Clorox: Now at a Much Lower Valuation

- By Nathan Parsh

Shares of The Clorox Co. (NYSE:CLX) have fallen more than 10% since I last looked at the stock. At that time, I felt that there were better options out there for those looking for income and value in the consumer staples sector. The company recently reported earnings results that were very strong and even raised estimates for the current fiscal year.

Following a review of the most recent report and taking into account the share price decline since my last discussion of the company, I find that there are reasons to be both optimistic and cautious when it comes to shares of Clorox.

Earnings highlights

Clorox reported earnings results for the second quarter of 2020 on Feb. 4 (the company's fiscal year ends June 30). The company continued to benefit from product demand related to Covid-19 as revenue grew 27% to $1.84 billion, topping Wall Street analysts' estimates by $92.4 million. Earnings per share improved 57 cents, or 39%, to $2.03, which was 28 cents ahead of expectations.

Organic sales for the quarter increased 26% while organic volumes grew 23%. Clorox saw double-digit sales growth in three out of four business segments.

Health and Wellness grew 42%. The cleaning business produced double-digit growth as the entire breadth of the product portfolio remains in high demand. This business is seeing an influx of new customers as it increases its household penetration while also seeing a higher level of repeat customers. Clorox is meeting demand by increasing its supply, which includes the opening of a new wipes plant during the third quarter.

Elsewhere in Health and Wellness, professional products continue to see strong demand for cleaning and disinfecting products. Clorox did note that health care facilities' demand is high, but commercial cleaning and food services remains weak due to social distancing restrictions. Vitamins, minerals and supplements was the lone business not to post growth.

The Household segment had revenue growth of 20% due to strength in grilling and litter product lines. Grilling benefited from higher than usual consumption amongst customers due to an overall increase in the number of at home meals consumed. This is the third straight quarter that grilling has seen a substantial benefit from Covid-19 as indoor dining remains limited in many areas of the country. More time spent at home has led to a growing demand for trash bags, wraps and food bags as well, which has aided Clorox's Glad product line.

Cat litter sales improved at a double-digit clip, supported by new products recently brought to market. Since the beginning of the pandemic, more people have become pet owners then ever before, leading to higher sales in the pet-related areas.

Revenue for the Lifestyle segment improved 9%. Brita sales remain quite strong, posting its fourth consecutive quarter of double-digit growth. The company noted that once customers purchase a Brita pitcher, they tend to stay within the brand family. Dry seasoning and bottle dressings for the Hidden Valley Ranch portfolio continue to see improved rates of household penetration. Lip balm sales were lower overall, with Burt's Bees declining due to lower mall and convenience store traffic.

The International segment, which contributes around 15% of total sales, grew 23% due to gains made in all major regions. Clorox recently purchased a majority stake in a joint venture in Saudi Arabia, which added 9% to results for this segment. The joint venture added 1% overall to tip-line totals. Currency translation was a 4% headwind for the segment.

Better volumes combined with cost savings programs and lower promotion spending helped drive a 130-basis point expansion of gross margins to 45.4%. This is the ninth consecutive quarter for year-over-year gross margin improvements for the company. Despite a 420-basis point headwind from higher manufacturing and logistics costs, Clorox's selling, general and administrative expenses only increased 10 basis points to 14.6% for the quarter. While Clorox has benefited from increased demand related to Covid-19, this track record of gross margin expansion is evidence that the company had been controlling costs well prior to the pandemic.

Clorox's balance sheet appears well equipped to handle any major obstacles. Total assets equaled $6.9 billion as of the most recent quarter, including $732 million in cash and cash equivalents. Inventory has climbed to $616 million from $534 million sequentially, but this likely isn't a major issue given the demand for the company's products. Total liabilities were $5.5 billion, with current liabilities of $1.7 billion. The company does have total debt of almost $3.2 billion, of which just $361 million is due within the next year. Year to date, operating cash flow has increased 26% to $629 million.

The company also provided guidance for the remainder of the fiscal year. Organic sales are now expected to grow 10% to 13% from the prior year, up from the previous forecast of 5% to 9%. Earnings per share are projected in a range of $8.05 to $8.25, up from $7.70 to $7.95 previously and ahead of consensus estimates of $8.12. At the midpoint, earnings per share growth would be nearly 11%, which compares favorably to Clorox's five-year earnings compound annual growth rate of 8.4%.

Final thoughts

Clorox's second quarter was excellent as the company produced its third straight quarter of over 24% organic growth and fourth consecutive quarter of high double-digit growth.

Three out of four segments had double-digit organic growth as demand for products was higher almost across the board. Much of this demand was related to the Covid-19 pandemic, which appears likely to be an issue for quite some time. Vaccines continue to be administered, but the U.S. just marked its 500,000 Covid-19 related death. The market for cleaning and disinfecting supplies is likely to remain robust for as long as the virus is present. And as the company noted, they are seeing new customers turn into repeat customers at a high rate, which could lead to continued usage even after a recovery from the pandemic.

Social distancing restrictions have been eased in certain parts of the U.S., but indoor dining, schools and many businesses remain under various levels of constraint. This should provide support for non-cleaning supplies, such as grilling items and garbage bags, as consumers still consume more meals and spend more time at home.

In addition, Clorox is a very shareholder-friendly company, having raised its dividend for 46 consecutive years, making it a member of the dividend aristocrats. The company's dividend has compounded at an annual rate of 6.5% over the last decade. Most recently, Clorox raised its dividend by 10.4%. Shares yield 2.4% as of Friday's closing price. The current yield is below the stock's 10-year average yield of 3%, but represents a superior level of income than the average yield of 1.5% for the S&P 500.

The last time I discussed Clorox, I noted shares were trading at more than 30 times expected earnings for the year. A double-digit decline in share price in combination with higher-than-expected earnings per share for the year has lowered the forward multiple to 22.8. This is nearly in line with the price-earnings ratio of 22 that the stock has averaged since 2010.

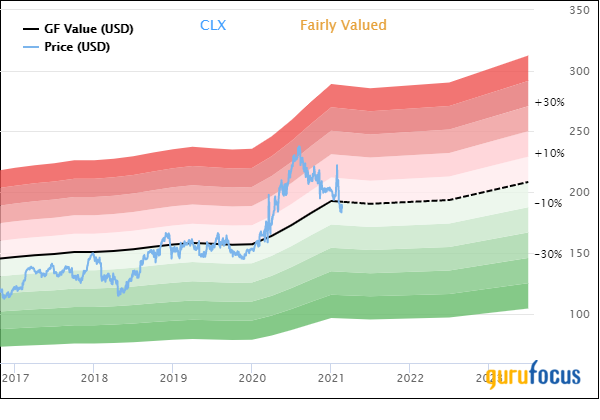

GuruFocus believes the stock to be trading slightly below its intrinsic value.

With a current share price of $185.77 and a GF Value of $192.08, Clorox has a price-to-GF Value of 0.97, earning the stock a rating of fairly valued from GuruFocus. Reaching its GF Value would reward shareholders with a return of 3.4%. Factoring in the dividend yield and total returns would be almost 6%.

While I find Clorox to be much better valued today then it was in early June, there are some headwinds investors should keep in mind.

The company does expect organic growth to be in the double-digit range for the year, but the second half is projected to be flat. The reasoning is due to the 17% and 24% organic growth rates produced, respectively, in the third and fourth quarters. It was during these quarters that Clorox really began to see the first tailwinds from the Covid-19 pandemic. Clorox is simply facing tough comparisons to the previous periods.

Given how well the company performed during this time, an expectation for flat organic growth is impressive in its own right. Looking into the company's guidance, it is clear that they expect demand to be on par with what occurred in the second half of the previous fiscal year.

I am now much more bullish on Clorox than I was in June of last year, simply due to a combination of the company's continued performance and the stock's valuation. Clorox does face tough comparisons in the third and fourth quarters of fiscal 2021, but the company appears to believe that Covid-19-related demand should remain resilient until the end of the year.

For investors looking for more growth, Clorox might not be the best purchase as it trades just above its long-term valuation and offers just a mid-single-digit return based on its GF Value.

Those looking for income should find its market-beating yield and four-plus decades of dividend growth quite appealing. For those investors, Clorox could be a solid addition to their portfolio.

Disclosure: The author has no positions in any stocks mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.