Church & Dwight (CHD) Queued for Q2 Earnings: Things to Note

Church & Dwight Co., Inc. CHD is likely to register top-line growth, when it reports second-quarter 2021 numbers on Jul 30. The Zacks Consensus Estimate for revenues currently stands at $1,253 million, suggesting an increase of 4.9% from the prior-year quarter’s reported figure.

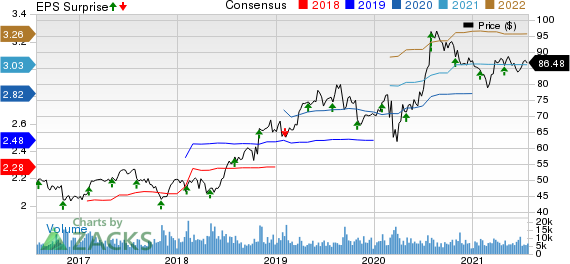

The Zacks Consensus Estimate for earnings has remained stable over the past 30 days at 70 cents per share, which suggests a decline of 9.1% from the figure reported in the prior-year period. The developer, manufacturer and marketer of household, personal care, and specialty products has a trailing four-quarter earnings surprise of 7.6%, on average. In the last reported quarter, Church & Dwight posted an earnings surprise of 3.8%.

Church & Dwight Co., Inc. Price, Consensus and EPS Surprise

Church & Dwight Co., Inc. price-consensus-eps-surprise-chart | Church & Dwight Co., Inc. Quote

Key Factors to Note

Church & Dwight has been gaining from solid demand for household and personal care products amid the pandemic-led higher at-home consumption. This has been boosting the company’s organic sales, which have been rising year over year for quite some time now. For the second quarter of 2021, organic sales are expected to have risen nearly 4%. Reported sales for the same period are likely to have advanced 4.5%.

The company on its last earnings call stated that it continues to expect elevated demand for categories like vitamins, laundry additives and cat litter, in 2021. Also, condoms, dry shampoo, power flossers and women's grooming items are likely to witness growth from the year-ago period level. Apart from these, Church & Dwight’s e-commerce sales have been playing a strong role amid the pandemic, backed by consumers’ accelerated online shopping preferences. These factors bode well for the quarter under review.

Church & Dwight has also been benefiting from its brand strength, courtesy of its regular innovation as well as gains from buyouts. To this end, the buyouts of FLAWLESS and WATERPIK have been prudent additions to Church & Dwight’s portfolio. Another noteworthy acquisition of the company includes Batiste. Also, in December 2020, the company took over Matrixx Initiatives, which owns the ZICAM brand.

That said, management stated that costs of raw materials and transportation started to escalate in the first quarter of 2021 due to the Texas freeze. Consequently, the company expects additional costs of $90 million for full-year 2021, which raises concerns over the quarter under review as well. However, this is likely to be partly negated by reduced coupons and promotions, along with the planned price hikes. Management expects a 350-basis-point contraction in gross margin in the second quarter due to elevated input costs and comparisons with low promotional levels last year. Adjusted earnings per share in the quarter are envisioned to be 69 cents, indicating a decline of 10.4% from the year-ago quarter’s reported figure. The downside includes an adverse impact related to a voluntary product recall. Also, it reflects increased marketing spend to support product introductions.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Church & Dwight this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Church & Dwight currently has a Zacks Rank #3 and an Earnings ESP of +0.32%.

Other Stocks With Favorable Combinations

Here are some other companies you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this season.

Mondelez International MDLZ has an Earnings ESP of +0.78% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medifast MED has an Earnings ESP of +7.27% and a Zacks Rank of 2.

Kellogg K has an Earnings ESP of +0.61% and a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research