Charles de Vaulx's Top 5 Trades of the 2nd Quarter

- By James Li

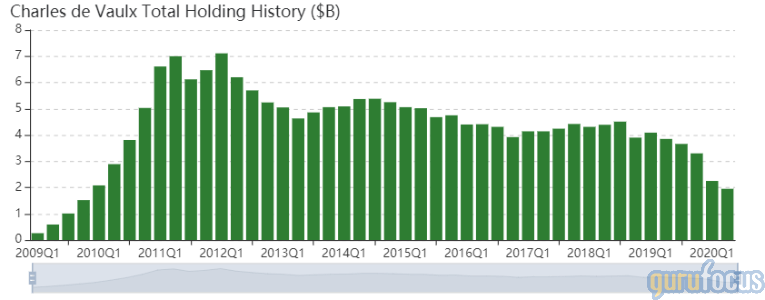

Charles de Vaulx (Trades, Portfolio), chief investment officer of International Value Advisors, disclosed this week that the IVA Worldwide Fund's top five trades for the second quarter featured a new holding in Chevron Corp. (NYSE:CVX) and sells in four companies: Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B), Cie Financiere Richemont SA (XSWX:CFR), Acuity Brands Inc. (NYSE:AYI) and Sodexo (XPAR:SW).

De Vaulx, a former portfolio manager at First Eagle Investment (Trades, Portfolio), employs a value-oriented approach and seeks investments in companies with strong balance sheets, temporarily depressed earnings and entrenched franchises. Emphasis is placed on the fundamental value of the security.

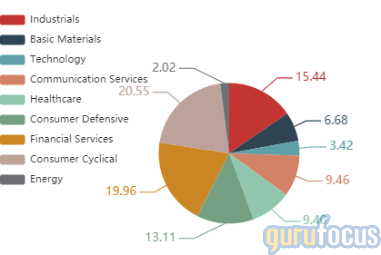

The fund manager said in his quarterly letter that the IVA Worldwide Fund returned 8.31% during the quarter, underperforming the MSCI All-Country World Index benchmark return of 19.22%. As of the quarter-end, the fund's $1.95 billion equity portfolio contains 72 stocks, with five new holdings and a turnover ratio of 3%. The top three sectors in terms of weight are consumer cyclical, financial services and industrials, with weights of 20.55%, 19.96% and 15.44%.

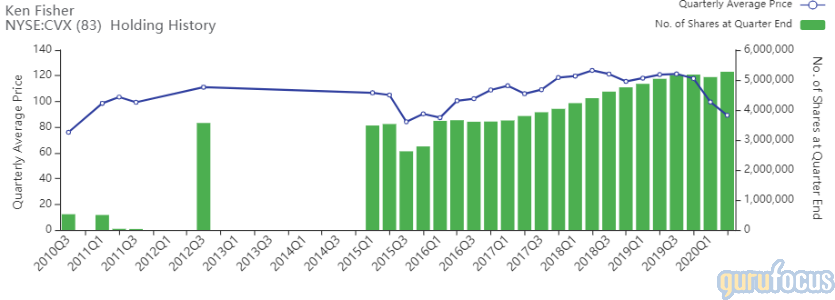

Chevron

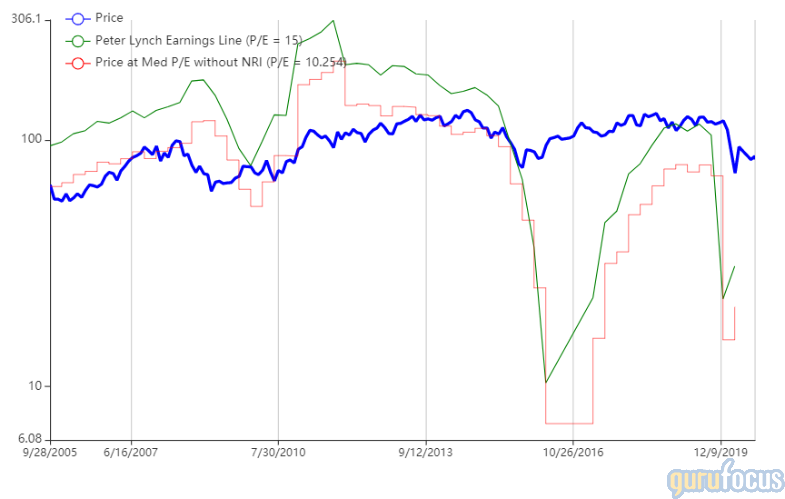

De Vaulx purchased 322,746 shares of Chevron, giving the position 1.47% equity portfolio weight. Shares averaged $89.20 during the second quarter.

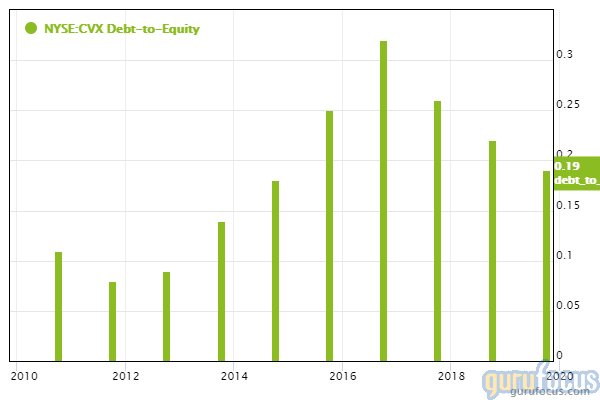

The San Ramon, California-based energy giant explores for, produces and refines oil and gas worldwide. GuruFocus ranks Chevron's financial strength 5 out of 10: Although the company's debt ratios outperform over 62% of global competitors, it has a weak Piotroski F-score of 3 and a low Altman Z-score of 2.48.

Gurus with large holdings in Chevron include Ken Fisher (Trades, Portfolio), Diamond Hill Capital (Trades, Portfolio) and Pioneer Investments (Trades, Portfolio).

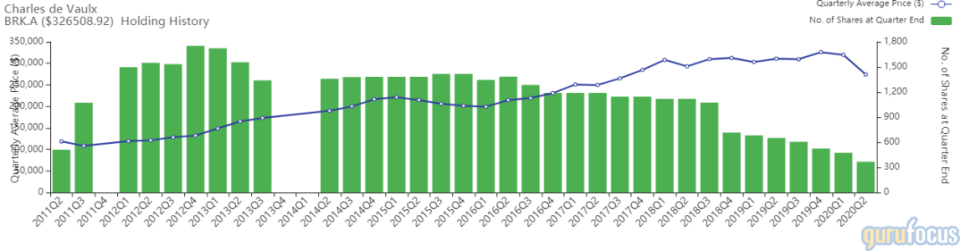

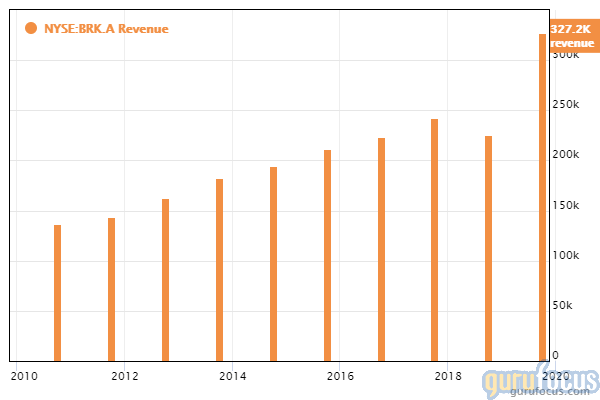

Berkshire Hathaway

De Vaulx sold 107 Class A shares of Berkshire Hathaway, reducing the holding 22.57% and the equity portfolio 1.29%. Shares of Warren Buffett (Trades, Portfolio)'s conglomerate averaged $274,087 during the second quarter.

The Omaha, Nebraska-based conglomerate operates several insurance businesses, including Geico, Berkshire Hathaway Reinsurance Group and Berkshire Hathaway Primary Group. The conglomerate seeks good companies at fair prices using a four-criterion approach to value investing.

GuruFocus ranks Berkshire's profitability 7 out of 10, driven by a three-star business predictability rank and a net profit margin that outperforms over 66% of global competitors.

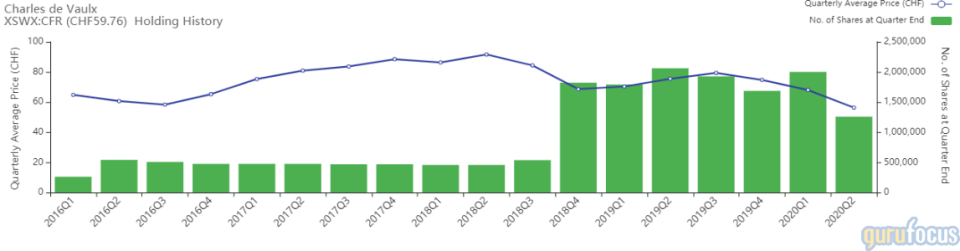

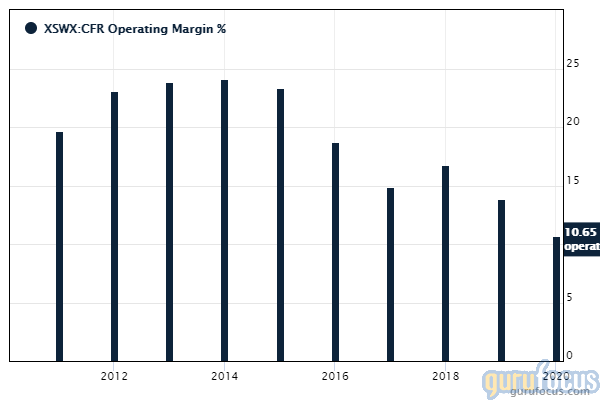

Cie Financiere Richemont

De Vaulx sold 743,175 shares of Cie Financiere Richemont, reducing the stake 37.16% and the equity portfolio 1.81%. Shares averaged 56.33 francs ($61.97) during the second quarter.

The Geneva, Switzerland-based company manufactures luxury jewelry through brands like Cartier and Van Cleef & Arpels. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a 3.5-star business predictability rank and profit margins that are outperforming over 83% of global competitors.

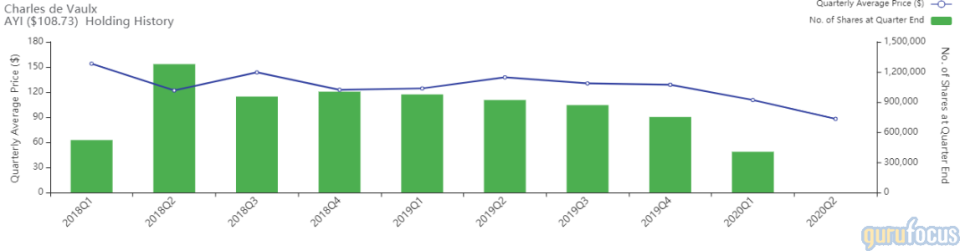

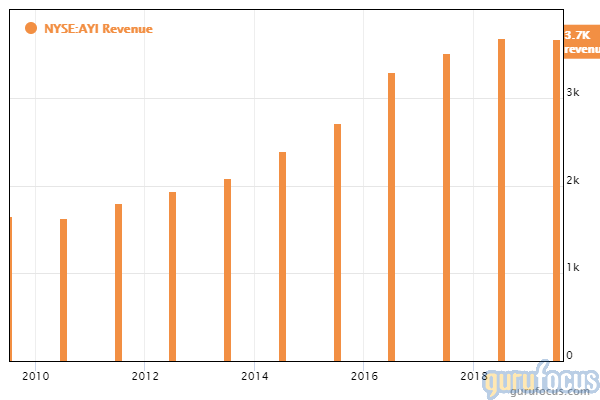

Acuity Brands

De Vaulx sold 405,429 shares of Acuity Brands, eliminating the holding and reducing the equity portfolio 1.54%. Shares averaged $87.94 during the second quarter.

The Atlanta-based company provides lighting products for commercial, institutional, industrial and residential appliances. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and returns that are outperforming over 83% of global competitors.

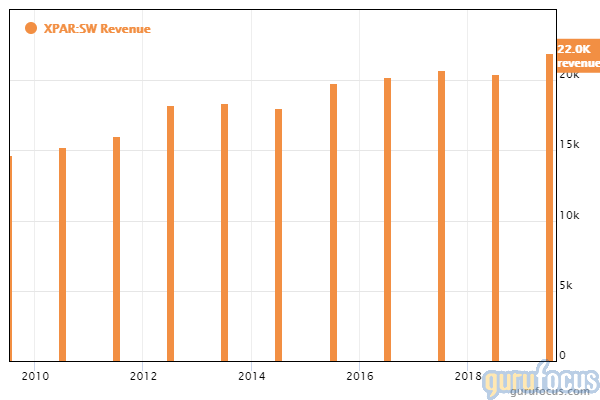

Sodexo

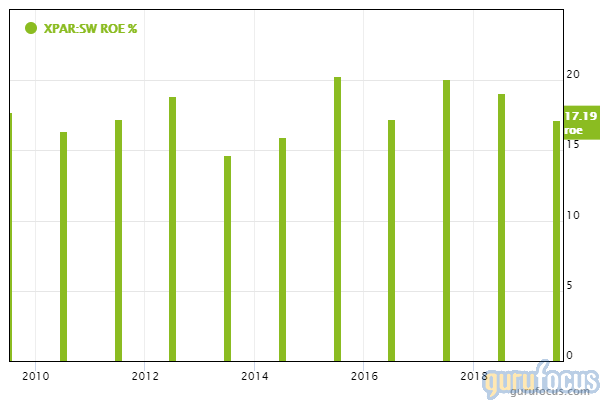

De Vaulx sold 471,076 shares of Sodexo, reducing the position 34.95% and the equity portfolio 1.42%. Shares averaged 64.04 euros ($76.32) during the second quarter.

GuruFocus ranks the French food service company's profitability 8 out of 10, driven by a 4.5-star business predictability rank and a return on equity that outperforms 81.52% of global competitors.

Disclosure: No positions.

Read more here:

Warren Buffett's Berkshire Plunges Into 5 Japanese Conglomerates

4 Buffett-Munger Stocks Ahead of Buffett's 90th Birthday

Warren Buffett's Top 5 Holdings as of the 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.