Chesapeake Energy Targeted for Six-Figure Bearish Options Bet

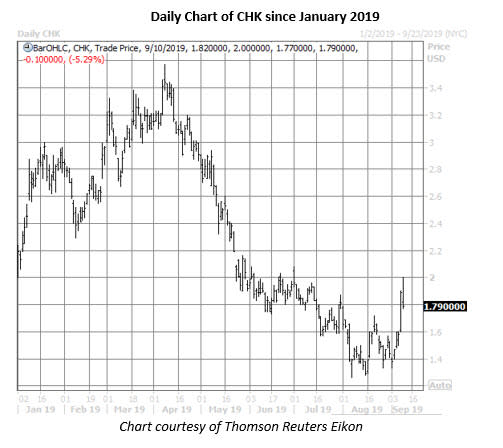

The shares of Chesapeake Energy Corporation (NYSE:CHK) surged 19.6% on Monday, amid rising natural gas prices. Today, CHK has turned lower -- down 5.3% at $1.79, after the company said it issued 250.7 million shares of common stock in exchange for senior notes and convertible preferred stock. The negative price action has sparked heavy action in Chesapeake's options pits, with volume running at four times the expected intraday pace.

By the numbers, roughly 59,000 puts and 49,000 calls have changed hands so far. The bulk of the activity has centered at the October 1.50 put, where it looks like a 39,000-contract block was likely bought to open for $331,500 (number of contracts * $0.085 premium paid * 100 shares per contract).

This is the most the put buyer stands to lose, should CHK settle above the strike at the close on Friday, Oct. 18, when the back-month series expires. Profit, meanwhile, will accumulate on a move below breakeven at $1.415 (strike less premium paid), with a CHK move all the way down to zero resulting in the maximum potential profit on the trade.

While this bet may have been made with bearish intentions, it's also possible a shareholder initiated the protective put to guard recently attained paper profits. Whatever the reason, short-term CHK options are pricing in elevated volatility expectations at the moment, per the stock's 30-day at-the-money implied volatility of 84%, which registers in the 84th annual percentile. This makes it harder for options buyers to benefit from leverage.

Options traders aren't the only ones chiming in on Chesapeake Energy stock today, with SunTrust Robinson Humphrey reinstating its $2 price target -- matching the consensus 12-month price target for CHK. Meanwhile, three covering analysts currently maintain a "buy" rating on the security, compared to 12 "holds," and 10 "sell" and "strong sell" recommendations.