Cross-Sector: Market Data Highlights

CROSS-SECTOR

DATA REPORT

11 February 2021

CLIENT SERVICES

Americas

1-212-553-1653

Asia Pacific

852-3551-3077

Japan

81-3-5408-4100

EMEA

44-20-7772-5454

Cross-Sector

Market Data Highlights

The latest market data from Weekly Market Outlook. Click

for access to the full WMO.

SPREADS

0

200

400

600

800

0

200

400

600

800

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Spread (bp)

Spread (bp)

Aa2

A2

Baa2

Source: Moody's

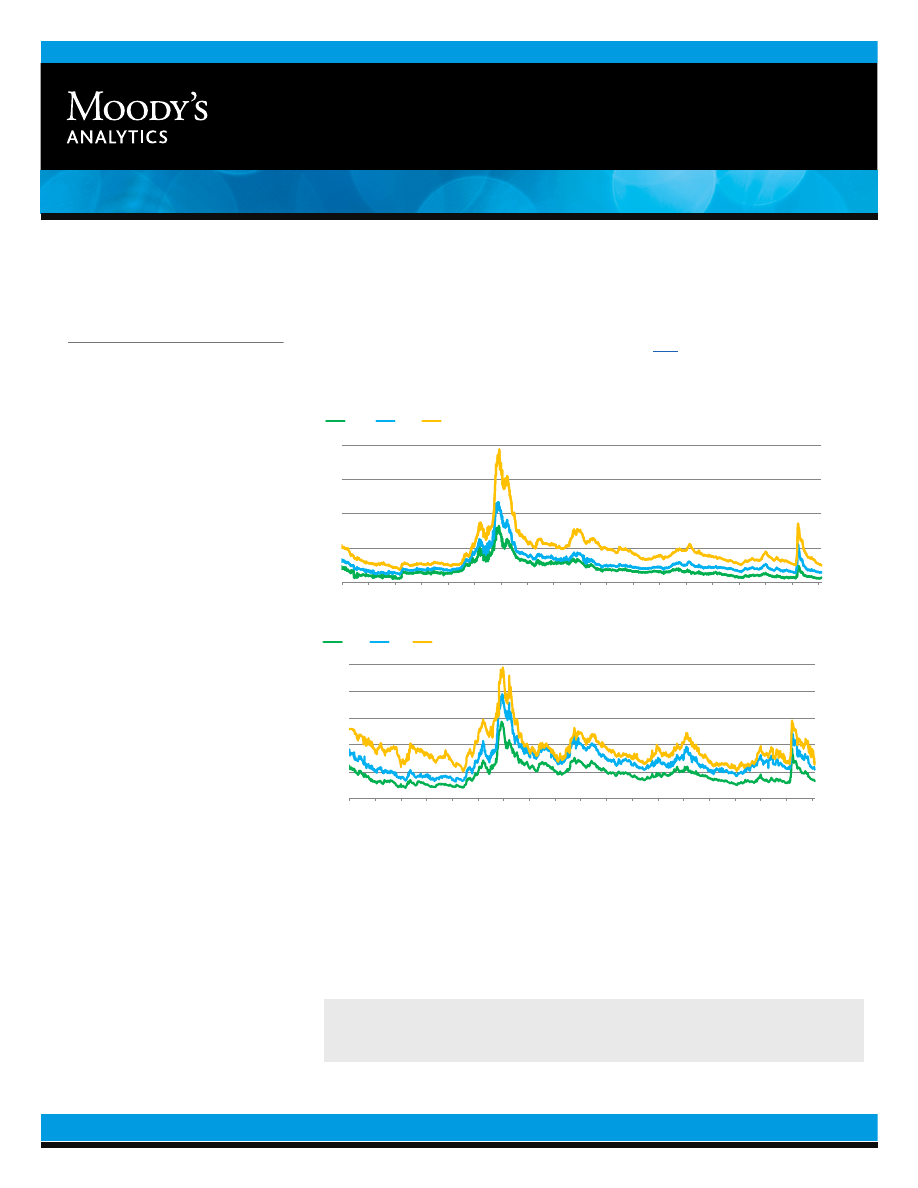

Figure 1: 5-Year Median Spreads-Global Data (High Grade)

0

400

800

1,200

1,600

2,000

0

400

800

1,200

1,600

2,000

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Spread (bp)

Spread (bp)

Ba2

B2

Caa-C

Source: Moody's

Figure 2: 5-Year Median Spreads-Global Data (High Yield)

Moody’s Analytics markets and distributes all Moody’s Capital Markets Research, Inc. materials. Moody’s Capital Markets

Research,Inc. is a subsidiary of Moody’s Corporation. Moody’s Analytics does not provide investment advisory services or

products. For further detail, please see the last page.

MOODY'S ANALYTICS

CROSS-SECTOR

CDS MOVERS

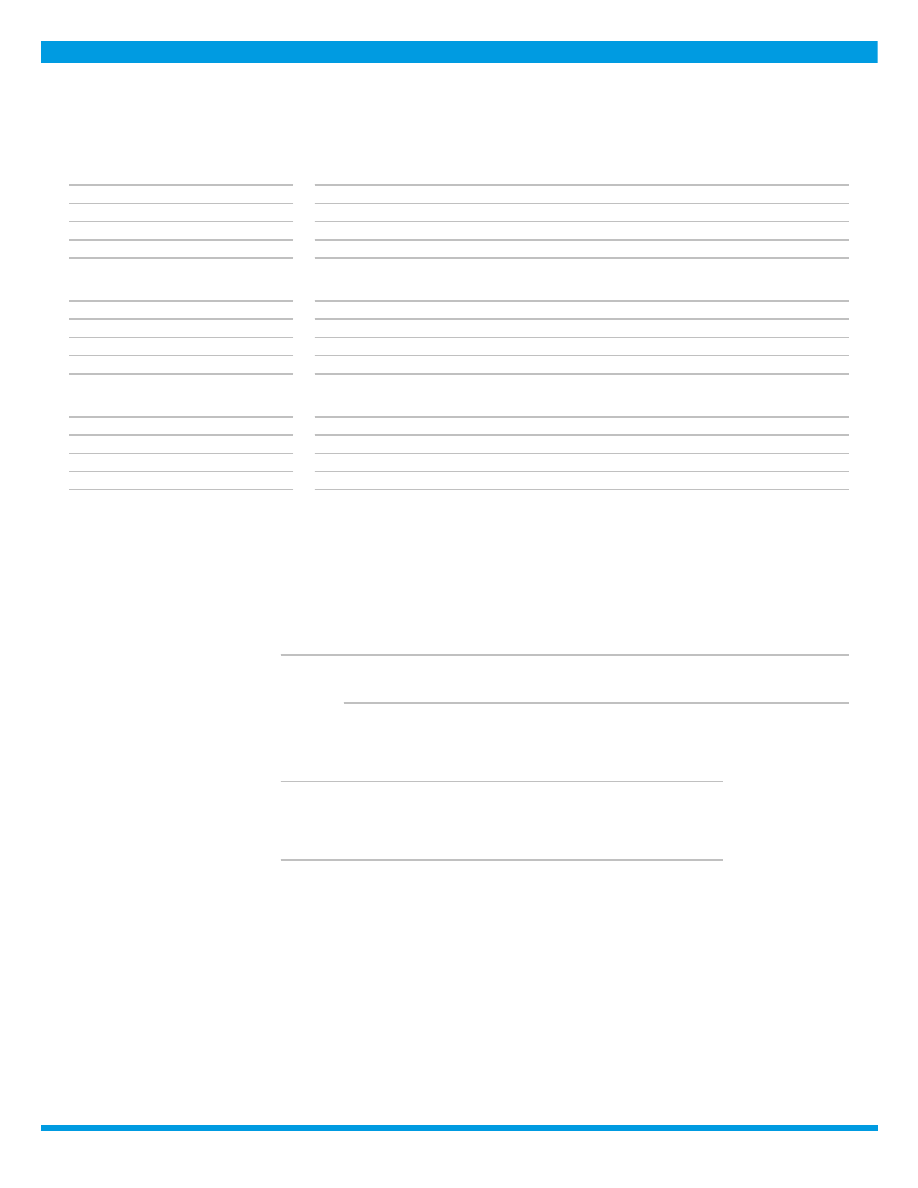

CDS Implied Rating Rises

Issuer

Feb. 10

Feb. 3

Senior Ratings

American Express Credit Corporation

Aa2

A1

A2

Burlington Resources LLC

Aa3

A2

A3

Ford Motor Credit Company LLC

Ba2

Ba3

Ba2

International Business Machines Corporation

A2

A3

A2

Occidental Petroleum Corporation

B3

Caa1

Ba2

NextEra Energy Capital Holdings, Inc.

Baa1

Baa2

Baa1

Sempra Energy

A2

A3

Baa2

Southwest Airlines Co.

Baa3

Ba1

Baa1

Pioneer Natural Resources Company

Baa2

Baa3

Baa2

Eastman Chemical Company

Baa1

Baa2

Baa3

CDS Implied Rating Declines

Issuer

Feb. 10

Feb. 3

Senior Ratings

International Paper Company

A2

Aa3

Baa2

Entergy Corporation

Aa3

Aa1

Baa2

Verizon Communications Inc.

Baa2

Baa1

Baa1

John Deere Capital Corporation

Baa2

Baa1

A2

Exxon Mobil Corporation

A2

A1

Aa1

Merck & Co., Inc.

Aa3

Aa2

A1

Union Pacific Corporation

Aa1

Aaa

Baa1

General Motors Company

Ba1

Baa3

Baa3

Cox Communications, Inc.

Baa1

A3

Baa2

Waste Management, Inc.

Baa2

Baa1

Baa1

CDS Spread Increases

Issuer

Senior Ratings

Feb. 10

Feb. 3

Spread Diff

United States Steel Corporation

Caa2

441

401

41

Nordstrom, Inc.

Baa3

291

273

18

DPL Inc.

Ba1

353

336

18

Commercial Metals Company

Ba2

293

277

16

First Industrial, L.P.

Baa2

245

232

13

Univision Communications Inc.

Caa2

433

422

11

Pactiv Corporation

Caa1

293

282

11

Entergy Corporation

Baa2

38

30

9

Service Corporation International

Ba3

164

156

8

JetBlue Airways Corp.

Ba3

555

547

8

CDS Spread Decreases

Issuer

Senior Ratings

Feb. 10

Feb. 3

Spread Diff

Nabors Industries , Inc.

Caa2

1,037

1,257

-220

K. Hovnanian Enterprises, Inc.

Caa3

933

1,138

-205

United Airlines Holdings, Inc.

Ba3

497

577

-79

Murphy Oil Corporation

Ba3

425

481

-56

Occidental Petroleum Corporation

Ba2

297

351

-54

L Brands, Inc.

B2

187

227

-40

Goodyear Tire & Rubber Company (The)

B2

257

297

-40

Ford Motor Credit Company LLC

Ba2

164

202

-39

Talen Energy Supply, LLC

B3

1,069

1,108

-39

American Axle & Manufacturing , Inc.

B2

360

398

-38

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

Figure 3. CDS Movers - US ( February 3, 2021 February 10, 2021)

2 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

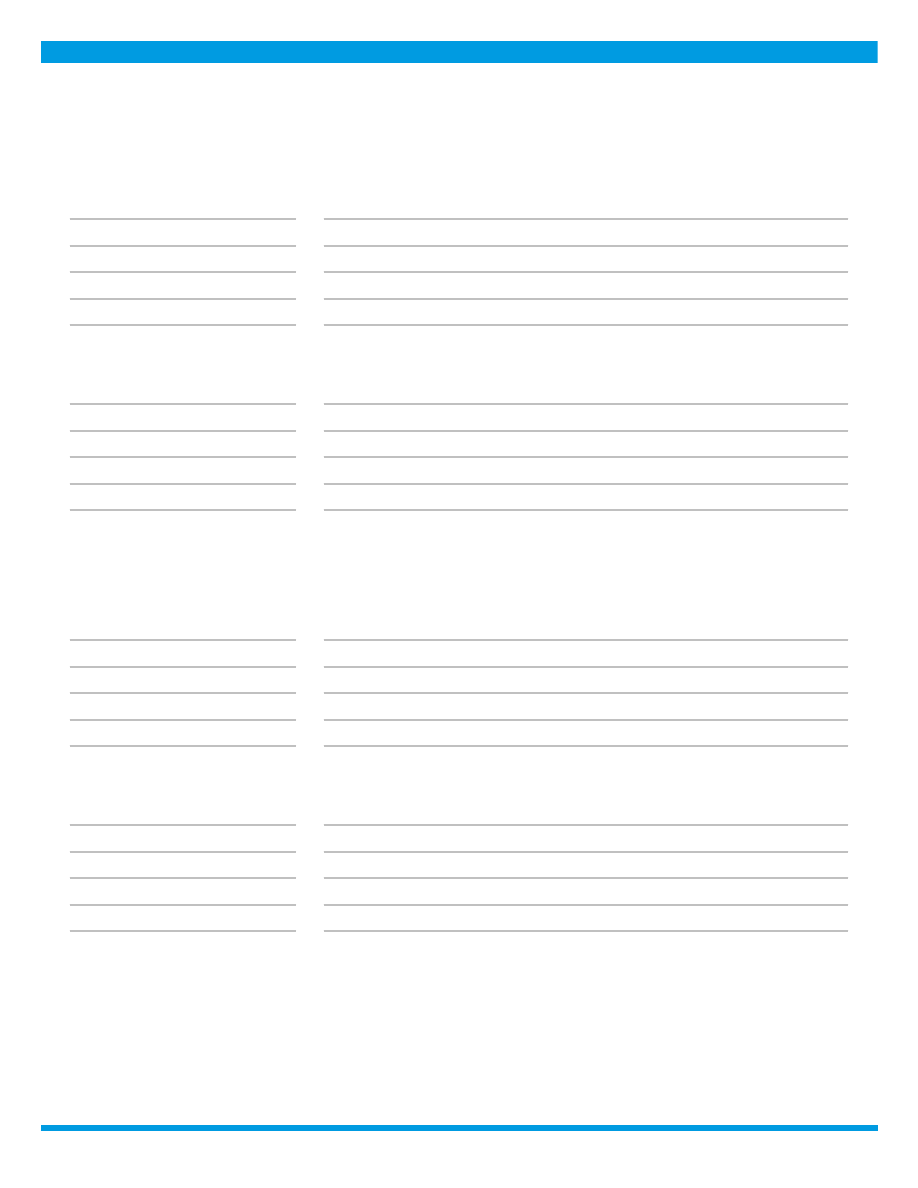

CDS Implied Rating Rises

Issuer

Feb. 10

Feb. 3

Senior Ratings

Spain , Government of

Aa2

A1

Baa1

Natixis

Aa1

Aa2

A1

UniCredit Bank AG

Aa1

Aa2

A2

Swedbank AB

Aa1

Aa2

Aa3

Vodafone Group Plc

A3

Baa1

Baa2

Total SE

Aa1

Aa2

Aa3

Bayerische Motoren Werke Aktiengesellschaft

A2

A3

A2

SEB AB

Aa1

Aa2

Aa2

Volkswagen Aktiengesellschaft

Baa2

Baa3

A3

HSBC Bank plc

Aa1

Aa2

A1

CDS Implied Rating Declines

Issuer

Feb. 10

Feb. 3

Senior Ratings

Landesbank Hessen-Thueringen GZ

Baa2

Baa1

Aa3

Anheuser-Busch InBev SA /NV

Baa1

A3

Baa1

KBC Bank N.V.

Aa2

Aa1

Aa3

Banca Monte dei Paschi di Siena S.p.A .

Ba3

Ba2

Caa1

FCE Bank plc

Ba3

Ba2

Ba2

Credit Suisse AG

A2

A1

Aa3

Atlantia S.p.A .

Ba3

Ba2

Ba3

Bank of Scotland plc

A2

A1

A1

National Bank of Greece S.A.

B3

B2

Caa1

Ardagh Packaging Finance plc

B1

Ba3

Caa1

CDS Spread Increases

Issuer

Senior Ratings

Feb. 10

Feb. 3

Spread Diff

Deutsche Lufthansa Aktiengesellschaft

Ba2

313

300

13

Sappi Papier Holding GmbH

Ba2

354

341

13

Permanent tsb p.l.c.

Baa2

220

211

9

Alpha Bank AE

Caa1

423

417

7

Boparan Finance plc

Caa1

586

581

5

Stena AB

Caa1

633

627

5

EWE AG

Baa1

110

106

4

3i Group plc

Baa1

97

93

4

Stagecoach Group Plc

Baa3

80

76

4

Anheuser-Busch InBev SA /NV

Baa1

49

46

3

CDS Spread Decreases

Issuer

Senior Ratings

Feb. 10

Feb. 3

Spread Diff

TUI AG

Caa1

730

765

-35

Novafives S.A.S .

Caa2

882

916

-34

Iceland Bondco plc

Caa2

337

370

-32

Casino Guichard-Perrachon SA

Caa1

585

613

-28

CMA CGM S.A.

Caa1

408

427

-19

Telecom Italia S.p.A .

Ba2

159

174

-14

Jaguar Land Rover Automotive Plc

B1

387

401

-14

Ziggo Bond Company B.V.

B3

198

210

-12

RCI Banque

Baa2

172

182

-10

Avon Products, Inc.

B1

214

224

-10

Source: Moody's, CMA

CDS Spreads

CDS Implied Ratings

CDS Implied Ratings

CDS Spreads

Figure 4. CDS Movers - Europe ( February 3, 2021 February 10, 2021)

3 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

ISSUANCE

0

700

1,400

2,100

2,800

0

700

1,400

2,100

2,800

Jan Feb Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Issuance ($B)

Issuance ($B)

2018

2019

2020

2021

Source:

Moody's / Dealogic

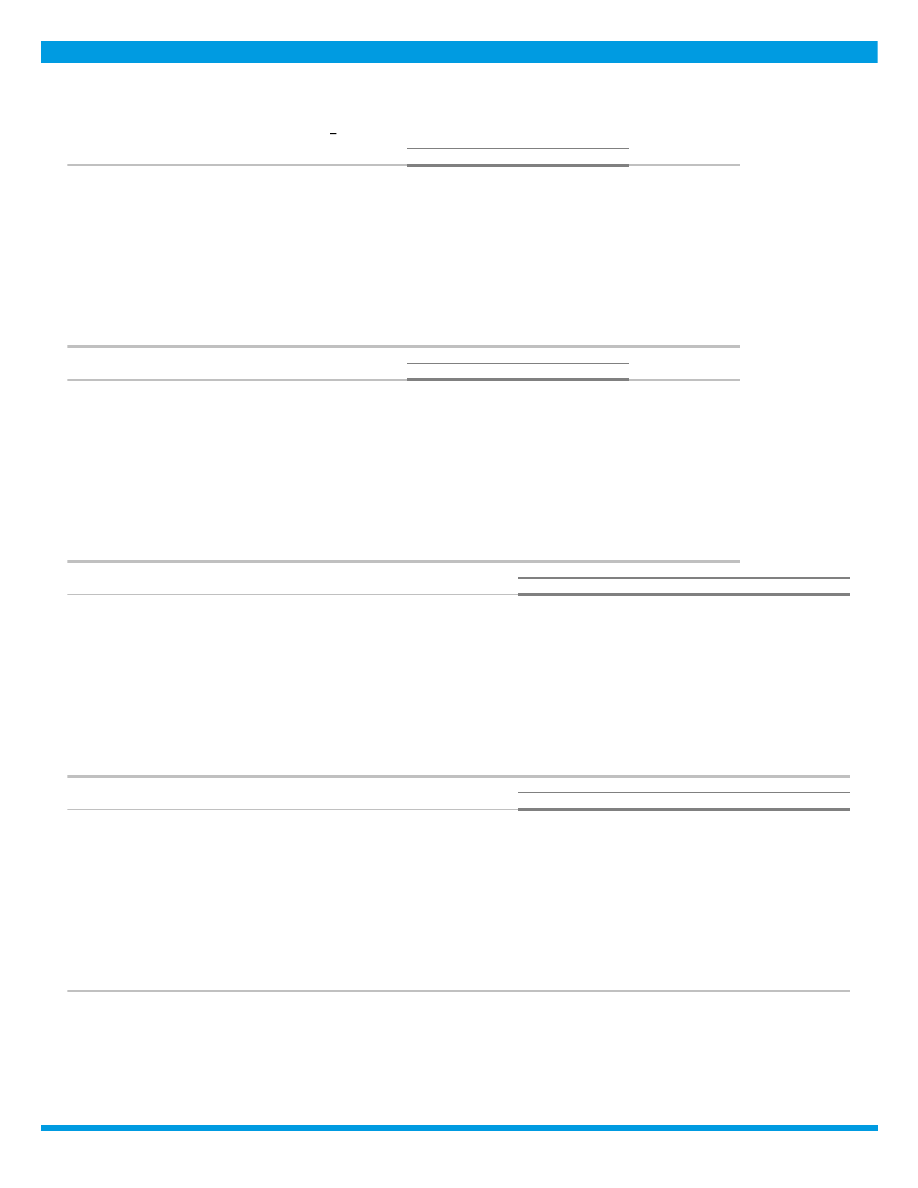

Figure 5. Market Cumulative Issuance - Corporate & Financial Institutions: USD Denominated

0

200

400

600

800

1,000

0

200

400

600

800

1,000

Jan Feb Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Issuance ($B)

Issuance ($B)

2018

2019

2020

2021

Source:

Moody's / Dealogic

Figure 6. Market Cumulative Issuance - Corporate & Financial Institutions: Euro Denominated

4 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Investment-Grade

High-Yield

Total*

Amount

Amount

Amount

$B

$B

$B

Weekly

53.769

11.219

67.127

Year-to-Date

211.396

89.171

311.011

Investment-Grade

High-Yield

Total*

Amount

Amount

Amount

$B

$B

$B

Weekly

16.197

2.791

20.558

Year-to-Date

91.574

20.156

114.651

* Difference represents issuance with pending ratings.

Source: Moody's/ Dealogic

USD Denominated

Euro Denominated

Figure 7. Issuance: Corporate & Financial Institutions

EMERGING MARKET CREDIT SPREADS

Emerging Market

Duration

A

Baa

Ba

B

A

Baa

Ba

B

>=1 and <3

63

102

267

408

74

130

59

48

>=3 and <5

82

133

270

414

65

124

47

47

>=5 and <7

104

157

313

471

48

85

28

17

>=7

121

210

347

541

116

212

55

38

Emerging Market Sovereign

Duration

A

Baa

Ba

B

A

Baa

Ba

B

>=1 and <3

28

64

118

342

16

33

16

20

>=3 and <5

44

82

193

404

16

35

22

28

>=5 and <7

94

115

265

477

15

35

19

16

>=7

71

179

333

537

68

108

46

37

Emerging Market Corporate

Duration

A

Baa

Ba

B

A

Baa

Ba

B

>=1 and <3

71

116

289

455

58

97

43

28

>=3 and <5

89

147

304

474

49

89

25

19

>=5 and <7

111

186

411

315

33

50

9

1

>=7

155

235

573

683

48

104

9

1

Source: Moody's

Median Spreads

Bond Counts

Median Spreads

Bond Counts

Figure 8. Emerging Market Median OAS

Bond Counts

Median Spreads

5 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

0

600

1,200

1,800

2,400

0

600

1,200

1,800

2,400

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Spread (bp)

Spread (bp)

A

Baa

Ba

B

Source: Moody's

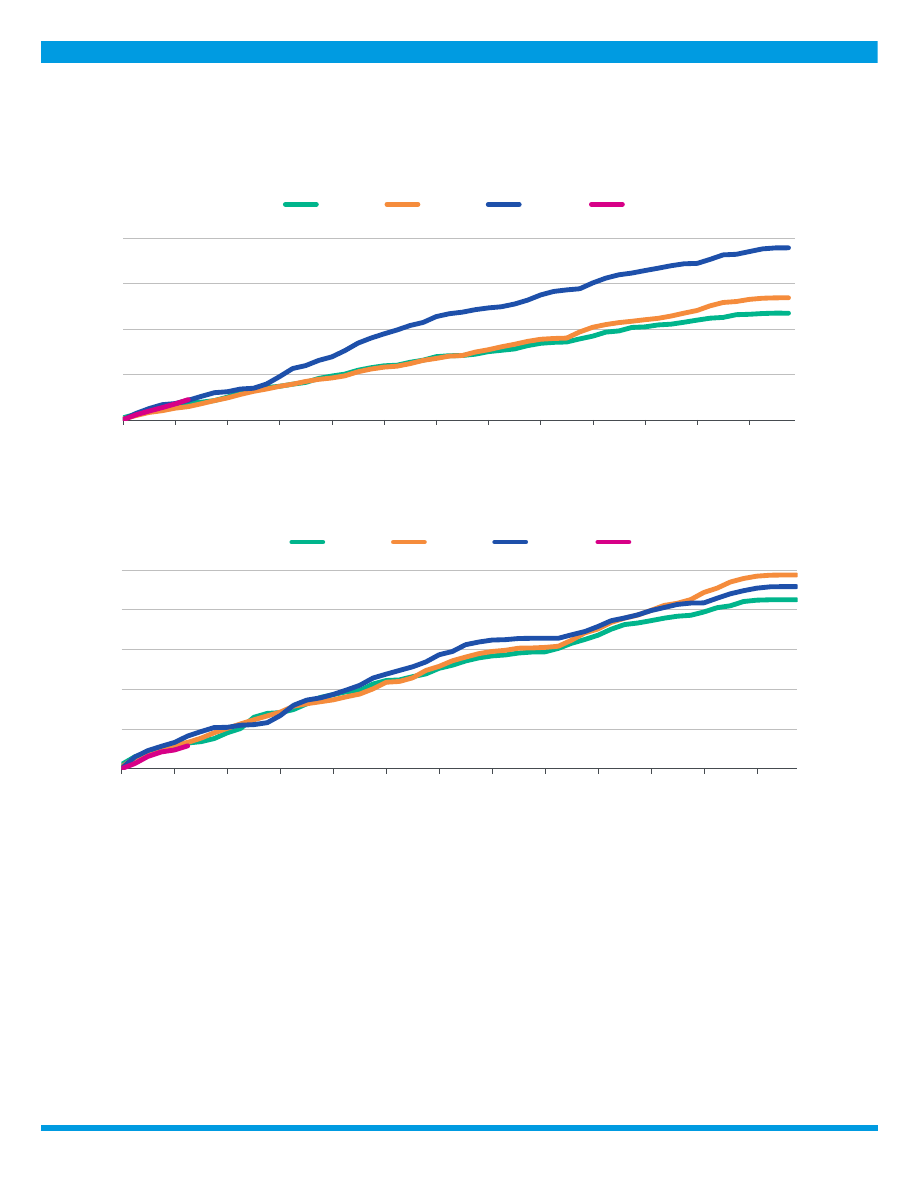

Figure 9: Emerging Markets Median Credit Spreads (3-5 year duration)

MEDIAN CREDIT SPREADS

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

4

26

38

68

215

421

516

>=3 and <5

8

35

49

100

264

479

500

>=5 and <7

23

30

68

122

285

342

-

>=7

34

35

108

164

208

-

405

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

377

260

446

291

77

27

6

>=3 and <5

206

163

373

295

68

14

3

>=5 and <7

94

117

217

149

18

2

-

>=7

99

277

416

245

13

-

2

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

25

79

174

165

48

24

6

>=3 and <5

27

74

160

165

39

14

3

>=5 and <7

23

56

102

91

13

2

-

>=7

29

89

155

117

10

-

1

Source: Moody's

Figure 10. Global Financial Institutions Median Credit Spreads

Median Spreads

Debt Counts

Issuer Counts

6 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

9

27

34

54

256

388

516

>=3 and <5

26

39

44

67

264

421

592

>=5 and <7

22

48

59

93

285

384

681

>=7

53

106

119

158

317

470

575

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

39

136

559

893

355

267

64

>=3 and <5

33

126

503

986

291

198

61

>=5 and <7

21

90

416

829

152

70

14

>=7

34

292

1428

1979

198

32

8

Duration

Aaa

Aa

A

Baa

Ba

B

Caa

>=1 and <3

10

57

268

503

254

204

53

>=3 and <5

6

52

266

566

192

160

56

>=5 and <7

8

41

229

482

104

61

13

>=7

7

55

350

589

84

14

6

Source: Moody's

Issuer Counts

Figure 11. Global Corporate Median Credit Spreads

Median Spreads

Debt Counts

MEDIAN 5-YEAR CDS SPREADS

Global Median Spreads by Fine Rating Category

Aaa

Aa1

Aa2

Aa3

A1

A2

A3

Baa1

Baa2

19

26

36

38

39

41

45

49

54

Baa3

Ba1

Ba2

Ba3

B1

B2

B3

Caa

78

112

162

189

220

257

307

511

Global Median Spreads by Broad Rating Category

Aaa

Aa

A

Baa

Ba

B

Caa

22

36

41

54

162

257

437

Global Issuer Counts by Broad Rating Category

Aaa

Aa

A

Baa

Ba

B

Caa

9

54

171

344

99

47

31

Source: Moody's, CMA

Figure 12. Global Median CDS Spreads By Rating Category

7 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

22

36

38

62

152

255

395

Europe

10

27

38

54

121

210

552

Asia Pacific (ex.Japan)

14

22

35

61

163

357

-

Japan

-

-

24

29

51

70

-

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

3

20

85

210

60

34

14

Europe

6

34

81

122

28

10

15

Asia Pacific (ex.Japan)

3

18

31

35

5

2

-

Japan

-

-

35

13

3

1

-

Source: Moody's, CMA

Issuer Counts

Figure 13. Median CDS Spreads By Region

Median CDS Spreads

Sector

Aaa

Aa

A

Baa

Ba

B

Caa

Corporates

23

30

35

58

154

240

497

Financials

11

27

35

59

157

366

376

Sovereigns

11

14

32

47

90

366

-

Banks

-

27

37

59

170

-

330

Sector

Aaa

Aa

A

Baa

Ba

B

Caa

Corporates

4

25

153

324

88

49

25

Financials

8

47

84

68

19

1

6

Banks

-

35

53

29

10

-

5

Sovereigns

8

6

4

6

3

1

-

Source: Moody's, CMA

Figure 14. Global Median CDS Spreads by Sector

Median CDS Spreads

Issuer Counts

8 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

11

40

42

70

164

-

639

Europe

10

27

40

57

129

-

330

Asia Pacific (ex.Japan)

14

22

34

59

90

366

-

Japan

-

-

25

39

-

-

-

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

1

8

22

24

7

-

1

Europe

5

26

38

27

6

-

5

Asia Pacific (ex.Japan)

2

13

13

13

3

1

-

Japan

-

-

11

2

-

-

-

Source: Moody's, CMA

Figure 15. Global Financial Institutions Median CDS Spreads by Region

Median CDS Spreads

Issuer Counts

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

23

33

38

62

151

255

358

Europe

10

28

36

50

121

210

609

Asia Pacific (ex.Japan)

28

29

35

61

164

348

-

Japan

-

-

24

27

51

70

-

Region

Aaa

Aa

A

Baa

Ba

B

Caa

North America

2

12

63

186

53

34

13

Europe

1

8

43

95

22

10

10

Asia Pacific (ex.Japan)

1

5

18

22

2

1

-

Japan

-

-

24

11

3

1

-

Source: Moody's, CMA

Median CDS Spreads

Issuer Counts

Figure 16. Global Corporates Median CDS Spreads by Region

9 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

© 2021 Moody’s Corporation, Moody’s Investors Service, Inc. , Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S CREDIT RATINGS AFFILIATES ARE THEIR CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT

COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MATERIALS, PRODUCTS, SERVICES AND INFORMATION PUBLISHED BY MOODY’S (COLLECTIVELY,

“PUBLICATIONS”) MAY INCLUDE SUCH CURRENT OPINIONS. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL

FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT OR IMPAIRMENT. SEE APPLICABLE MOODY’S

RATING SYMBOLS AND DEFINITIONS PUBLICATION FOR INFORMATION ON THE TYPES OF CONTRACTUAL FINANCIAL OBLIGATIONS ADDRESSED BY MOODY’S

CREDIT RATINGS. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE

VOLATILITY. CREDIT RATINGS, NON-CREDIT ASSESSMENTS (“ASSESSMENTS”), AND OTHER OPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT

STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND

RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. AND/OR ITS AFFILIATES. MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER

OPINIONS AND PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER

OPINIONS AND PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. MOODY’S CREDIT

RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS DO NOT COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR.

MOODY’S ISSUES ITS CREDIT RATINGS, ASSESSMENTS AND OTHER OPINIONS AND PUBLISHES ITS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING

THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE,

HOLDING, OR SALE.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS, AND PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS

AND INAPPROPRIATE FOR RETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS OR PUBLICATIONS WHEN MAKING AN INVESTMENT

DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED

OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE

FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODY’S PRIOR WRITTEN

CONSENT.

MOODY’S CREDIT RATINGS, ASSESSMENTS, OTHER OPINIONS AND PUBLICATIONS ARE NOT INTENDED FOR USE BY ANY PERSON AS A BENCHMARK AS THAT TERM IS

DEFINED FOR REGULATORY PURPOSES AND MUST NOT BE USED IN ANY WAY THAT COULD RESULT IN THEM BEING CONSIDERED A BENCHMARK.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well

as other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information it

uses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However,

MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing its Publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any

indirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any

such information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or

damages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a

particular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory

losses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the

avoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,

representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY CREDIT

RATING, ASSESSMENT, OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc. , a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (including

corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any credit rating,

agreed to pay to Moody’s Investors Service, Inc. for credit ratings opinions and services rendered by it fees ranging from $1,000 to approximately $5,000,000 . MCO and Moody’s

Investors Service also maintain policies and procedures to address the independence of Moody’s Investors Service credit ratings and credit rating processes. Information regarding

certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold credit ratings from Moody’s Investors Service and have also publicly

reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at

under the heading “Investor Relations — Corporate Governance —

Director and Shareholder Affiliation Policy.”

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s Investors

Service Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended

to be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia , you

represent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly or

indirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion as to

the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors.

Additional terms for Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’s

Overseas Holdings Inc. , a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally

Recognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an

entity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered

with the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred

stock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any credit rating, agreed to pay to MJKK or MSFJ (as applicable) for credit ratings opinions and services

rendered by it fees ranging from JPY125,000 to approximately JPY550,000,000 .

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.

REPORT NUMBER

1265358

10 11 February 2021

Cross-Sector: Market Data Highlights

MOODY'S ANALYTICS

CROSS-SECTOR

CLIENT SERVICES

Americas

1-212-553-1653

Asia Pacific

852-3551-3077

Japan

81-3-5408-4100

EMEA

44-20-7772-5454

11 11 February 2021

Cross-Sector: Market Data Highlights