Will Colgate's (CL) Growth Strategies Aid Amid Cost Woes?

Colgate-Palmolive Company CL is well-poised on innovation, brand strength and digital capabilities. The company continues to gain from its stringent pricing actions and accelerated revenue growth management plans. Revenue growth management initiatives led to double-digit pricing gains worldwide in third-quarter 2022. This led to impressive organic sales growth in third-quarter 2022.

Colgate’s third-quarter 2022 organic sales reflected gains from robust pricing actions and revenue management initiatives. Organic sales grew for the 15th successive quarter, with improvements in all divisions and categories. Innovation, brand strength and digital capabilities drove organic sales growth, with double-digit growth in oral care and pet nutrition in the third quarter.

Colgate remains on track with its efforts to improve product availability through enhanced distribution to newer markets and channels. However, the company is not immune to higher raw material and logistics costs worldwide, and unfavorable currency issues.

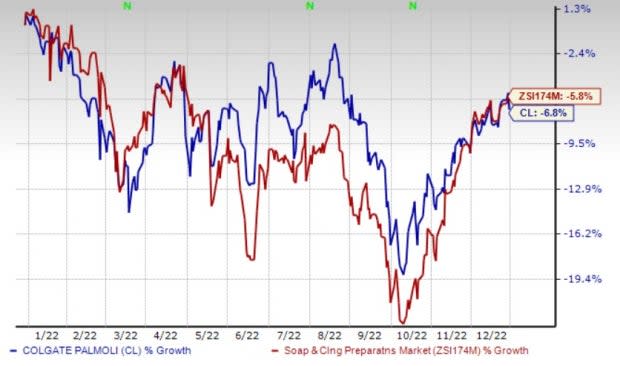

Shares of Colgate have declined 6.8% in the past year compared with the industry’s fall of 5.8%. The Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company’s current financial year’s sales suggests growth of 2.6% from the year-ago reported number, while earnings estimates indicate a decline of 7.5%.

Image Source: Zacks Investment Research

What’s Working Well for CL?

Innovation and in-store implementation have been the guiding principles for Colgate’s growth strategy over the years. The company’s innovation strategy is focused on growing in adjacent categories and product segments. It is also focused on the premiumization of its Oral Care portfolio through major innovations. Backed by premium innovation, products, including CO. by Colgate, Colgate Elixir toothpaste, and Colgate enzyme whitening toothpaste, have been performing well.

Its innovation efforts are highlighted by the continued expansion of the Naturals and Therapeutics divisions, as well as the Hello Products LLC buyout. The company recently partnered with Philips to introduce electric toothbrushes in Latin America, where the use of electric toothbrushes is low. The long-term deal will bring together the world’s number one oral care brand and number one manufacturer of sonic toothbrushes under a co-brand, namely Philips Colgate. The product line will come with a variety of electric toothbrushes at different prices. The new brand will be available in limited countries in the said region.

Expanding the availability of products through enhanced distribution to newer markets and channels is one of Colgate’s priorities to improve organic sales. The company is aggressively expanding into faster growth channels, while extending the geographic footprint of its brands. In 2019, the company expanded its portfolio by introducing pharmacy brands like elmex and meridol to newer markets. It remains impressed with the performance of professional skincare businesses — Elta MD and PCA Skin — in spas and dermatologists.

The company expanded its premium skincare portfolio with the buyout of the Filorga skincare business. Colgate is witnessing strong market share gains in North America and China, its two largest markets, with increased share gains across all other regions.

Management raised its organic sales guidance for 2022. The company anticipates net sales growth in the middle of the previously mentioned 1-4% rise. This includes a modest benefit from the Red Collar acquisition. Organic sales are expected to increase 6-7% compared with 5-7% growth mentioned earlier. Advertising investments are expected to be nearly flat year over year (on a dollar basis) on both GAAP and adjusted basis for 2022. Advertising, as a percentage of net sales, is expected to be down slightly for 2022, driven by reductions in Europe.

The company expects a tax rate of 23.5-24% for 2022 on a GAAP and adjusted basis. It anticipates earnings growth in double-digits on a GAAP basis for 2022. For the fourth quarter, the company anticipates the production of pet food for Red Collar to add 200 bps to net sales and be neutral to earnings per share.

Headwinds to Overcome

Despite sales growth, the company has been witnessing higher raw material and logistics costs worldwide, which dented the bottom-line performance in third-quarter 2022. Colgate’s Base Business (non-GAAP) earnings declined 9% year over year, while GAAP earnings were down 1%.

Increases in raw and packaging material and logistic costs, as well as volatile currency, hurt Colgate’s third-quarter gross margin. Although the company expects to witness reduced impacts of logistic-related headwinds on a sequential basis, it expects logistic costs to increase year over year in the fourth quarter. For the fourth quarter, the company anticipates the production of pet food for Red Collar to have a 100-bps negative impact on the gross margin. Colgate expects a gross margin decline on both GAAP and adjusted basis for 2022.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely, e.l.f. Beauty ELF, Inter Parfums IPAR and Clorox CLX.

e.l.f. Beauty currently flaunts a Zacks Rank of 1 (Strong Buy) and has an expected long-term earnings growth rate of 26.7%. ELF has a trailing four-quarter earnings surprise of 92.8%, on average. The company has rallied 70.4% in the past year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ELF’s current financial-year sales and earnings suggests growth of 24.6% and 33.3%, respectively, from the prior-year reported numbers. The consensus mark for ELF’s earnings per share has been unchanged in the past 30 days.

Inter Parfums currently sports a Zacks Rank #1 and has an expected long-term earnings growth rate of 15%. IPAR has a trailing four-quarter earnings surprise of 27.8%, on average. The company has declined 8.9% in the past year.

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales and earnings per share suggests growth of 16.6% and 23.6%, respectively, from the year-ago reported numbers. The consensus mark for IPAR’s earnings per share has been unchanged in the past 30 days.

Clorox currently carries a Zacks Rank #2 (Buy). CLX has a trailing four-quarter earnings surprise of 11.2%, on average. The company has declined 17.4% in the past year. CLX has an expected long-term earnings growth rate of 11.6%.

The Zacks Consensus Estimate for Clorox’s current financial year’s sales suggests a decline of 0.8% from the year-ago reported number, while the same for earnings per share indicates growth of 0.2%. The consensus mark for CLX’s earnings per share has moved down by a penny in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ColgatePalmolive Company (CL) : Free Stock Analysis Report

The Clorox Company (CLX) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report