings beat the Zacks Consensus Estimate in all of the trailing four quarters. SMP pulled off a trailing four-quarter earnings surprise of 40.34%, on average. The stock has lost 13% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Standard Motor Products, Inc. (SMP) : Free Stock Analysis Report

Dorman Products, Inc. (DORM) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research